Cornerstone 3rd Quarter 2022 Commentary

Volatility is a symptom that people have no idea of the underlying value.

Jeremy Grantham

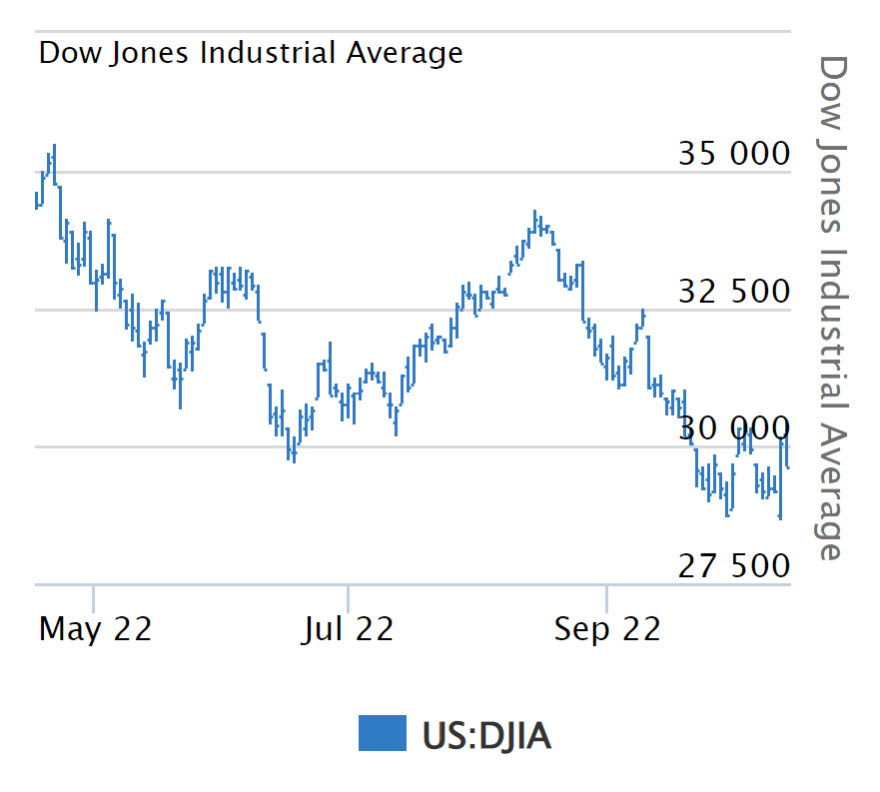

This quote from a man who nearly lost his firm during the bull market leading up to the 2000-2002 bear market is, in our humble opinion, a perfect explanation of the third quarter! The market rocketed off the June lows and promptly turned in one of the strongest summer rallies on record during the month of July and into early August.

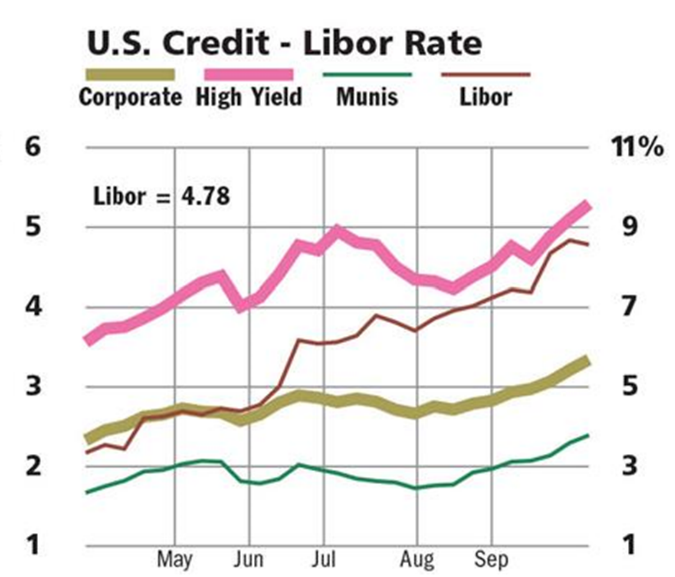

However, the fun was short-lived as inflationary fears coupled with strong economic data spurred the Fed’s rate hiking campaign to new heights. The Fed’s campaign appears to be far from over. Despite a 75bps hike at the September meeting, expectations have continued to climb for significant additional rate hikes at the Fed’s upcoming November and December meetings. “Higher for longer” became the mantra on the street! As investors grappled with where inflation is going and what the impact of tighter monetary policy might be on global growth, they quickly bailed out of the stock market and sold their bonds to de-risk portfolios throughout the month of September.

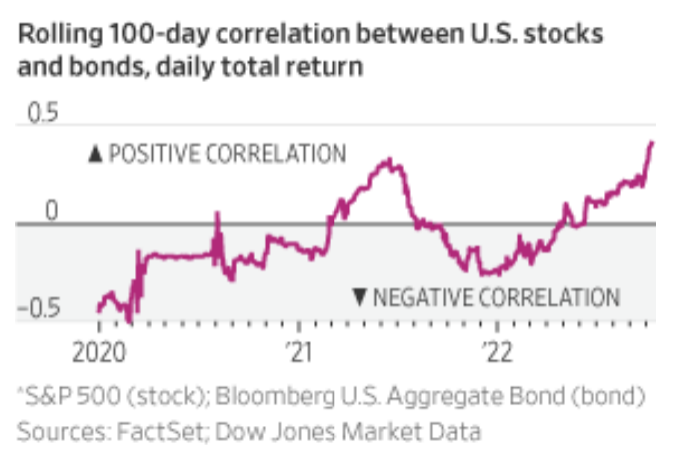

Radically changing rate expectations led to higher bond yields, and both bonds and stocks hit the skids, ultimately ending the quarter around the lows set in June. Clearly, few if any investors know what the underlying value of stocks or bonds should be at the moment.

It was a really rough quarter for most investors. There was no place to hide as both stocks and bonds were hit hard. However, despite the drop in price, there seemed to be little sign of capitulation. The market staged several significant day-long or even multi-day rallies. It also bounced significantly just after the end of the third quarter. Which brings us back to our initial comment: few investors have any real idea where stocks or bonds should be priced at the moment.

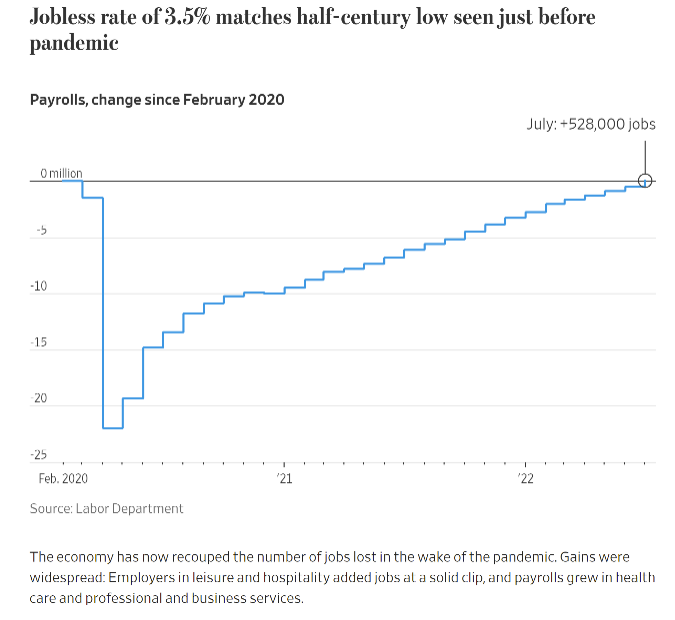

While earnings expectations have come down, second quarter earnings were quite strong, and it looks as though third quarter earnings will not be particularly bad. So despite all the recessionary rhetoric, companies are still performing, unemployment is low and may even fall a bit further before bottoming out, and consumers are still spending. In short, the recession is likely coming but isn’t here yet! Consequently, we believe that stock prices are simply adjusting to the impact of higher interest rates. Remember, that rising rates impact the discount rate, effectively lowering the price-to-earnings multiple for stocks as future earnings are discounted back to present at ever higher rates. As the Fed’s rhetoric has become ever more hawkish and the economy has proved resilient, stock prices have had to adjust to the reality of those higher interest rates.

The month of September was crushing for both stocks and bonds. The aforementioned summer rally was put out with a vengeance, and both stocks and bonds declined as quickly as they had rallied. The S&P 500 dropped 9.21% in September and ended the quarter down over 20%–back in bear market territory. So much for those who had called the bottom of this bear market back in June! Peak inflation also proved elusive, and the Fed’s 75bps move and hawkish comments sent bond yields higher and prices lower. The Bloomberg U.S. Agg dropped over 4% in September alone and is now down nearly 15% for the year, the worst performance on record by far! The Bloomberg Global Agg fared even worse and is now down nearly 20% on a year-to-date basis. Bond volatility has been unprecedented in 2022.

Smaller capitalization stocks, REITs, and growth stocks all got hit hard during the quarter, and the Russell 2000 Index is now off approximately 25% for the year. REITs are also down significantly. The FTSE NARIET Index dropped almost 13% during the third quarter and is down approximately 28% year to date. Even gold declined 2.5% for the quarter. In short there was no place to hide! About the only thing in the “green” column is the U.S. Dollar. It continues to gain strength and is at levels last seen a couple of decades ago. For U.S. investors this has hurt the performance of their international positions. MSCI EAFE is now down over 27% in dollar terms and the MSCI Emerging Markets Index is down about the same amount. International assets would look a lot better if it weren’t for the significant appreciation of the U.S. Dollar.

As we have noted the third quarter of 2022 was a grim one for investors. Economic data remained relatively strong. Unemployment actually declined during the quarter, and the job market remains extremely strong.

While manufacturing weakened during the quarter, it remained healthy and the service sector remains solid. These factors led to continued inflationary pressure throughout the quarter and resulted in strong action by the Fed. The Fed not only raised rates by 75bps at the September meeting, but also stepped up its hawkish statements. The Fed is striving along with other central banks to combat inflation that has proved to be more persistent than expected.

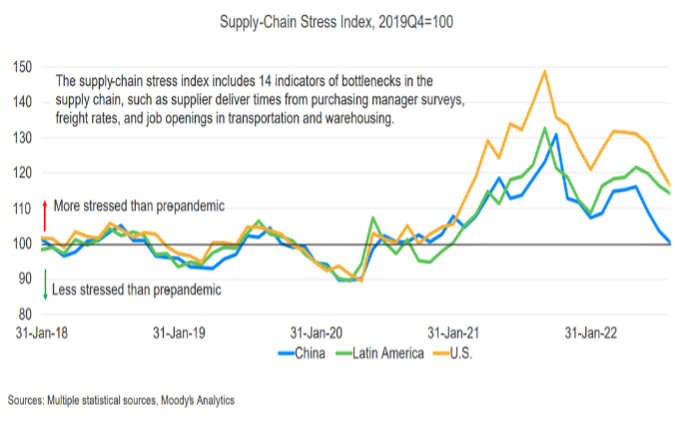

While supply chains have shown improvement, they remain problematic. China’s “zero” Covid policy has continued to cause challenges. A recent example of this situation can be seen in Apple’s statement of its intention to move more of its iPhone assembly process to India. The ongoing war in Ukraine continues to impact global supply chains as well, most notably in the markets for wheat, oil, and natural gas. This has put additional pressure on European countries who rely heavily on Ukraine and Russia for natural gas and oil.

The U.S. inflation rate is comprised of a basket of goods and services. It also reflects the cost of housing through a measure referred to as “homeowners’ equivalent rent.” Some parts of the commodity complex have already experienced a decline in price. Several major elements of the CPI remain problematic, namely homeowners’ equivalent rent, energy, and food. The factors are likely to push inflation higher in the near term and suggest that the Fed rate hiking cycle is not yet over. That poses problems for both stocks and bonds. Bond prices are directly impacted by rising rates, and stock prices are indirectly impacted through multiple contraction and the impact of higher costs on corporate margins. As we move into the fourth quarter of 2022, we believe that volatility will remain the norm as markets seek to determine appropriate valuations for both stocks and bonds.

In the short term, equity markets have sold off and may experience a short-term technical rally, but we do not believe we are out of the woods yet! As the Fed continues to raise rates, the probability of a “soft landing” declines, and the corresponding likelihood of a recession grows. At this point, there remains a slim chance that the economy could escape a recession and the Fed could rein in inflation without ending this post 2020 expansion. However, we believe such an outcome is unlikely. Our portfolios have been positioned, within policy parameters, to weather this volatile period. During the third quarter, relative portfolio returns remained solid as our defensive positioning in fixed income protected us from the worst of the losses experienced by the Bloomberg Agg Indexes. Our value tilt continues to help lower volatility and enhance our overall equity return relative to broader benchmarks.

Whenever possible throughout the fourth quarter, we will allow cash from dividends and interest to accrue in our portfolios providing some additional volatility protection and allowing for liability management with minimum portfolio disruption. As noted, we believe a technical rally in the fourth quarter is likely, but we doubt such a rally will have legs. Consequently, additional rebalancing opportunities are likely to present themselves as this bear market continues to grind along.