What is a Charitable Gift Annuity?

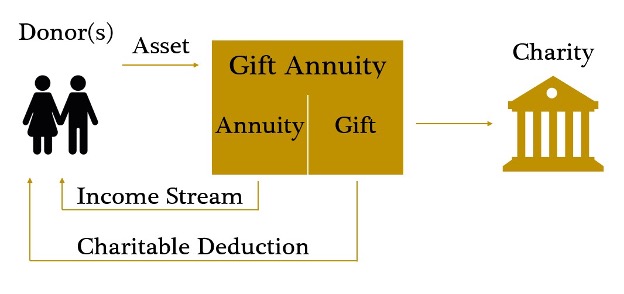

A charitable gift annuity is a planned gift that allows the donor to make a donation to charity, take a charitable deduction, and receive lifetime payments from the charity. For enterprising donors who want to give to their favorite charity but do not want to outlive their retirement funds, charitable gift annuities provide a perfect planned gift option.

How does a charitable gift annuity work? A charitable gift annuity is a contract between the charity and the donor or donors. The donor transfers cash or appreciated assets to the charity, and the charity guarantees to pay the annuitant a set rate applied to the gift amount. The donor receives an initial charitable deduction for a portion of the gift amount when the funds are transferred. Charitable gift annuities may pay immediately or pay deferred payments. The most accommodating charitable gift annuity type is the flexible deferred annuity.

Charitable gift annuities can be paid to one or two annuitants (beneficiaries) only. The payout rates are based on the ages of the annuitants at their nearest birthday. Most charities use the recommended payout rates from the American Council on Gift Annuities maximum rate schedule. Payments from charitable gift annuities continue for the lifetime of the annuitants.

A portion of each payment to the annuitant is considered return of principal and is tax-free while the rest is taxed as ordinary income. If the donor gifted an appreciated asset, a portion of the capital gains tax is avoided while the rest of the capital gains are spread over the life expectancy of the annuitant(s). The capital gain portion and the ordinary income portion are both taxable to the annuitants each year.

Now that we have highlighted some of the benefits to donors, it is also important to consider the benefits and responsibilities of the charity when asking, how does a charitable gift annuity work? There are specific requirements for establishing and maintaining a charitable gift annuity program. The charity should be financially viable, established for at least five years for most states, have a large number of prospective donors, and a dedicated staff person for donor relations. Cornerstone Management comes alongside the charity to assist with creating charitable gift annuity illustrations and agreements, paying annuitants, preparing 1099-Rs, and checking for the life status of annuitants. Cornerstone also provides audit reports such as FASB liabilities reports, state reserve reports, payment reports, and market value reports. Cornerstone’s planned gift administration services provide efficiencies that benefit both our clients and their donors.

Another requirement for a charity’s charitable gift annuity program is the charity must be registered to write charitable gift annuities in the states where the donors reside. To ensure charities’ ability to make lifetime payments to donors, some states require charities to keep specific reserves. To support our clients in these areas, we assist with state registrations, notifications and annual filings.

Finally, the charity will need to create an appropriate investment policy statement for the gift annuity pool and implement an investment strategy designed to enhance expected returns. We believe it is best practice for the charity to deposit the full gift amount in the annuity pool to be invested. When the annuity matures, the remainder, also referred to as the residuum, is available to the charity to use for ministry purposes. Cornerstone’s investment team provides outsourced chief investment officer (OCIO) services for over 60 charitable gift annuity pools.

To summarize what is a charitable gift annuity: it is a unique opportunity to receive a present gift to your organization, provide ongoing donor engagement, and secure future funding for your mission. We have found that charitable gift annuity donors also become financially-engaged donors for the future of your organization.

Does your organization need help with the charitable gift annuity administration? At Cornerstone Management, we provide investment, planned gift administration, and gift and estate design consulting services. Contact us if you’d like to learn more.