Cornerstone 2nd Quarter 2022 Commentary

Whoever watched the wind will not plant; whoever looks at the clouds will not reap.

Ecclesiastes 11:4

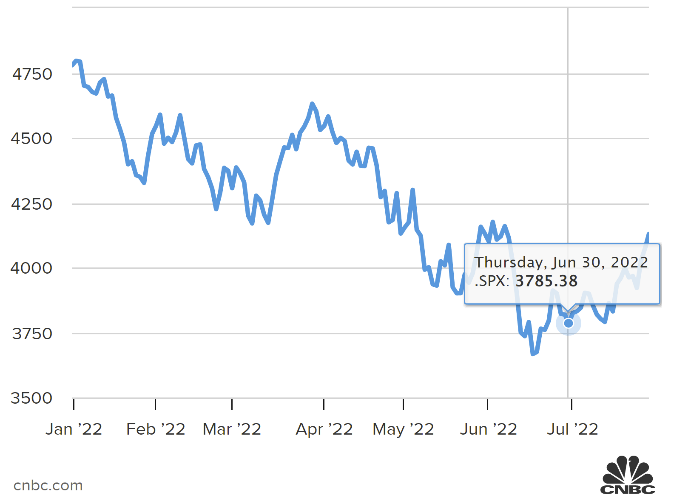

Unfortunately, the war in Ukraine did not end, inflation did not dissipate, and Covid-19 has a new variant! We suppose it follows that the second quarter of 2022 was a rough continuation of the first, ultimately culminating in the market’s worst first half since 1970.

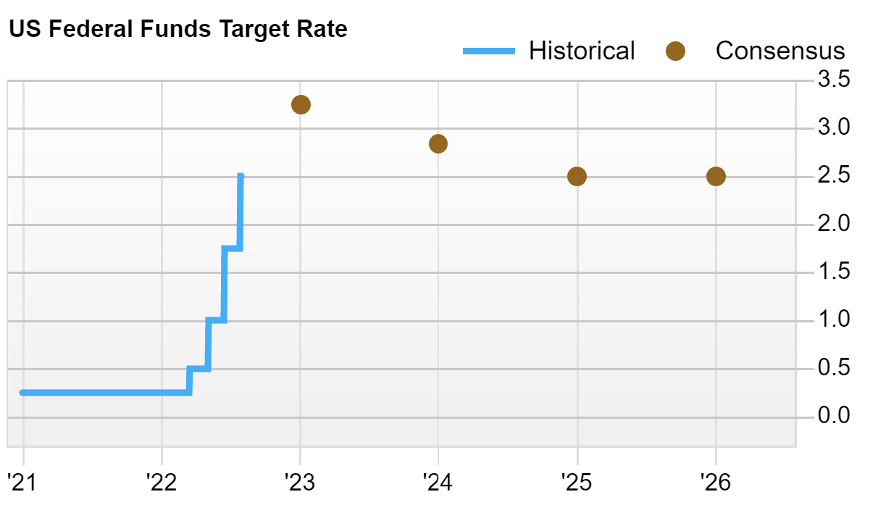

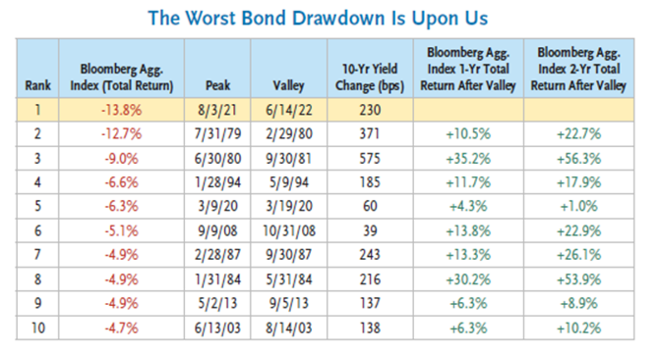

A tough first half of the year for stocks was accompanied by an equally tough first half of the year for bonds, leading many to question the historic benefits of diversification and the continued efficacy of a traditional 60/40 asset allocation. “60/40” is a short hand way of referring to a portfolio comprising 60% equity and 40% bonds, a subject that seems to be in question regularly these days. Incidentally, we think the “death” of the 60/40 asset allocation model is overstated, and we continue to believe that bonds have a significant place in long-term investment portfolios. The recent price action leading to significant investor concern is understandable. Afterall, it has been 40 years since bonds have experienced truly significant declines. The bond bull market of the last 35 years has led many bond investors to bank on falling interest rates, rising bond prices, and limited volatility. Frustratingly, persistent inflation and the corresponding battle to counter it waged by the Fed and other Central Banks have reversed these long-standing trends and caused significant investor heartburn. However, we should note that rising rates actually bring with them the potential seeds for a future bond bull market or, at the very least, higher nominal returns from the 40% of the 60/40 asset allocation. The Fed is in full inflationary defense mode and, as of this writing, not only raised rates 125BPS in the second quarter, but added an additional 75BPS at their July meeting bringing the current Fed funds rate to 2.50%.

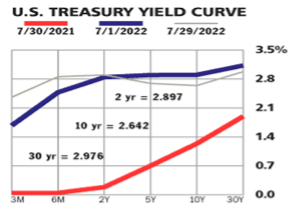

While expectations continue to point to higher future short-term rates, there remains little indication that the market believes that significant inflation is here to stay.

In fact, quite the opposite is true. Despite the 9.1% CPI print in June, fixed income markets remain remarkably sanguine about future inflationary prospects. While yields rose sharply through the first half of the year, they have already moderated as the market grapples with continued aggressive action by the Fed set against a slowing global economy. Consistent inversions in the 2-10 (2-year yield higher than 10-year yield) relationship have led to growing concern that a recession is imminent. When comparing the two graphs above, one can also see that if the Fed stays on track and raises an additional 50BPS at the September meeting, 25BPS at the November meeting, and 25BPS at the December meeting the Fed funds rate would end the year around 3.5%, which is higher than thirty-year rates at the present time. All of this data suggests that either the market is correct and inflation is likely to significantly decline over the next 12-24 months, or rates will have to rise significantly more than currently expected to combat persistent inflationary pressure. We believe that most of the pain in the fixed income market has already been experienced. While we expect the Fed to continue to hike rates throughout the remainder of 2022, we believe the bulk of those hikes are already priced into the market. Regardless, as we noted in our recent fixed income commentary, as rates go higher bond investors gradually begin to benefit from more significant interest income. Further, as long as default rates do not rise significantly, bonds currently held in investor portfolios will experience gradual price appreciation as they roll down the curve and approach par value at maturity.

During the second quarter, the shorter duration of Cornerstone portfolios allowed us to weather the storm and led to significant outperformance relative to the Bloomberg Global Aggregate Index. We are currently allowing our portfolio durations to gradually drift upward, but we intend to remain significantly shorter than the “Agg.”

As inflationary fears increased, spreads also widened and led to negative outcomes for credit and high-yield bonds. The Bloomberg U.S. Aggregate Index fell nearly 5% in the second quarter and was down 10.35% for the first half of the year. The second quarter of 2022 made the current bear market in bonds the deepest bear on record for the U.S. Aggregate Index.

However, as we have noted bonds generally rally relatively quickly following significant drawdowns, and we expect the fixed income portion of portfolios to do relatively well over the next 12- to-18-month period.

Stocks on the other hand experienced a tough quarter, and we expect negative volatility to be an ongoing challenge in the quarter to come. While the VIX has moderated, volatility remains higher than in recent years, and economic uncertainty also remains high. Despite relatively strong first half earnings, rising rates have led to significant multiple compression. Equity markets around the world struggled during the first half of 2022. The S&P 500 finished the quarter down 19.96% but was down over 23% at its worst point in mid-June. Smaller capitalization stocks, as measured by the Russell 2000 Index, remained in bear market territory down 17.20% during the quarter and over 23% for the first half of 2022. Growth-oriented stocks were hit significantly harder than value stocks across all market capitalizations. Both the Russell 1000 Growth and the Russell 2000 Growth were both down nearly 30% for the first half of 2022, while their value-oriented counterparts were down approximately 13% and 17%, respectively.

Index performance, as poor as it was, masks broader market carnage particularly in the tech sector where many darlings of the Covid economy have been hammered and are down more than 40%. In our view U.S. equity market performance is, in many ways, similar to that of the “dot.com” bust of the early 2000s. Broader indices declined in 2000, 2001, and 2002, but value stocks outperformed growth stocks significantly throughout the period as the overall market multiple contracted significantly.

International equities struggled throughout the second quarter as well but actually performed slightly better than their U.S. counterparts. The MSCI EAFE Index was down 14.5% during the second quarter, and its return of -19.57% is similar to that of the S&P 500 for the first half of the year. The EAFE’s performance is even more impressive when considered in light of the significant rise in the U.S. Dollar, which was up approximately 10% during the first half of 2022. While emerging markets also struggled, the MSCI EM Index dropped only 11.5% during the quarter and is down approximately 17.6% on a year-to-date basis. We expect the dollar to remain strong throughout the third quarter and into the end of 2022. However, as central banks around the world raise interest rates to combat inflation, the dollar’s gains are likely to wane and eventually reverse. Given the extremely low valuations in non-U.S. developed markets, a declining dollar could act as a significant tail wind and suggests growing opportunities for non-U.S. equities. The second quarter of 2022 was a challenging quarter, and throughout the first half of 2022 there have been few places to hide. With the possible exception of Commodity Trading Accounts and MLP investments, alternative assets provided little support to traditional long only strategies. Returns were poor across the board, and diversified investors were rewarded only on a relative basis, as small pockets of value-oriented securities, shorter-duration bonds, and cash outperformed the broader markets. While earnings expectations remain relatively robust, there is no question that the U.S. and global economy are beginning to slow in the face of rising interest rates. Unemployment in the U.S. remains very low, and broader economic activity continues to remain above a “contraction” inflection point. However, we have now experienced back-to-back quarters of negative real GDP growth, and recessionary concerns are growing. Covid-19 remains a threat to the global supply chain, and the war in Ukraine continues to pressure commodity prices, particularly oil and natural gas, making recession in Europe a significant possibility. On a more optimistic note, we must also point out that nominal U.S. GDP growth remains positive and when coupled with strong consumer and corporate balance sheet data, suggests that the U.S. may continue to avoid a technical “NBER” (National Bureau of Economic Research) defined recession in 2022. Regardless, due to the uncertainty surrounding both a potential recession and inflation, we expect equity markets to remain volatile through the third quarter and into year end with sudden rallies likely followed by a loss of confidence and a set-back. New highs for equity markets remain unlikely in our view. Consequently, we will retain a more defensive posture in our portfolios overweighting value and defensive sectors and maintain a shorter duration in our fixed income portfolios.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.