What’s Going on With Bonds?

There’s no way to sugarcoat it. We’re currently in the worst period for bonds in history. As of October 31, the Bloomberg U.S. Aggregate is down 15.7% year-to-date. The Bloomberg Global Aggregate is faring even worse, with a year-to-date decline of 20.4%.

Bonds are supposed to be a steady asset class. Why are we experiencing record losses in 2022?

The primary reason for 2022’s negative bond returns is rising interest rates. When fixed income markets determine that a new level of interest is required for an existing bond, the new interest rate is reached through a change in the bond’s price. For an existing bond to pay a higher rate of interest, its price must fall (and vice versa). We’ll discuss this occurrence in more detail in a bit. But first, let’s discuss what a bond is.

Bond Basics – How Do Bonds Work?

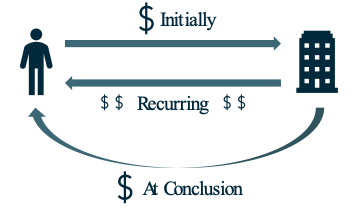

A bond is a contractual arrangement between a borrower and a lender. Initially, the lender provides cash to the borrower. The borrower then makes recurring interest payments (called “coupon payments”) to the lender. At the conclusion of the bond’s term, the borrower returns the bond’s original face value amount to the lender.

Three primary factors drive the bond’s interest rate:

- The first factor is expected inflation. In order to hand over capital to a borrower, investors generally expect to be compensated at a greater rate than the expected inflation rate. The term “inflation risk” refers to the possibility that the bond’s return will not exceed the inflation rate.

- The second factor is the creditworthiness of the borrower. The less likely the borrower will be able to make all of its payments to the lender, the higher the interest rate the lender will command. This factor is called credit risk.

- The third factor is the length of time the bond will be outstanding. In most environments, the longer the bond’s term, the higher the necessary interest rate. (Note: In some environments, shorter term bonds may have higher interest rates than do longer term bonds.) This factor is called the maturity premium. A longer maturity creates greater interest rate risk, which is the change in a bond’s price due to changes in interest rates.

Market Repricing of Bonds

Bond markets are constantly evaluating the appropriate yield for publicly-traded bonds. Consider a bond with five years until maturity, a $1,000 face value and $40 annual coupon (interest) payments. This bond’s yield to maturity is 4%.

Assume that the market now believes a 5% yield to maturity is appropriate for the bond. The bond must be priced at approximately $957 – a reduction of $43 from its original face value. The bond’s market price is the factor that must change because the coupon payments and the final amount to be returned to the investor are both contractually set.

Why would the market determine that a bond should have a new price and therefore a new yield to maturity? Primarily because of a change in current interest rates, credit risk, or time to maturity.

Bond Returns

The investment return from a bond has two components. The first component is the coupon payments the investor receives from the bond. The larger the coupon payments as a percentage of the bond’s market price, the higher the interest rate return.

The second component of bond returns in the price return. An example of price return is discussed above. The key concept to note is that there is an inverse relationship between changes in the bond’s yield and changes in the bond’s market price. Additionally, the longer the bond’s maturity, the more the bond’s market price changes with interest rate movements. The term “duration” is connected to this concept.

2022 (Partial) Annual Review for Bonds

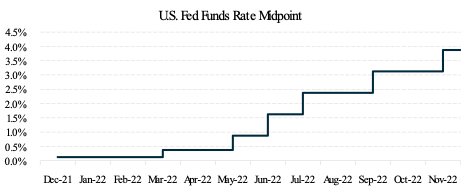

As stated in the opening, bonds are experiencing a record-worst year. The main reason for bonds’ negative returns has been the inflation element and the U.S. Federal Reserve’s response to inflation. Inflation has stubbornly continued to be high. The Fed has raised the overnight Fed Funds rate as a means of reducing demand and therefore attempting to lessen inflation. The Fed’s influence is strongest over very short-term interest rates, but its changes to the Fed Funds rate have at least a small impact on intermediate and longer term interest rates.

Additionally, the market has demanded a higher return for taking on credit (default) risk. As discussed earlier, the mechanism for reaching higher required returns is lower bond prices. The market presumes higher credit risk when the economy is poor, and many market pundits are predicting a recession in 2023. Fixed income markets have priced in a higher probability of default among credit bonds.

Going Forward

The fall in bond prices has been tough to swallow, especially for conservative investors who tend to be bond-focused. Looking forward, there are two pieces of good news:

- Forward-looking expected returns for bonds are higher. The number one predictor of a bond’s return is its yield. Bonds have a much higher yield now than they did at the beginning of the year. These higher yields also provide a return cushion against any price declines. And hopefully, we are past the worst of interest rate increases having a negative impact on bond prices.

- Bonds have contractual cash flows. The recurring payments from a bond are typically fixed in amount over the bond’s life. Regardless of how the market’s required level of interest changes, the bond’s cash flows proceed as expected (assuming no default). In other words, market volatility does not influence whether a bond continues to make its current payments and returns principal at conclusion.

Conclusion

It’s been an unprecedented year for bonds in a bad way. Conservative investors have been impacted like never before. But thankfully, bond math shows us that better days are ahead. Investors who are willing to stay in the market have an opportunity to recoup price declines via higher yields going forward.

About Cornerstone Management

Cornerstone Management’s mission is to preserve, grow and distribute the assets entrusted to the Christian non-profit community through enhanced organizational stewardship. Learn more about Cornerstone’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting. If you would like to be in touch with us, please send us a message here.