4Q 2019 Cornerstone Commentary

Those persons are happiest in this restless and mutable world who are in love with change, who delight in what is new simply because it differs from what is old; who rejoice in every innovation, and find a strange alert pleasure in all that is, and that has never been done before.

– Agnes Repplier

What a difference a year makes! As we headed toward 2019 the Fed was raising interest rates, corporate earnings were rising, the market was falling, and the trade war with China was being aggressively prosecuted. As we head into 2020 the situation has reversed course. The Fed cut rates for the third time during the 4th quarter, earnings are weakening, the market is rising, and a “phase one” trade deal with China has been declared.

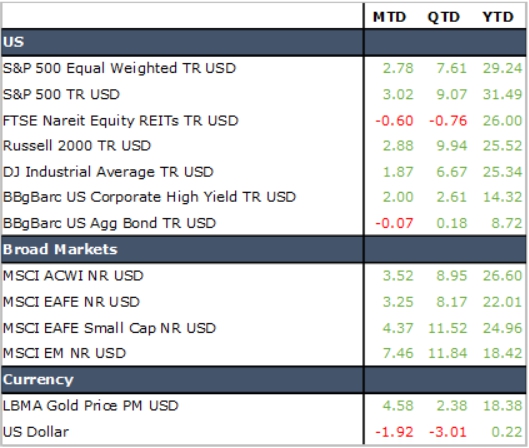

Markets finished off 2019 in a surprisingly strong fashion. Despite a continued slowdown in corporate earnings, the market moved higher throughout the 4th quarter capping off what was already a strong year with a stellar finish. The S&P 500 rose over 9% during the quarter to end the year up 31.49%, its best annual return since 2013. Smaller capitalization stocks also rallied in the 4th quarter with the Russell 2000 rising nearly 10% during the period. The Russell 2000 ended the year up 25.52%, slightly eclipsing the Dow’s return of 25.34%.

International equities gained ground throughout the quarter and narrowed the performance gap between major US indices and significant international bellwethers like the MSCI EAFE, which ended the year up 22% in dollar terms. International small cap securities fared even better with the MSCI EAFE Small Cap Index up nearly 12% in the 4th quarter and a stunning 25% for 2019. On the back of a modest decline in the US dollar, emerging market equities also rallied strongly in the 4th quarter by gaining nearly 12% and finishing the year up more than 18%.

While the Fed’s interest rate pivot was helpful for bond investors throughout 2019, the 4th quarter response was muted with intermediate term bonds basically flat for the quarter but still up nearly 9% for the year. The positive year in fixed income coupled with strong returns from equities and other asset classes like real estate certainly boosted the return of diversified portfolios. Unfortunately, despite the strong gains of various asset classes throughout 2019 and particularly in the 4th quarter, any diversification away from large US equities was detrimental to total portfolio return. The tech sector led the way again, up nearly 15% in the 4th quarter alone and up a stunning 50% for the entirety of the year. As one might expect given the strong performance of the tech sector, large cap growth stocks drove broader index returns and the Russell 1000 Growth Index was up over 36% in 2019.

Ultimately, virtually any equity market exposure was helpful during the 4th quarter of 2019; a theme which remained true throughout the year. The 4th quarter of 2019 proved to be better than many expected and capped off a year of performance which was as welcome as it was unexpected.

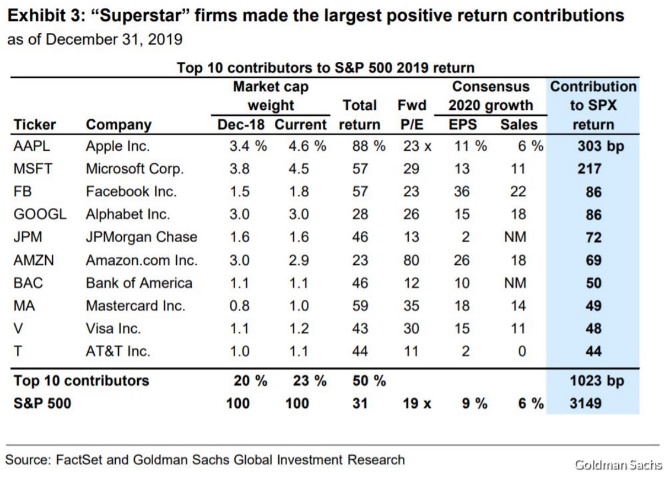

However, while the rally helped virtually all equity and risk related asset classes, performance centered on growth-oriented technology companies. Diversification away from this space was generally detrimental to total return. As the chart above indicates, the top ten contributors drove approximately 33% of the appreciation of the S&P 500 index. Five out of the top six contributors were mega capitalization tech companies. Consequently, any large cap active manager who chose not to own one of these companies was at a distinct disadvantage relative to his or her respective index. Value managers, in particular, struggled in this environment as they sought lower risk and lower valuations. A company like Amazon with a forward multiple of 80 is unlikely to be attractive to a value manager! Consider that Apple was up 80% followed closely by Microsoft which was up nearly 60%; together the two stocks contributed over five percentage points to the S&P 500. Therefore, not owning these two companies left you with a five-percentage point hole to fill. The Dow Jones Industrial Average provides additional insight into the challenges of both active and passive investing in a narrow high-flying market. The Dow Jones Industrial Average, which is price- weighted rather than cap-weighted and contains a number of the top ten contributors from S&P 500 including both Apple and Microsoft, underperformed the S&P 500 in 2019 by over 600 basis points and lost over 200 basis points relative to the S&P in the 4th quarter alone. In summary the 4th quarter of 2019 was very positive, boosting diversified portfolio returns substantially. Rallies in smaller capitalization companies, international, and emerging markets helped diversified portfolios and narrowed the performance gap between asset classes, but despite substantive gains elsewhere, US large cap technology companies continued to dominate market returns and portfolio results in 2019.

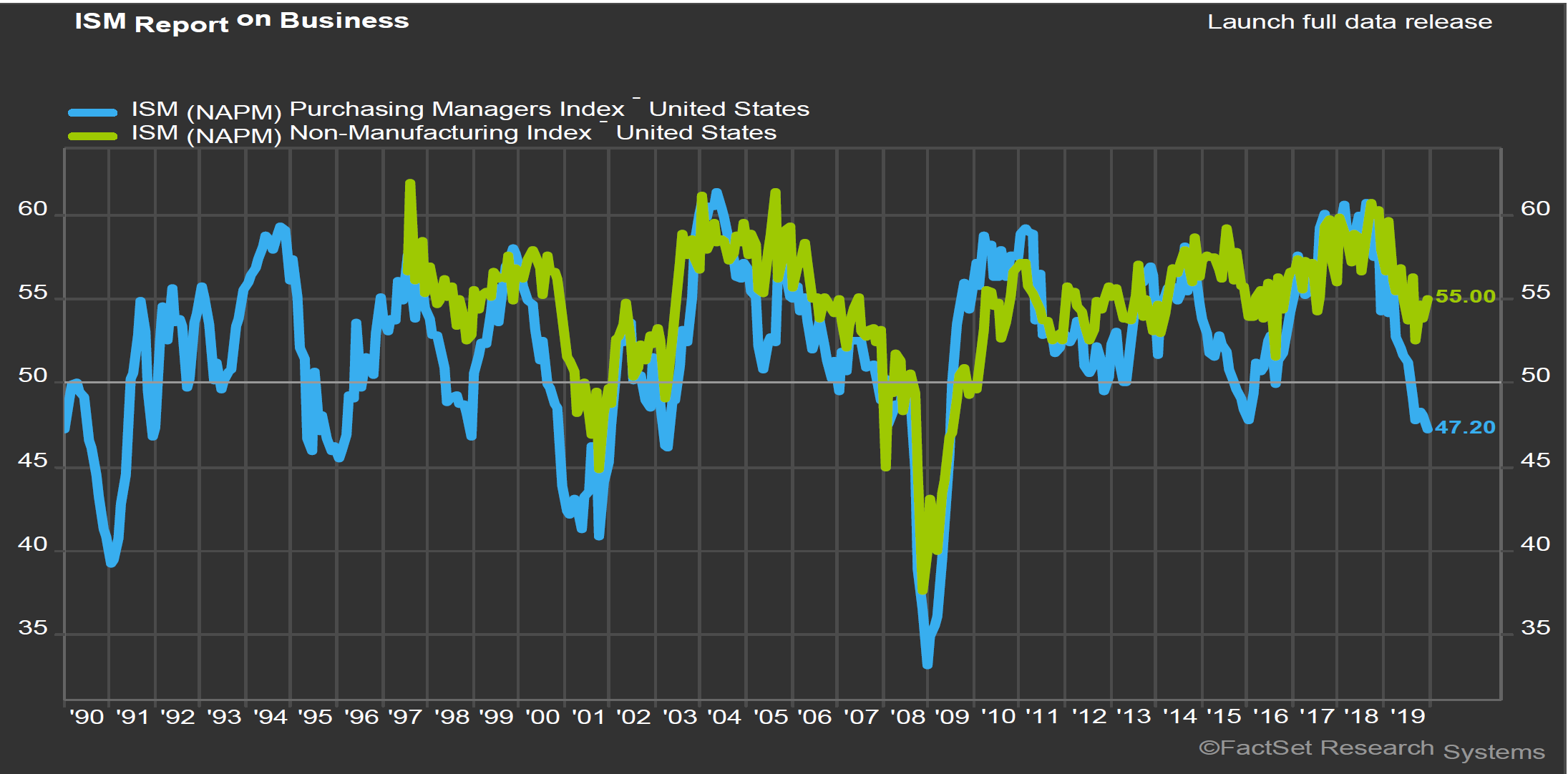

As we noted in our comments related to the 3rd quarter of 2019, the outlook for equity markets seemed, in the short term, to be intrinsically linked to Fed action and trade and to be less dependent on economic fundamentals. The 4th quarter underscores this position. The completion of the USMCA (United States Mexico Canada Agreement) along with a phase one deal with China have gone a long way in reassuring investors that a recession is not right around the corner.

Despite continued declines in the manufacturing sector and weak results related to corporate investment and other traditional economic indicators, the market seems determined to focus on positive data related to the resilience of the US consumer, an accommodative Fed, and trade dispute resolution. Negative news related to slower economic growth overseas, a weakening manufacturing sector, impeachment proceedings, and high equity valuations has largely been ignored. While we remain concerned that the probability of a US recession is elevated, we agree that the short-term outlook has brightened. The aforementioned positives are just that: positive. We are ten years into this economic expansion and while this bull market is showing its age, it continues to push equities upward. In this environment, we want our portfolios to participate in a significant way, but we are uncomfortable sounding the “all clear” and loading up on growth oriented, highly valued securities. In our view the short-term investment environment is certainly more positive than it was at this time last year, but significant threats remain. It is unlikely that the current expansion ends with a soft landing, and significant bear markets normally precede economic declines. Consequently, we will remain somewhat cautious. The domestic tilt to our portfolios proved positive throughout 2019, and we intend to maintain that posture. Our tilt toward value, put in place at the end of the first quarter, has acted as a headwind and resulted in a modest drag on our portfolios’ relative results. However, this positioning also limits portfolio volatility and, when coupled with our long-term strategic allocations to fixed income, provides significant additional protection in the event of a market decline. As we enter 2020, we are cautiously optimistic. Election years tend to be positive for equity markets, and as our comments have indicated, the probability of a recession in the near future has waned. It appears that the market has limited upside potential, and consequently our more conservative positioning should allow us to participate in the probable continuation of this rally while at the same time providing some additional protection in the event of an unpleasant surprise.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.