Cornerstone 4th Quarter 2023 Commentary

“Give a serving to seven, and also to eight, for you do not know what evil will be on the earth.” — Ecclesiastes 11:2

“As I have repeatedly said, inflation is a form of taxation without representation.” – Milton Friedman

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens…Lenin was certainly right.” – Essays in Persuasion, John Maynard Keynes

The fourth quarter of 2024 was an amazing testament to the power of investor sentiment and the impact of investor expectations on current market pricing! During the third quarter, investors became convinced that inflation remained a threat and that the economy was growing faster than the Fed expected, thus forcing the Fed to potentially raise rates further or at the very least maintain rates at their current level of 5.25-5.5%. This belief and the corresponding selloff in bonds resulted in a surge in intermediate and longer-term interest rates and a corresponding drop in bond prices.

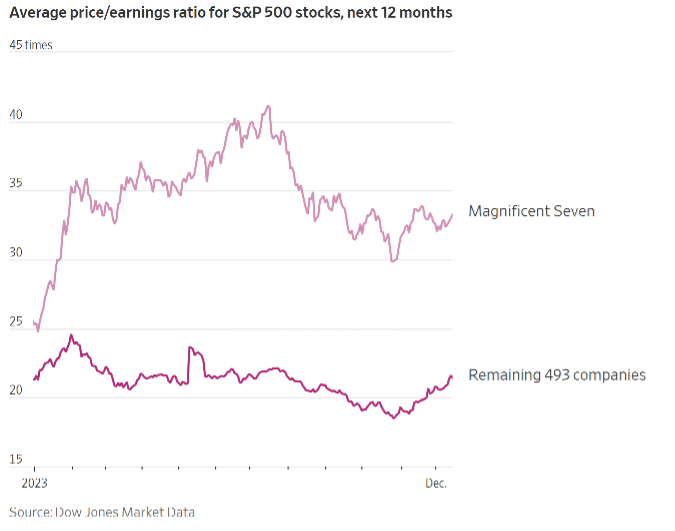

As we noted last quarter, the Bloomberg Aggregate Bond Index moved into negative territory for the year despite having a yield to maturity well over 4%. Equities also declined at the end of the third quarter as they adjusted to the potential higher interest rate regime and potential additional action by the Fed.

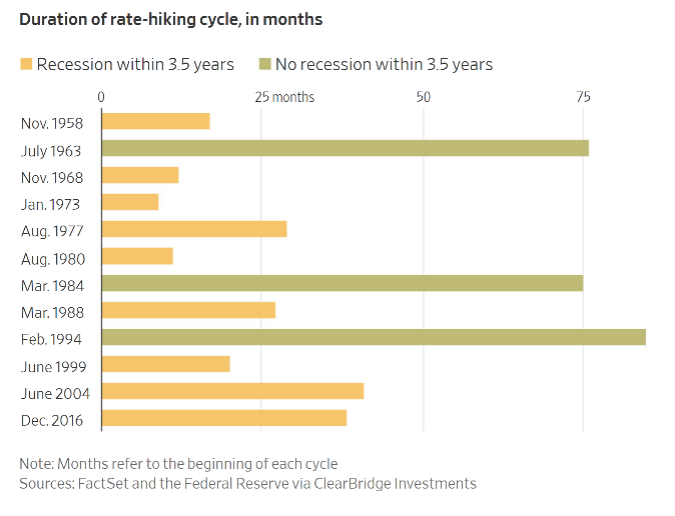

What a difference a month makes! Incoming economic data early in the fourth quarter was not quite as strong, inflationary fears diminished, and at the Fed’s November meeting a more “dovish” tone was conveyed. We suppose it helped that, with the Fed’s “about-face,” Wall Street also linked arms and declared that a soft landing was virtually assured. Goldman Sachs led the charge lowering their probability of a recession in 2024 to just 15%. Investors and the Street alike seemed to agree that a Goldilocks economy had arrived, and by the time we reached the Fed’s final meeting of 2023, the market could not be convinced that the Fed’s more muted plan for rate cuts in 2024 was sustainable. Instead, the long end of the curve continued to decline, bond prices rose, and the equity market continued to rally—perhaps like it was 1999? Well, maybe the party wasn’t quite that dramatic, but it was certainly a very strong quarter!

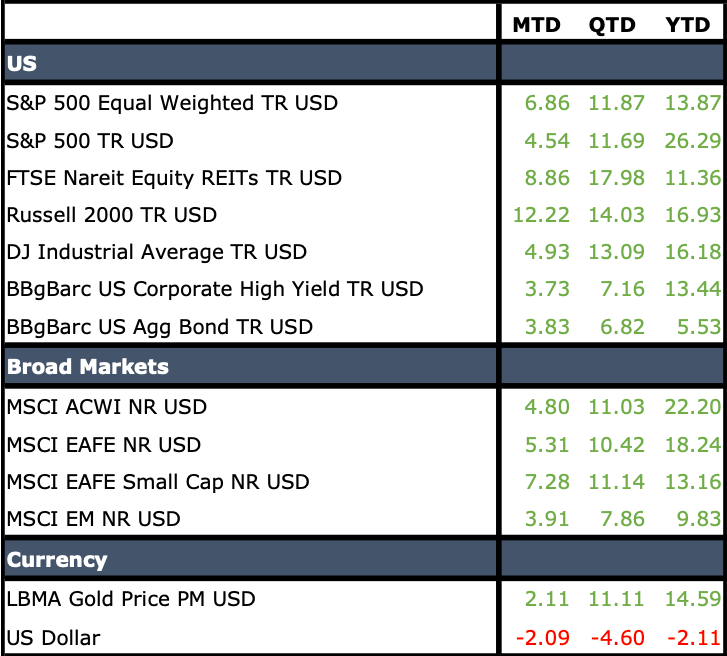

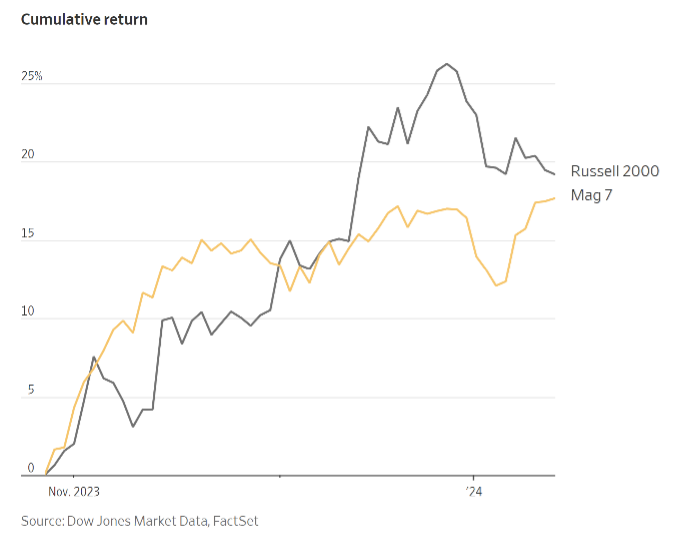

More importantly for investors, the rally broadened out during the fourth quarter. The Magnificent Seven continued to be a driving force, but the Frugal 493 rallied as well and in some cases finally eclipsed their beloved counterparts in the tech sector. The decline in interest rates drove bond prices up, and the proclaimed coming of the proverbial soft landing brought even the most feared sectors to life!

REITs, previously shunned due to rising interest rates and fears surrounding the “remote work” phenomenon, rallied a stunning 18% during the quarter, eclipsing virtually every other asset class. Large cap growth stocks, led by the Magnificent Seven, capped off a “magnificent” year with a fourth quarter return of over 14%. Large cap value did well too, up 9.5% for the quarter and a respectable 11.5% for the year. But what’s 11-12% in the face of the stunning 43% return produced by the Russell 1000 Growth Index in 2023?

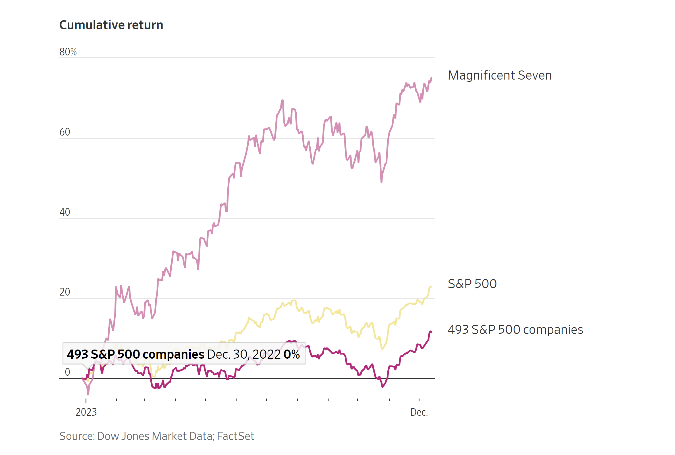

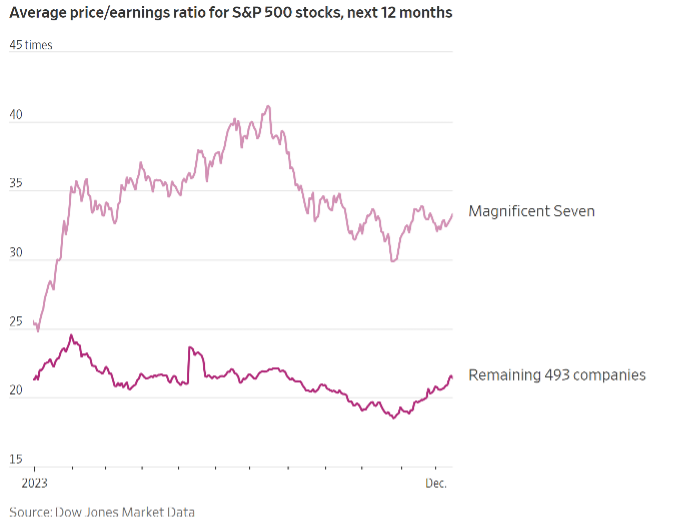

It was a quarter that capped a remarkable year for tech and AI-related equities. The Magnificent Seven contributed approximately 60% of the return of the S&P 500 which gained just under 12% during the fourth quarter and ended the year up over 26%. Not bad for a year in which we and virtually every other market forecaster expected a recession! Few investors would have been able to match that return because any reasonable level of diversification would have led to lower returns. Perhaps a more attainable and dare we say a more reasonable target in 2023 was the S&P Equal Weighted Index. The S&P Equal Weighted Index normally corresponds quite closely to its cap-weighted counterpart, but in 2023 the divergence was significant. The S&P 500 Equal Weighted Index also rose nearly 12% during the fourth quarter but was up “only” 14% for the entire year of 2023. With the exception of 2022, growth and tech have been the place to be over much of the last ten years. Their valuations reflect the premium that investors have been willing to pay to play in the space, and now the AI bubble has simply added another boost to what was already a hefty growth premium.

Perhaps they will be able to sustain that multiple, but growing one’s share price in a higher interest rate environment requires consistent above-average earnings growth. Earnings growth that may not be able to keep up with stratospheric expectations. Microsoft and Apple have both sported $3 trillion, yes that’s trillion with a “T,” market caps during the most recent quarter. It’s hard to double the valuation of your company when your company’s market cap is larger than most countries’ investable market! Trees don’t grow to the sky, and it may be wise to remind investors that after hitting similar peaks during the early part of the 2000s, Microsoft’s stock price went sideways for nearly ten years.

Small cap stocks also participated in the fourth quarter rally. In the small cap sector, we experienced something of a role reversal with small cap value stocks outpacing their growth counterparts. The Russell 2000 Value Index rose over 15% during the quarter finally outpacing larger cap stocks in the final quarter of the year. However, despite the strong fourth quarter finish, the Russell 2000 Value Index closed the year up 14.65%, once again trailing the Russell 2000 Growth Index which rose 12.75% during the quarter and ended the year up nearly 19%.

Small stocks finally gained some ground on the big guys in the final quarter of the year, and the outperformance of small cap added to the belief that perhaps a soft landing might just be emerging after all.

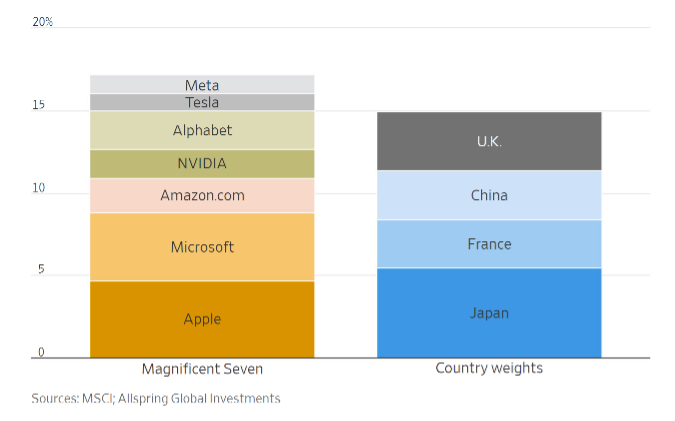

Cap-weighted global market indexes were also skewed by the Magnificent Seven effect. Approximately, 50% of the return experienced by the MSCI All Country World Index was driven by these seven stocks. Perhaps we should think of them as the stocks that drove the world in 2023! Their market cap is daunting, their growth has been amazing, and their P/E multiples are enough to make most long-time investors cry.

As the graph indicates, these stocks carry more weight in the broader indexes than several significant countries, and as a result, global indexes also performed well during 2023. The ACWI was up 11% during the fourth quarter and approximately 22% for the year. The MSCI EAFE, which is also cap-weighted but excludes companies domiciled in the U.S., was up just over 10% for the quarter and 18.24% for the year. Even in emerging markets, which have been negatively impacted by a poor Chinese market in 2023, stocks rose nearly 8% in the final quarter of the year. No matter how you slice it, the fourth quarter of 2023 had something for every investor, and it capped off a surprisingly strong year.

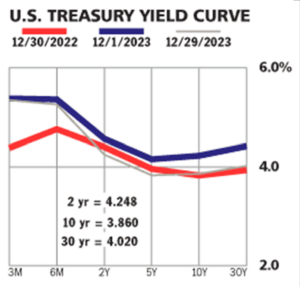

The treasury curve remains inverted, and as we noted at the outset of the commentary, intermediate and longer-term interest rates reversed course during the fourth quarter. Rates fell and bond prices rose significantly during the quarter. Balanced portfolios benefited not only from strong equity returns but also the sudden move in bonds—turning a lackluster year into a great year for most investors. The Bloomberg Aggregate Index rose nearly 7% during the quarter! It ended the year up a solid 5.5%, and once again the forward-looking expectations for the broader bond market remain the best they’ve been in two decades. Investment grade corporate credit and mortgage-backed securities remain attractive, and many managers have extended duration to take advantage of peaking short-term interest rates around the world and fading inflationary fears. Bond markets do indeed look attractive, and forward-looking expected returns are in the 5.5-6.5% range.

All in all, the fourth quarter of 2023 was a great quarter, and our portfolios like many others benefited from strong returns in both equity and fixed income buckets. Our tilt toward value wasn’t much of a factor in the fourth quarter, but it proved to be a drag for the year as a whole because the market, led by the Magnificent Seven, rallied much more than we would have expected. However, if we evaluate our performance relative to equal-weighted indexes like the S&P 500 Equal Weighted Index, then our diversified equity bucket looked quite strong in 2023. Our bond exposure produced solid returns, and it is hard to argue with diversified portfolio returns that, for the most part, were in double digits. The market has climbed the proverbial “wall of worry” and in the face of higher interest rates, two significant regional conflicts, and inflationary uncertainty, produced a surprising outcome!

So, what’s an investor to do?

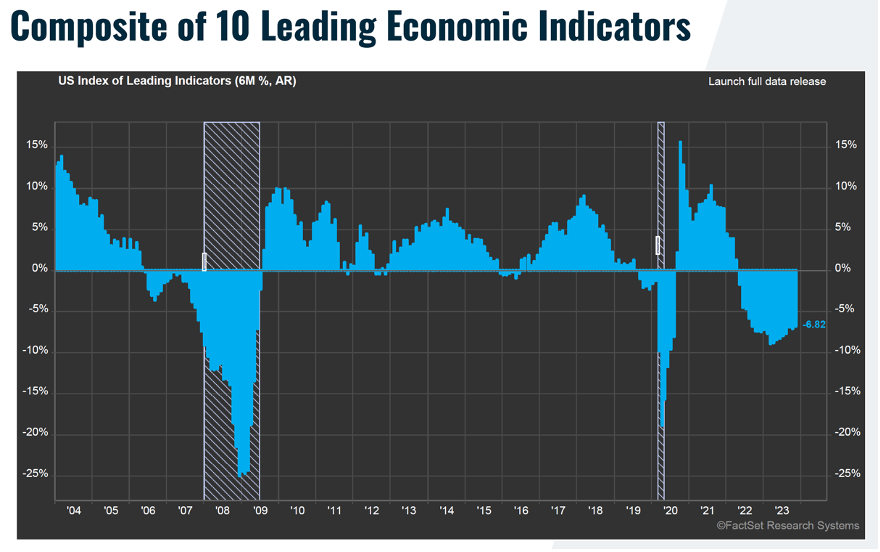

Economic data remains quite mixed. Preliminary estimates for fourth quarter GDP suggest that the U.S. economy grew strongly during the second half of 2023. At the outset of year, this is not what we would have expected to happen. Rather, we expected the consumer to throw in the towel later in the year, and we expected the ISM Service Index to slide toward contraction. The ISM Manufacturing Index has actually been in contraction for the last 11-12 months, and it has been consumer spending that has allowed the economy to continue to grow at a significant rate. We are not economists, but there are significant arguments for a slowdown in growth that avoids recession, i.e., a soft landing, and also for a slowdown that actually results in a recession.

The National Bureau of Economic Research (NBER) looks at six primary factors when determining whether or not the U.S. is in a recession. At the moment, the only one of those factors that looks particularly contractionary is manufacturing. The remainder are relatively healthy. Further, employment remains strong, and the consumer, while clearly slowing down, remains healthy. With a solid labor market, it is difficult to envision a sudden falloff in consumer spending. Without reiterating all of the competing factors, our base case remains that the U.S. is likely to experience a mild recession in late 2024, but the odds are rising that the country may simply experience a slowdown in growth thereby avoiding the more common recession definition of two consecutive quarters of negative GDP growth.

Regardless, we believe that the upside for investors is limited. The market is trading at a relatively high multiple, and earnings expectations for 2024 remain a significant hurdle. In general analysts are forecasting earnings of approximately $246 per S&P 500 share. Applying a multiple of 21 to this earnings estimate renders an S&P 500 2024 year-end target of 5,166. That number represents a 10% gain over the December 29, 2023 closing value. Given that analysts often overestimate earnings, we would view that target as quite optimistic. It remains possible that the market could hit this mark in 2024, particularly if the much maligned Frugal 493 experience solid earnings growth and a small amount of multiple expansion.

In a more negative scenario, the Frugal 493 are cheaper and would likely decline less than their more expensive counterparts in the Magnificent Seven and the tech sector more generally. While we believe it will be difficult for the U.S. to avoid a recession, we also believe that the upside of a soft landing is not all that significant. Consequently, a more conservative position is not likely to come with significant opportunity cost. As we noted the bond market also remains attractive, and any slowdown will likely be accompanied by a decline in interest rates. We will continue to maintain a more defensive equity posture as we enter 2024.