Cornerstone 1st Quarter 2023 Commentary

I sincerely believe with you, that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.

– Thomas Jefferson (To John Taylor 1816)

If everybody is thinking alike, then somebody isn’t thinking.

– George S. Patton Jr. (U.S. Army Field Commander WWII)

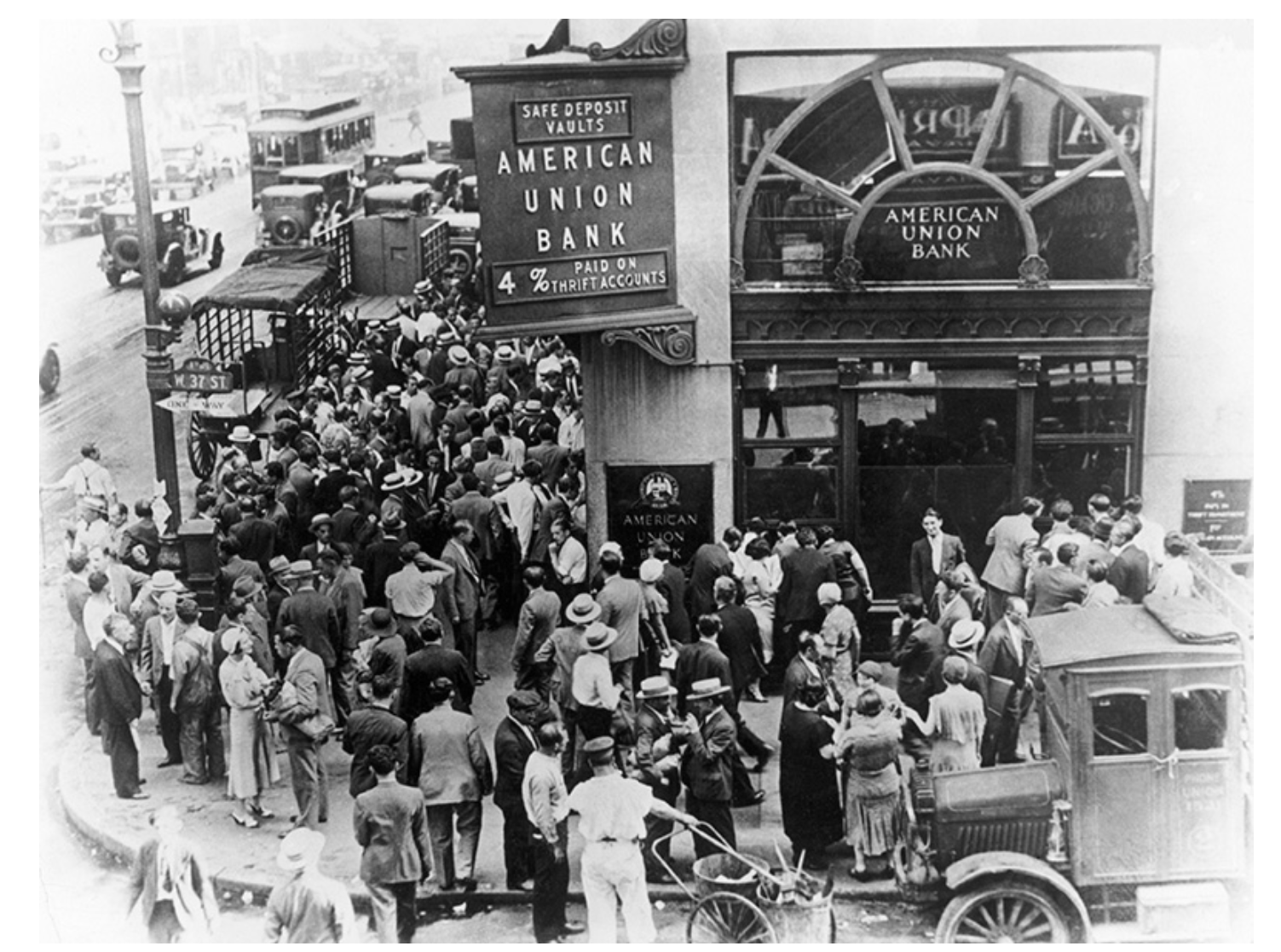

As if FTX wasn’t enough, the market was forced to deal with a bank failure or three during the first quarter of 2023! Things were going along swimmingly, if you can call runaway inflationary fears, weakening economic indicators, and a manufacturing sector in contraction swimming. The market, at least, seemed to be taking such data points in stride, and then along came the failure of Silicon Valley Bank (SVB). A favorite of the Private Equity crowd, SVB got a bit carried away with the investment of depositors’ money and created, as they say, a classic mismatch between the duration of assets and liabilities. Unfortunately for SVB, their woes were made a bit more obvious by Peter Thiel and other influential parties advising friends and clients to pull their funds from the bank. Tweets, you see, move a bit more quickly than financial statements and old-time newspapers.

In a matter of hours, it was over, and the FDIC and Fed were working through a plan to protect—well, virtually everyone!—the banking sector, the markets, the corporate sector, and any other person who had the misfortune to have funds with SVB. Ultimately, the FDIC determined that they would back all deposits at SVB, not just those under the venerable $250,000 limit. “Moral hazard,” anyone?

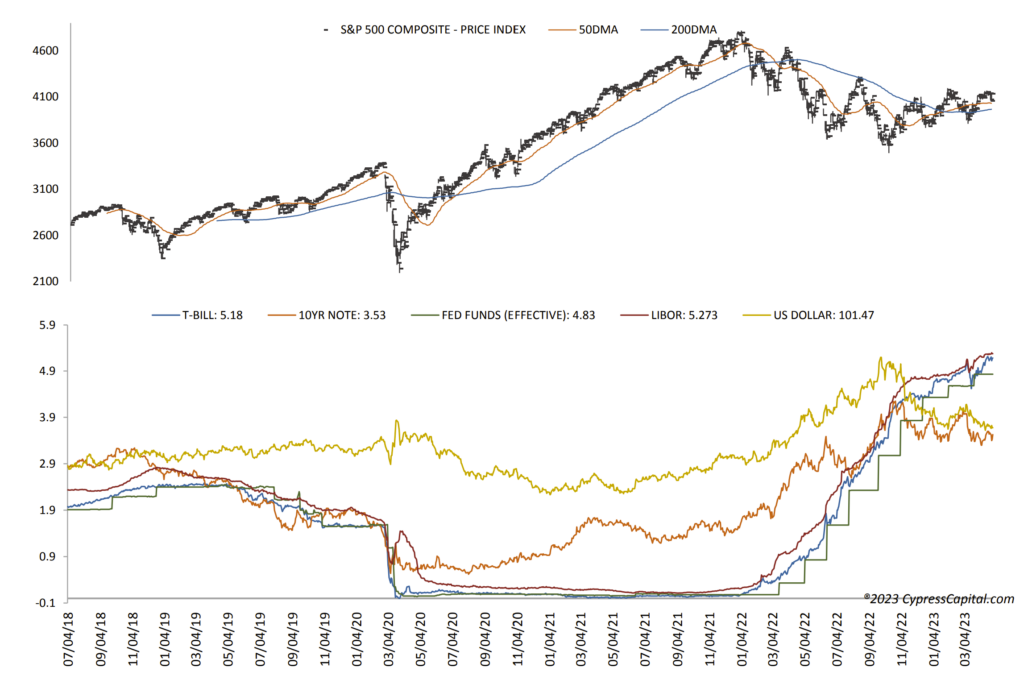

Not to be outdone, the Federal Reserve stepped in with the Bank Term Funding Program (BTFP) under which banks can borrow from the Fed for periods of up to a year pledging various forms of collateral that the Fed will value at par to secure the loans. Additionally, the Fed reminded banks that the discount window would remain open, further reassuring bankers that copious amounts of liquidity would remain available. While Signature Bank was a bit of a different story, its depositors also received full restoration through the FDIC. Interest rates dropped precipitously as investors worried that a full-scale banking crisis might be brewing. Further, concerns developed that the Fed would be forced to halt its rate-tightening regime and reverse course. Futures markets, which just days before forecasted a terminal Fed funds rate of near 6% by the end of 2023, reversed course implying multiple rate cuts prior to the end of the year. Bonds markets rallied dramatically.

Initially, fears surrounding a potential banking collapse coupled with elevated economic concerns rattled equity markets, but as more information became available and investors responded to the aggressive actions of the Federal Reserve and the FDIC, equity markets reversed course and rallied strongly into the end of the quarter. Growth stocks which had been taking a beating were bolstered by the prospect of lower rates and vaulted higher, leaving value stocks far behind. Banking entities often fall into value classification categories, and, needless to say, bank stocks were pummeled as investors threw the baby out with the bath water and the entire financial sector was pressured to the downside.

Not to be outdone, Europe experienced its own drama as the Swiss authorities stepped in with a plan for UBS to take over troubled banking giant Credit Suisse. Credit Suisse, it should be noted, has been under a cloud for some time, and the current environment was simply the straw that broke the camel’s back. However, the plan caused some consternation as a unique class of bonds (AT1s) was completely wiped out in the merger while equity shareholders retained at least some of their capital. The Credit Suisse debacle challenged the traditional assumption that bondholders always have seniority in the “capital stack” and may have some knock-on effects related to post “Great Financial Crisis” bank funding structure in Europe.

Bond investors did “know” that such an event could occur, but as usual it was not expected to occur, and so the hue and cry went up that the plan was unfair, unprecedented, etc., etc. For our part, we were rather grateful that not everyone got bailed out everywhere! Risk is after all what investors are paid to take. Theoretically, investors are paid more to take more risk, and corporate chieftains and bank executives alike are supposed to manage their businesses with the expectation that risk matters and poor management carries with it a price! At least in the case of Signature Bank, management was summarily removed and equity investors did lose their capital.

While the combination of the Fed’s intervention and the actions taken by the FDIC may have been a bit more than necessary, those actions did, at least for the moment, protect the broader markets and the banking sector from a meltdown. Some form of capitalism was preserved, and while all parties may not have experienced the full impact of their decisions, markets continued to function in a relatively normal fashion.

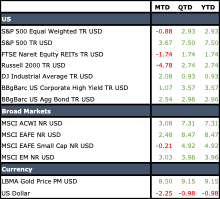

As noted, global equity and bond markets rallied during the first quarter of 2023. The S&P 500 finished the quarter up 7.5%, well below its historic 2022 high but adding to its fourth quarter gains. Growth outperformed value, and the market narrowed significantly during the quarter. The top five contributors to that performance make up only 18.3% of the index, but they contributed a stunning 67% of the first quarter return! Led by Info/Tech and Communication services, the Russell 1000 Growth Index rose 14.37% for the quarter while the Russell 1000 Value eked out a paltry 1.01% return over the same period. Small capitalization stocks rallied as well, but not to the same extent. The Russell 2000 was up 2.74% for the quarter hindered largely by the poor performance of value-oriented sectors during the month of March.

Despite continued concerns regarding office building occupancy rates and higher interest rates, REITS also managed to move higher. The FTSE NAREIT Equity Index was up over 2% for the quarter. The banking fears pushed up bond prices, and the Bloomberg Aggregate Bond Index tacked on nearly 3% for the quarter. Needless to say, the strong showing by both stocks and bonds resulted in solid returns for a traditional 60/40 asset allocation mix.

The economic picture in most developed markets looked a bit better than expected during the first quarter of 2023. This fact coupled with a modest decline in the dollar led to solid international equity returns. While growth outperformed globally, that out-performance was much more muted than here in the U.S. The MSCI EAFE ended the quarter up 8.47%. Small cap and emerging markets also performed quite well. The MSCI EAFE Small Cap Index was up nearly 5% while the MSCI Emerging Markets Index was up approximately 4% to end the first quarter. In short despite a significant amount of drama, the first quarter of 2023 was a good one for investors.

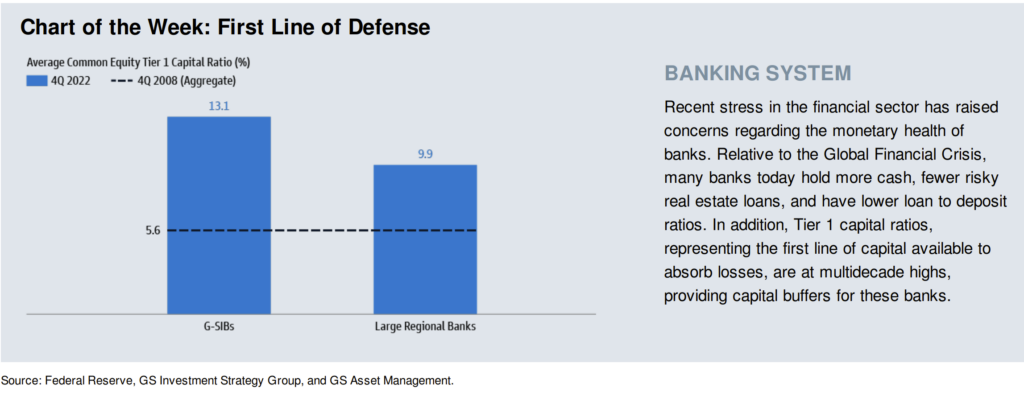

While we do not believe SVB, Signature Bank, and Credit Suisse represent the beginning of a banking crisis, they may represent some of the economic challenges brought about by the swift rise in the Fed funds rate. Banks operate off a spread, the difference between the interest they pay on deposits (liabilities) and the interest they collect on loans (assets). It was the mismatch in these assets and liabilities which brought about the downfall at SVB. The same is now looming large as First Republic collapses as well. While banks are often slow to raise rates paid to depositors relying on individuals’ hesitancy to brave the hassles of a bank change, the digital environment makes such changes easier and renders traditional bank loyalty less effective. Further, disintermediation accelerates as banking fears grow and investors move funds to brokerages, credit unions, and even decentralized finance opportunities to enhance their yield and avoid potential problems at their bank. Most bankers are not the risk-taking sort, and consequently, many banks respond by tightening loan standards and seeking to build their capital and solvency ratios.

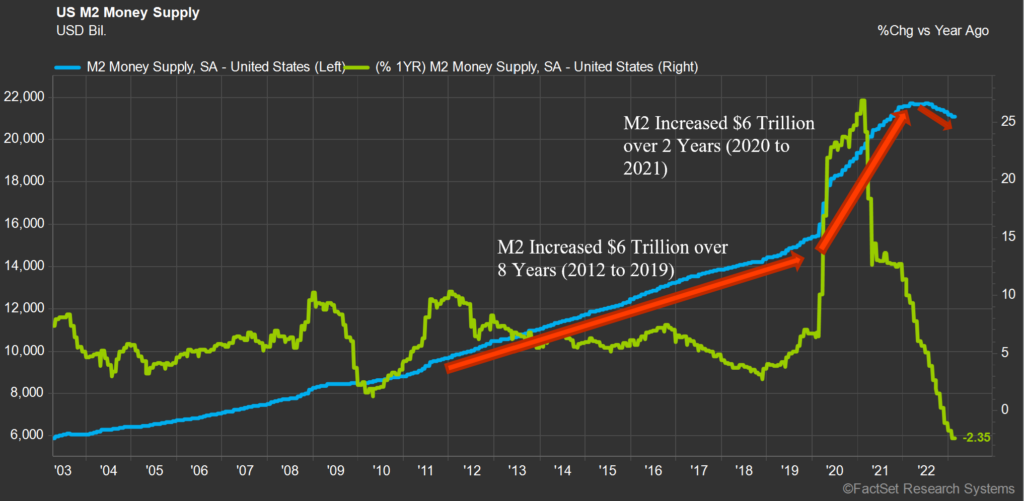

The effect of such moves is to further tighten monetary conditions and slow the economy. Of course, that is the objective of the Federal Reserve. Unfortunately, while M2 is beginning to contract, overall monetary conditions are not all that tight, and low levels of unemployment coupled with high levels of excess savings have allowed the consumer to go on spending, frustrating the Fed’s efforts to bring down inflation while seeking the ever-elusive soft landing.

In our mind, that soft landing is likely to remain elusive. Corporations have, thus far, been able to protect their margins, but earnings expectations continue to decline. Without substantial earnings growth or a significant decline in interest rates, there is little likelihood of a new bull market. Rather the best we can hope for is a range-bound market with little upside and significant downside. In our mind the probability of recession continues to rise; it is only the question of timing that remains opaque. Consequently, we remain defensively postured as we enter the second quarter of 2023.