Cornerstone 1st Quarter 2022 Commentary

War is mainly a catalogue of blunders

Winston Churchill

War in Europe, mounting inflationary fears, and Covid-19—clearly a recipe for a bearish first quarter. In fact, following new highs set by most indexes in the first week of January, the first quarter was one long string of bad news and increased volatility. Equity markets which had been priced for perfection, earnings growth, and strong demand were hit with worries related to rising interest rates, the growing probability of recession, and war.

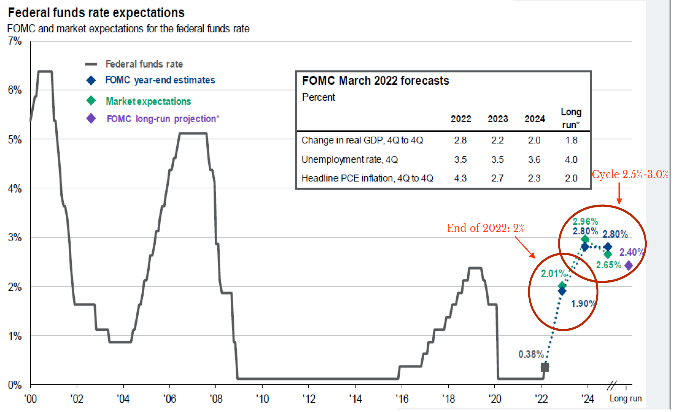

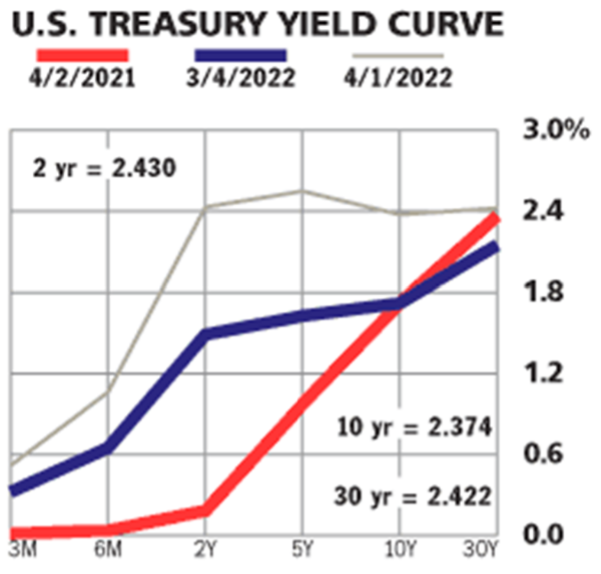

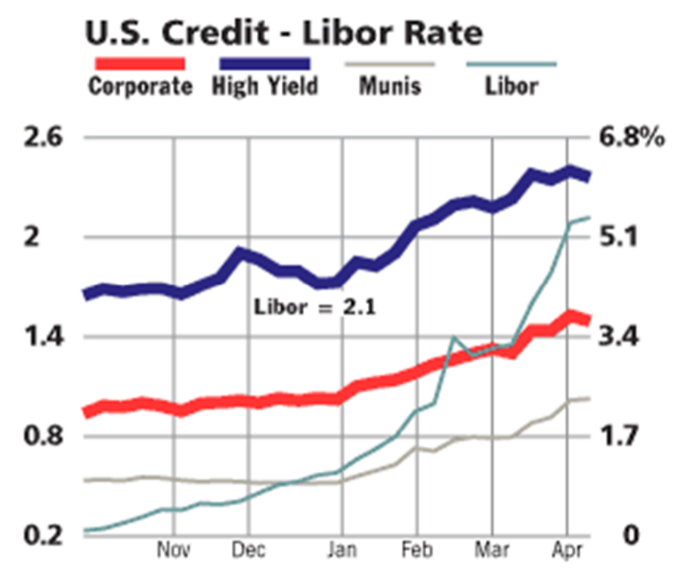

Fixed income markets, already weakened by the coming tightening cycle indicated by the Fed in late 2021, struggled to adjust to growing hawkish rhetoric and a more aggressive stance by the Fed. Initial expectations of three to four 25bps rate hikes in 2022 quickly gave way to expectations of six to seven hikes along with the increased probability that one or more of those hikes could be at least 50bps rather than the more common 25bps move utilized by the Fed in recent years.

This change in expectation led to a massive shift in interest rates along the yield curve. The entire curve shifted up, and the corresponding carnage in the bond market was of epic proportions. Our readers will remember that when interest rates rise, bond prices fall. Consequently, the sudden spike in interest rates led to the worst performance in intermediate-term bonds since the early 1980s. As we write this commentary, the Bloomberg Aggregate Bond Index is down nearly 10% for the year. This type of price move is nearly a four standard deviation event and would be similar to the S&P 500 dropping 40-45%. Yes, this was a very rough quarter indeed.

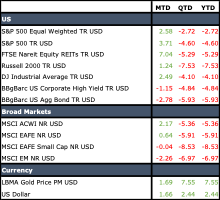

Bonds normally act as a buffer during periods of rising volatility and geopolitical instability, but in this case, they were of no real help during the quarter. The Bloomberg Aggregate Bond Index declined nearly 6% for the quarter while U.S. large cap stocks were only down about 4.5%. From the perspective of the globally diversified investor, there were very few places to hide!

Initial concerns about valuation and rising inflation gave way to fears surrounding the Russian invasion of Ukraine. The first truly significant armed conflict in Europe since the Bosnian war of the early 1990s, it has been perceived as much more significant on the world stage. Loss of life has already been significant, and the number of displaced persons has been stunning. From an economic perspective, the effect has also been significant. The sanctions imposed on Russia coupled with the huge disruption to the Ukrainian economy have exacerbated an already tenuous inflationary environment. Russia is a leading supplier of oil, and the conflict immediately led to a significant increase in the price of oil and other commodities. Wheat, a significant export product of Ukraine, has risen nearly 50% in the last two months along with other metals and rare earth elements.

With the supply shocks already brought about by the Covid-19 containment measures of the last two years, war has led to significant inflationary pressure and additional supply disruption. Once a system is under pressure, any additional challenge can feel like the breaking point, and China’s continued insistence on the elimination of Covid-19 through blanketing lockdowns has stressed supply lines that were already at the breaking point.

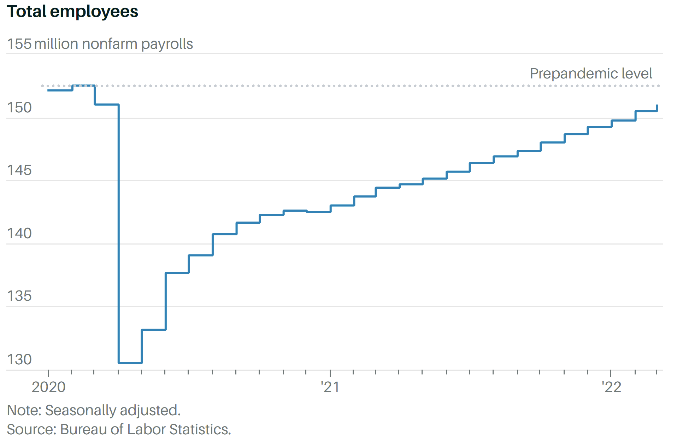

Finally, here in the U.S., the labor market has continued to tighten with unemployment falling to 3.6% albeit with a somewhat lower labor force participation rate than we experienced prior to the pandemic. Labor market pressure has led to rising wages and elevated concerns of growing margin pressure on the part of companies.

The cumulation of these factors has resulted in rapidly rising inflation and fears that the Fed is substantially behind the curve. Pressure to act and act decisively has led to very strong rhetoric by the Fed and the first rate hike of the cycle in March. The Fed has also accelerated its plans for balance sheet run-off, and when combined with tightening policies of central banks around the world, these actions point to significantly tighter monetary conditions in the quarters to come.

As previously noted, there was little place to hide during the first quarter. Energy and utilities were the only positive sectors during the first quarter of 2022. Equity markets across the world were negatively impacted and, despite a relief rally in March, ended the quarter in negative territory.

Large capitalization stocks in the U.S. were down approximately 4.6% for the quarter. However, this masked the continued divergence between growth and value sectors of the market. The Russell 1000 Value Index was down approximately 1% while the Russell 1000 Growth Index declined 9% for the quarter, a significant reversal from the previous quarter and for much of the last ten-year period. Small cap stocks bounced significantly off their quarterly lows, but were still down 7.53% at the end of March. Small cap performance divergence was similar to that experienced in larger U.S. stocks with the Russell 2000 Value Index down 2.4% and the Russell 2000 Growth Index down 12.63% over the same period. Rising interest rates tend to put more pressure on growth companies because much of their valuation is based on future earnings creation. Rising rates raise the discount factor utilized in valuation calculations resulting in lower current valuation estimates for growth companies. Value companies, by contrast, tend to have stronger current streams of earnings and are not as affected by changes in the discount factor.

REITs performed in line with traditional equities during the first quarter. The FTSE Nareit Index was down 5.29%. International stocks were similar to U.S. equity with the MSCI EAFE down just under 6% for the quarter. Small cap stocks were a bit worse, and value tended to outperform growth around the world. Emerging markets were also down, and the MSCI EM Index was down approximately 7% during the first quarter. Gold and other long-only commodities were generally positive and provided some level of protection during the period.

Cornerstone’s fixed income allocations benefited from our shorter duration exposure. Typically, our portfolios have a duration equivalent to about 65% of the Bloomberg Aggregate Bond Index. We believe this will continue to be helpful throughout 2022.

We should note that over the past 100 years intermediate-term bonds have been positive over three-year rolling periods 100% of the time. This is due to the fact that price changes are gradually overcome by the inflow of coupon income along with a slight reversal in the price impact.

While this first quarter has been particularly difficult, we remain hopeful that bond returns are likely to be positive over the next couple of years following the pain of 2021 and early 2022. Coupons will rise and interest income will gradually eclipse these recent negative price moves. It is also significant to note that bond markets have already priced in significant moves by the Fed. The price action is quite quick; therefore, should the Fed be forced to reverse course due to slowing growth or outright recession, bond markets will experience a significant price recovery.

CMI portfolios also benefited from our home country bias and our tilt toward value across the equity spectrum. This was most evident in small cap and emerging markets where our value exposure contributed significantly to returns. As we look ahead to continued volatility and inflationary pressure throughout the remainder of 2022, we plan to tilt our European exposure more toward our defensive value-oriented strategies. One of these managers also maintains significant precious metals exposure along with its cash position, and we believe it will help stabilize and protect the international component of the majority of our portfolios.

The remainder of the year appears challenging. Cornerstone believes that it is possible for equity prices to rally later in the year and potentially move back into the black for 2022 in its entirety.

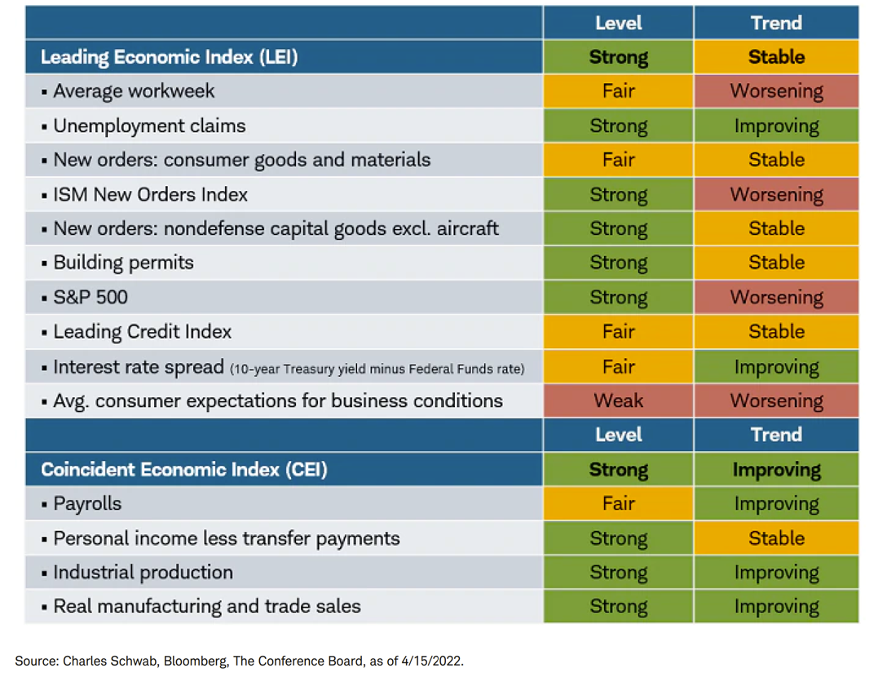

However, we expect volatility to remain high and more value-oriented sectors of the market to outperform. The strong response of the Fed together with the relative stability of the U.S. relative to the rest of the world suggests that the dollar is likely to remain relatively strong throughout 2022 as well. Currently, demand remains quite strong in the U.S. and earnings expectations remain elevated. However, as the year progresses, weakening consumer demand brought about by inflationary pressure, higher interest rates, and declining savings will likely result in a significant slow-down in overall economic growth.

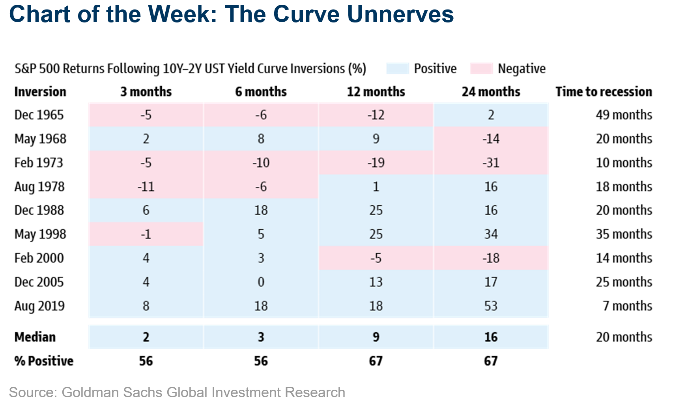

The pressure on the Fed to raise rates remains intense, and consequently, we have already experienced some mild yield curve inversion. Such inversions often signal a slowing of economic growth and the possible emergence of a recession. Currently, while we do believe that economic growth will slow during the remainder of 2022, we would not expect a full-blown recession until 2023. Markets tend to act as a forecasting mechanism moving three to six months in advance of the economy. It remains difficult to ascertain if the market is simply responding to higher interest rates and the prospect of slowing growth or whether a full-blown recession is on the horizon.

At this point in the cycle, we intend to retain our value overweight as well as our structural preference for U.S. equity. We will also keep the duration in our fixed income allocations well below the Bloomberg Aggregate Bond Index for the immediate future. We believe this slightly more defensive approach will serve us well over the upcoming months. As circumstances continue to evolve, we will evaluate our allocations and make adjustments within our given strategic policy constraints.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.