The Hazards of War

Oh troika, winged troika, tell me who invented you? Surely, nowhere but among a nimble nation could you have been born in a country which has taken itself in earnest and has evenly spread far and wide over half of the globe, so that once you start counting the milestones you may count on till a speckled haze dances before your eyes… Rus, are you not similar in your headlong motion to one of those nimble troikas that none can overtake? The flying road turns into smoke under you, bridges thunder and pass, all fall back and is left behind!… And what does this awesome motion mean? What is the passing strange steeds! Has the whirlwind a home in your manes?… Rus, whither are you speeding to? Answer me. No answer. The middle bell trills out in a dream its liquid soliloquy; the roaring air is torn to pieces and becomes wind; all things on earth fly by and other nations and states gaze askance as they step aside and give her the right of way…

As a Russian, therefore—as one bound to you by consanguinity and identity of blood—I make to you my appeal. I make it to those of you who understand wherein lies nobility of thought. I invite those men to remember the duty which confronts us, whatsoever our respective stations; I invite them to observe more closely their duty, and to keep more constantly in mind their obligations of holding true to their country, in that before us the future looms dark, and that we can scarcely…(Here the manuscript of the original comes abruptly to an end) – Nikolai Gogol

Back in 2014, during the Winter Olympics held in Sochi, Russia, we shared with our readers the first section of this quote. Above we have added a section from the end of the same book Dead Souls by Nikolai Gogol because it seems to us that it may reflect something of the mind of Vladimir Putin and perhaps his counterpart Dmitry Medvedev as well. We are certainly not experts on Russian policy, but we do try to be students of history. History, it is said, rarely repeats but often rhymes, and in those rhymes we may find insights into the current situation. There is also the old saw: those who ignore history are doomed to repeat it. So it is with no small degree of trepidation that we wade into the current murky waters of the Ukrainian conflict, its impact on the current economic environment, and its current and potential impact on global equity, fixed income, and commodity markets. There are no easy answers to these questions, and information abounds. Our focus over the next few paragraphs, is to synthesize and summarize our view of the current environment as well as our response to expected outcomes for the benefit of our readers.

Medvedev Doctrine

Many have forgotten the Russian invasion of Georgia in 2008. We believe that Russian political doctrine outlined by Dmitry Medvedev, the Russian President during that conflict and current Deputy Chairman of the Russian Security Council, has direct bearing on both the subsequent Russian annexation of Crimea as well as the current conflict with Ukraine. The Medvedev Doctrine (summarized below) was originally outlined by Dmitry Medvedev in August 2008 following the Russo-Georgian Conflict.

- Russia recognizes the primacy of the fundamental principles of international law.

- The world should be multipolar since a world dominated by one power is unstable and threatened by conflict.

- Russia does not want confrontation with any other country.

- Protecting the lives and dignity of our citizens, wherever they may be, is a priority for Russia.

- Russia, like other countries of the world, has regions in which it maintains privileged interests.

It would seem items four and five provided internal impetus for the annexation of Crimea in 2014. When considered in light of Russia’s historic concern over border protection, the extension of NATO, and its interests in geographic areas linked to historic Russian statehood, this doctrine suggests an operational methodology employed by Vladimir Putin, Dmitry Medvedev, and the Russian elite to protect and advance Russian interests. While it is possible, as some news outlets have suggested, that Putin has become more mentally unstable, we believe it is most likely that he is simply doubling down on previously known and expressed principals. His growing concern regarding the western influence in Ukraine simply reached a tipping point. It is certainly possible that this tipping point was linked to both economic and hard power projection.

The Invasion of Ukraine

In our view, this summary suggests that Putin’s foray into Ukraine is unlikely to be protracted but that he will require some level of concession to project victory to the broader Russian population. It is quite possible that limited territorial acquisition and renewed establish-ment of Russian willingness/determination to act if its interests are threatened may allow Putin to claim victory and negotiate a peace deal. However, even in this more optimistic scenario, it is unlikely that a deal will occur immediately, and normalizing relations is likely to take several months. Consequently, investors must be prepared for additional geo-political headwinds throughout the 2nd and potentially into the 3rd quarter of 2022.

Economic Fall Out

The economic fall out of the Russo-Ukrainian conflict is significant in both human and economic terms. In this more limited overview, we are not able to address fully all facets of this conflict. Instead, we will focus the majority of our comments on the expected economic impact. We hasten to note the human impact and distress of war is terrible, and our hearts remain with the people of Ukraine. We should also note that from a geopolitical perspective, we believe that this Russian incursion has, among various other outcomes, strengthened the resolve of NATO, provided China with an object lesson relative to their territorial interests in Taiwan, and allowed the U.S. to re-energize historic alliances.

Due to ongoing supply shortages linked to the COVID-19 pandemic, current disruptions to various commodity supplies brought about by the conflict have added additional fuel to the global inflationary fire.

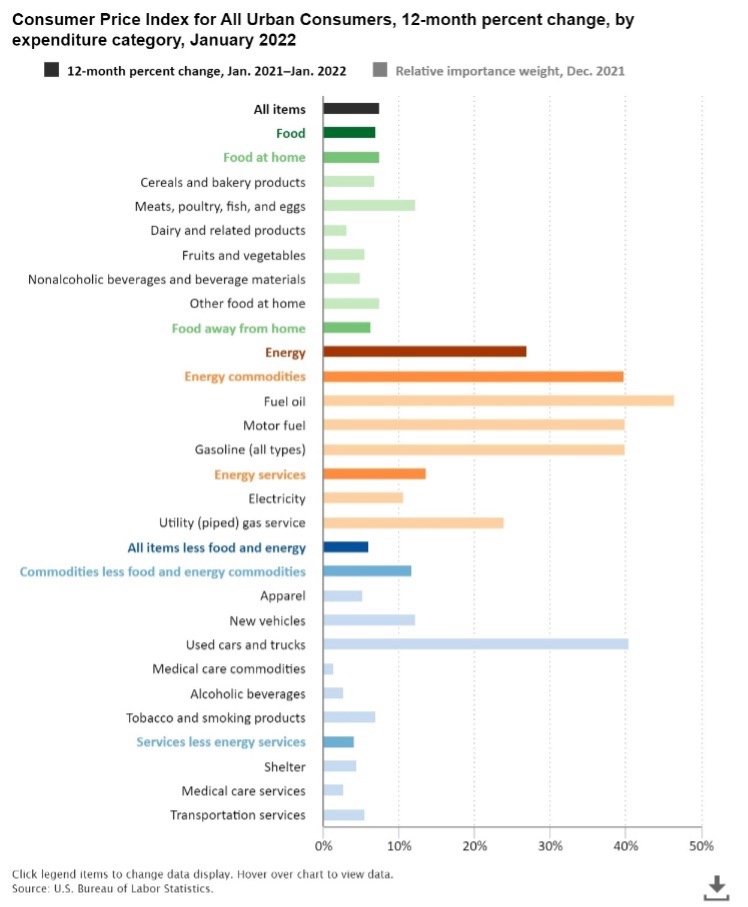

Oil prices have skyrocketed in recent days hitting levels not seen since 2008. Wheat prices and various metals, particularly nickel, have also been significantly affected. Inflation in the U.S. as measured by the CPI (Consumer Price Index) rose 7.4% over the last 12 months. This is the highest rate of inflation experienced in the U.S. since the early 80s.

COVID-19 Supply Chain Disruption

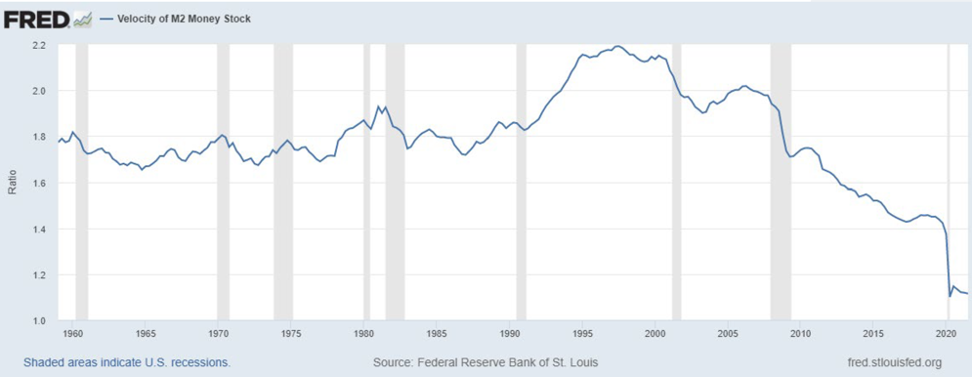

Over the course of the last year, we have maintained that the bulk of inflation has been caused by supply chain disruptions brought about by the global governmental response to the COVID-19 pandemic. Quarantines, travel limitations, and illness have all resulted in significant challenges to the global supply chain. These challenges have resulted in significant increases in the price of goods. Our base case suggests that such disruptions will gradually be eased as the COVID-19 containment measures run their course and the world slowly returns to a more normal state. We have also argued that although monetary and fiscal stimulus programs have ballooned the money supply, the velocity of money has actually decreased limiting the inflationary impact of these policies.

Finally, we have suggested that as vaccinations increase and fear wanes, workers will re-enter the workforce slowing the impact of rising wages and preventing the wage/price spiral of the mid-70s from recurring.

Level of Demand

We have long felt that the primary risk to our base case scenario was a limited appreciation for the level of demand inside the economy. We have posited that much of the demand for goods was backed by government transfer payments and that those transfer payments brought forward a significant amount of demand into late 2020 and 2021. After all, how many new dishwashers can one buy? High savings rates during the pandemic and limited opportunities for spending on services have led to some level of pent-up demand, but savings rates have declined over the last few months, and it appears that consumers have continued to spend through excess savings. Consequently, it has been our position that demand would weaken in the second half of 2022, economic growth would slow, and corporate earnings growth would also slow. This slowing would ease inflationary pressures and, along with interest rate hikes by the Fed, would likely result in U.S. economic growth slowing significantly. However, the probability of the U.S. slipping into recession during 2022 was, in our view, quite low.

Primary Risks

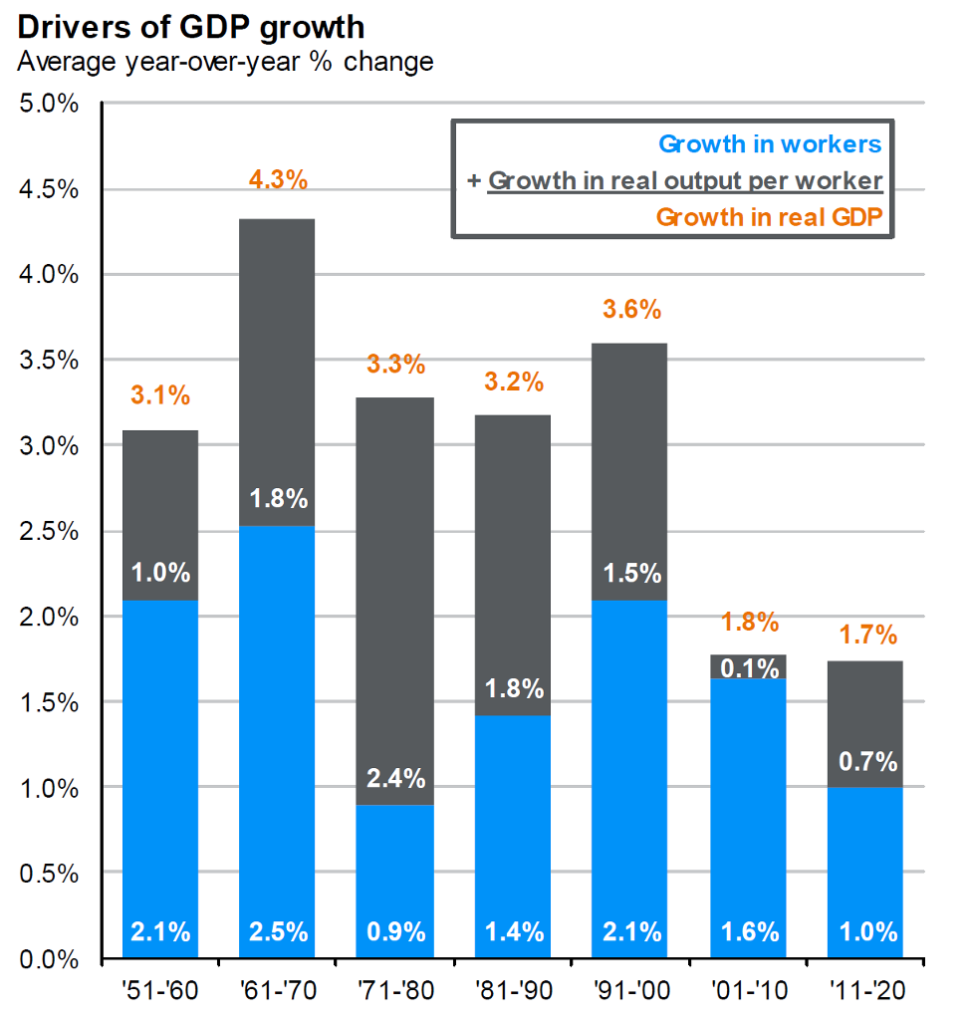

We believe there are two primary risks to our base case scenario. The first is that economic demand in the U.S. and around the world is much more significant than expected. (This is more likely to be the case in the U.S. because the U.S. addressed the economic decline brought about by COVID-19 quarantine measures through transfer payments, i.e. as people were laid off from their jobs the government offered significant increased benefits to the unemployed. In other developed countries, different governmental measures were employed and the workforce experienced less disruption.) It is quite possible that wage gains, increased savings, and the wealth effect may be greater than we expect and that the consumer may be able to offset the fall off in government expenditures and continue to boost economic demand at levels significantly above the long-run potential of the U.S. economy. It is important to remember that in the long run GDP is primarily driven by only two sources: growth of the workforce and productivity.

In the long run, given America’s aging workforce and limited immigration policy, it is unlikely that productivity growth alone will be enough to allow the U.S. economy to expand much above 2-2.5%. However, in the short run, the expansive government policies outlined above, coupled with robust wage growth, may result in the economy running hotter than expected. Such an outcome would also carry with it increased risk of inflation, and consequently the Fed has become more aggressive in both its rhetoric and its plan to eliminate quantitative easing and raise interest rates.

The second challenge to our base case relates to demand exhaustion. It is possible that even a small amount of monetary tightening would be enough to expose significant weakness on the part of the U.S. consumer. In such an event, growth would slow much more quickly than expected, and it is likely that the U.S. economy would slip into recession sooner, perhaps as early as late 2022.

The Ukrainian conflict challenges both of these possible scenarios. As noted, the conflict stresses commodity supplies, further exacerbating the inflationary effect. It simultaneously pressures demand by negatively impacting consumer confidence and forcing consumers to spend more of their discretionary income on food and energy. Rising gas prices act like a tax on consumers and, when coupled with rising interest rates, may be seen as an additional form of monetary tightening. Consequently, the Ukrainian conflict increases the risk of overshoot by the Fed.

How Will the Fed Respond?

We are concerned that the Fed may be forced to respond to increased inflationary pressure largely brought about by increases in the food and energy sectors. These increases are not being brought about the demands of a growing economy but rather by additional supply limitations caused by the current conflict. Ultimately, a Fed overshoot would likely shorten the current expansion and lead to recession more quickly. However, lack of Fed action due to the instability brought about by the conflict also raises the potential for stagflation—an environment in which growth slows but the Fed is unable or unwilling to fully address the impact of steadily growing inflation. In this scenario, the goods-based inflation brought about by the pandemic and exacerbated by the Ukrainian conflict embeds itself in both wages and consumer expectations. Growth slows because demand is constrained by higher fuel costs, rising rates, and demand exhaustion brought about by the decline in monetary and fiscal policy support. A stagflationary environment is challenging for both stocks and bonds. To address such an environment, the Fed would be forced to raise rates significantly regardless of the short-term economic impact. This would likely ultimately result in a significant recession as it did in the early 80s, but it is probable that more time would elapse prior to the recession under this scenario.

Other Contributing Factors

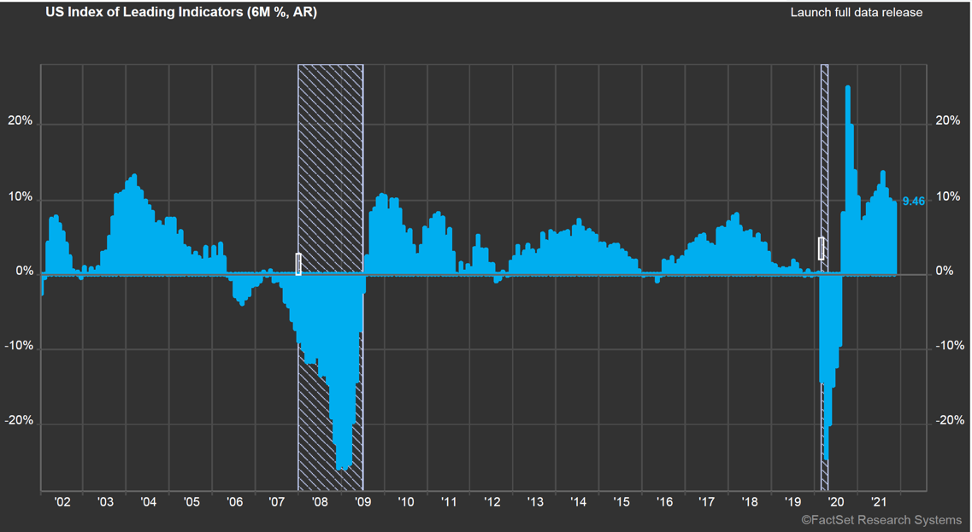

The conflict also causes instability and uncertainty. In the face of such uncertainty, consumers are likely to reign in their spending, and businesses may also be more cautious in their approach to capital expenditures. These responses are also negative and would likely result in an accelerated slowing of the economy. At this point, we remain cautiously optimistic. The pandemic is ebbing, Americans are returning to work, and some areas of the global supply chain are easing. We currently believe the impact of the Ukrainian conflict will be limited. Both the U.S. Manufacturing Index and Services Index remain at expansionary levels, and the most recent jobs report was extremely positive.

Corporations and individual consumers have taken advantage of governmental largesse and low interest rates and have further fortified their balance sheets. If the Ukrainian conflict can be resolved in relatively short fashion, it is quite possible that a full-blown recession can be forestalled and the current economic expansion may continue throughout 2022 and into 2023.

Market Volatility

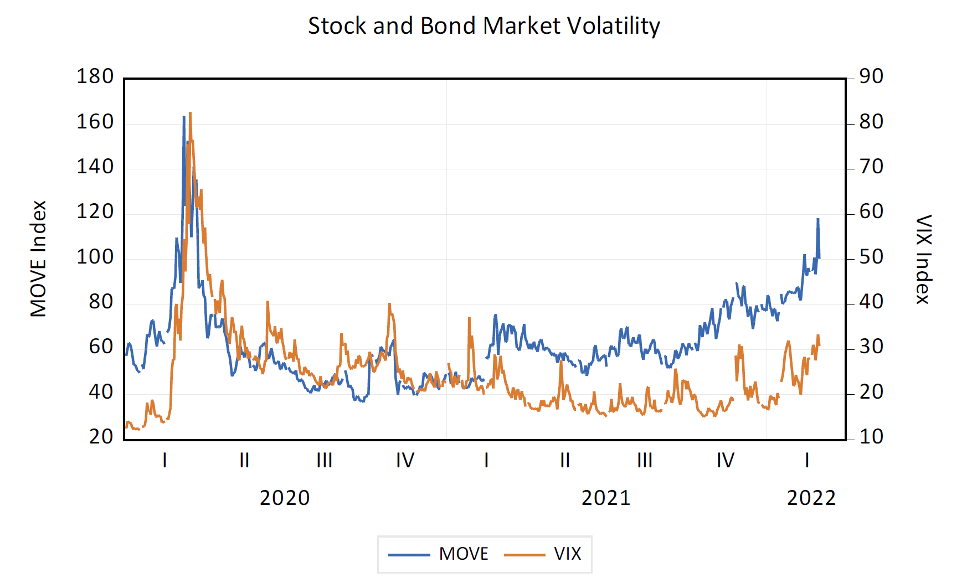

Equity markets entered 2022 priced for perfection with virtually all major U.S. markets hitting new highs. The S&P 500 achieved its most recent new high on January 3, 2022. The concerns about inflation, rising wages, the Omicron surge, and weakening demand were enough to rock markets and usher in a wave of negative volatility. The prospect of the Fed raising rates to combat inflation and increased margin pressure resulted in falling stock prices as markets sought to adjust to the expected future environment.

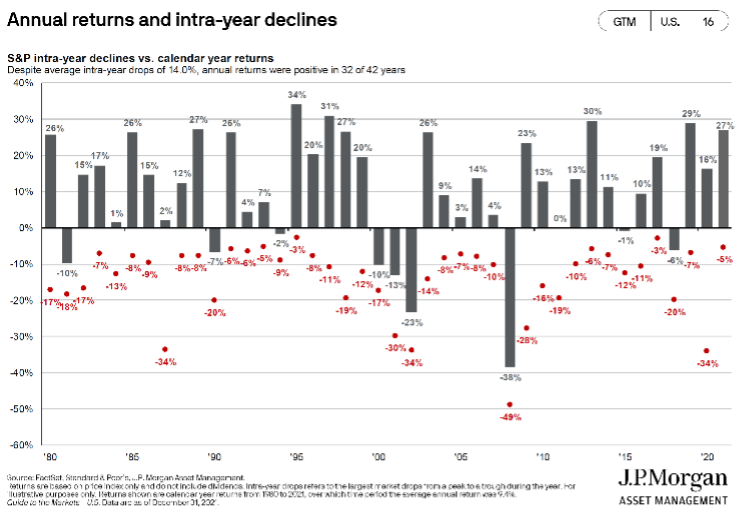

Markets tend to be leading economic indicators, and this fast-paced economic expansion has been preceded by an extremely fast-paced ascent in public markets. Now with uncertainty growing, markets are repricing. Given our economic outlook and the uncertainty brought about by the Ukrainian conflict, we believe additional volatility is quite likely. However, contrary to popular opinion, volatility is not inherently bad. Volatility is a significant component in equity returns. Investors are paid to take risk.

Corrections and even bear markets are necessary if equity investors are to earn returns above the risk-free rate. We refer to this excess return as the equity risk premium. In the current environment, many equities still offer significant value while others, particularly more growth-oriented securities, remain overpriced or are correcting significantly. In our view, rebalancing equity exposure helps limit the impact of such divergences and may also be utilized strategically to take advantage of pricing distortions during periods of fear and volatility.

Fixed income is also under duress at the moment. Rising rates pressure prices, and although bonds provide a safe haven in times of economic and geo-political uncertainty, some of that protection is offset by rising rates. In the current environment, shorter duration securities help protect against the price declines brought about by rising interest rates while still allowing the portfolio to retain the stabilizing influence of bonds. We continue to expect the Fed to raise rates in a measured fashion throughout the remainder of 2022. Should inflationary pressure increase, the Fed may be forced to respond in a more dramatic fashion. Regardless, retaining a shorter duration bond portfolio should continue to provide a buffer in the face of equity volatility while at the same time limiting the downside impact of rising rates.

Opportunities continue to exist but patience, fortitude, and adherence to one’s investment program are necessary in volatile times. War, inflationary concerns, rising interest rates, and a global pandemic are certainly enough to test the resolve of most people. During such times, reliance on proven portfolio construction methods, consistent rebalancing, and well-defined risk parameters provides a significant measure of comfort to the disciplined investor.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.