2Q 2021 Cornerstone Commentary

Market risk tends to be poorly rewarded when market valuations are rich and interest rates are rising.”

-John P. Hussman, Ph. D.

Relative to Q1 of 2021, Q2 was decidedly anticlimactic! However, the positive news for investors was that the market continued to rally and did so in a decidedly undramatic fashion.

Volatility declined to extremely benign levels, new stock market records were set, and late in the quarter interest rates fell allowing bond markets to stage a bit of a recovery. All in all, it was a great quarter for investors. Diversified portfolios continued to surge ahead, and while value- oriented securities lost ground to growth stocks on growing concerns that the “reflation trade” could be ending, virtually all sectors of the market gained ground during the quarter.

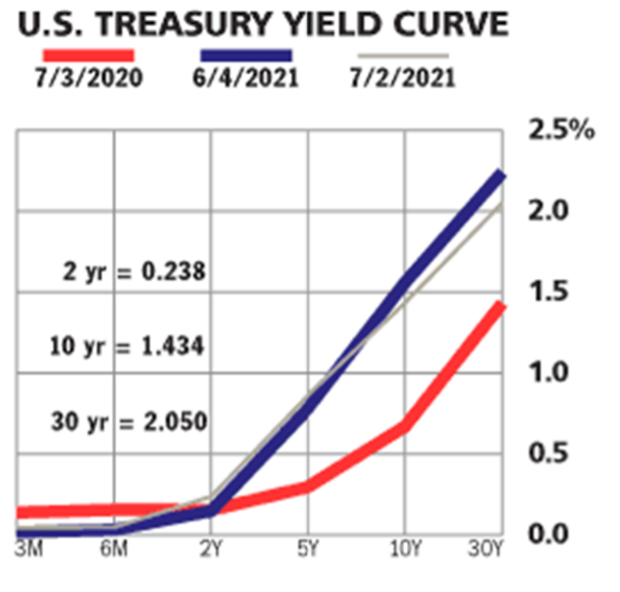

The following graph clearly illustrates not only the flattening of the yield curve late in the quarter, but also the significant drop in longer-term rates that brought about something of a rally in intermediate and long-term debt securities late in the quarter.

In this low-yield environment, it can be easy to forget that income does actually add to return and we are not investing in debt securities purely based on expectations for short-term capital appreciation. Midway through the year, exposure to higher yielding sectors of the fixed income market place has significantly boosted the returns of “Flex” bond funds and allowed for positive performance despite the fact that broader indices remain in negative territory. REITs also gained ground during the second quarter.

Despite concerns that fundamental work habits have shifted due to the pandemic and, therefore, the future of office properties remains somewhat cloudy, office properties have not yet witnessed dramatic increases in vacancy rates. Additionally, other areas of the REIT sector, particularly those related to growth, like 5G and data storage, have experienced significant appreciation. While low on an absolute basis, REIT yields remain attractive on a relative basis and may continue to attract interest purely from an income perspective. Despite solid performance across the capitalization spectrum, larger U.S. and international companies reasserted their dominance during the second quarter.

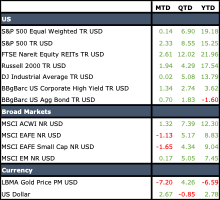

The S&P 500 was up approximately 8.5% during the quarter providing investors with nearly 20 percentage points of return during the first half of 2021. This gain was enough to push large capitalization stocks back above their smaller cap brethren. Small cap stocks also had a strong quarter, up over 4% bringing their total return to nearly 18% on a year-to-date basis. International stocks also performed well during the quarter. The MSCI EAFE was up over 5% and is now up nearly 9% in 2021. Smaller capitalization companies overseas were also up during the quarter and have performed in line with larger capitalization companies thus far in 2021. Emerging markets are slightly behind but are also performing well this year. The MSCI EM index was up 5% during the quarter and is up approximately 7.5% through June.

Had the dollar not bounced back a bit in June, it is quite likely that international equity and bond returns would have looked even more attractive during the second quarter. We can’t resist noting that Bitcoin and other crypto currencies got crushed during the quarter. Bitcoin declined by nearly 60%, and other crypto currencies were similarly affected. Regardless of your view, the crypto space remains extremely volatile and should be approached, at least in our view, with extreme caution if at all.

So, what’s not to like? The market is up, interest rates are low, the pandemic is on the ropes (at least in the U.S.), unemployment has fallen. In short, the second quarter was full of good news. The challenge, if there is one, is that perhaps the news was a bit too good. As we look toward the remainder of 2021, we are concerned that both the broader economy and the stock market have borrowed significantly from future growth prospects. The market is priced for perfection, and to a large extent the reflation trade may have run its course. The latter part of the second quarter was largely dominated by economic commentary debating the stickiness of inflation and the impact of the continued “reopening” trend on the U.S. and global economy.

As we move into the third quarter of 2021, this debate shows no sign of weakening, and we expect it to continue throughout much of the remainder of 2021 and potentially into 2022.

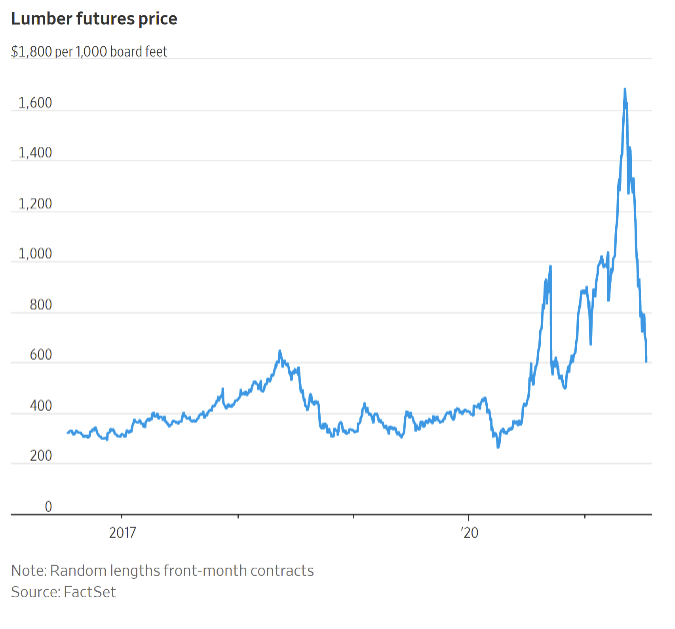

A full review of these broader economic issues is beyond the scope of this commentary, but we will comment briefly on our view that the current inflationary effects are largely transitory in nature and that we remain more concerned with disinflationary trends that are likely to manifest themselves more fully as we transition into 2022. However, in the short term there are several points that can be made which suggest that current inflationary sightings are more related to supply chain disruptions and are, therefore, less likely to be problematic over the next few years.

Lumber prices, as indicated in the preceding chart, are a great example of transitory supply and demand imbalances brought about by the Covid pandemic. Most experts would agree that there is no lack of lumber in North America! However, supply chain issues between the U.S. and Canada, coupled with a surprising surge in demand for single family homes and home improvement projects during the pandemic, led to a dramatic spike in prices.

Similar spikes have been seen in other areas of the commodity complex: not least, the surge in oil prices. However, we must keep in mind that oil prices declined rapidly in the face of Covid containment measures and that suppliers were already dealing with relatively low oil prices going into the pandemic. They have little incentive to immediately boost supply, and it will take some time for marginal suppliers to become comfortable enough to expand production. The move in oil prices is hardly dramatic when considered in the light of past price action, and oil remains well below $100 per barrel at this time.

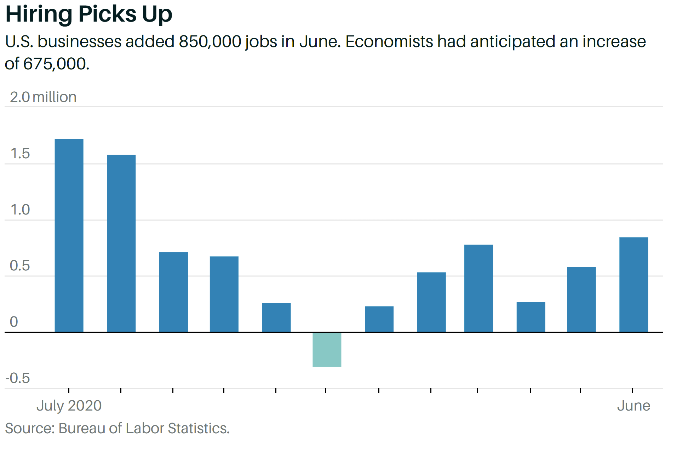

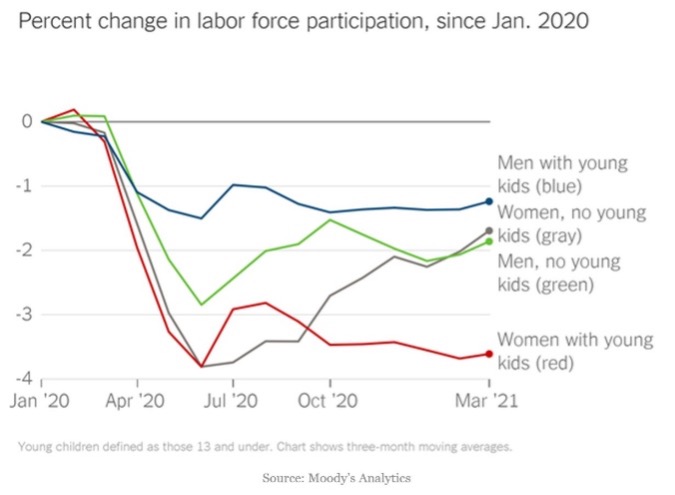

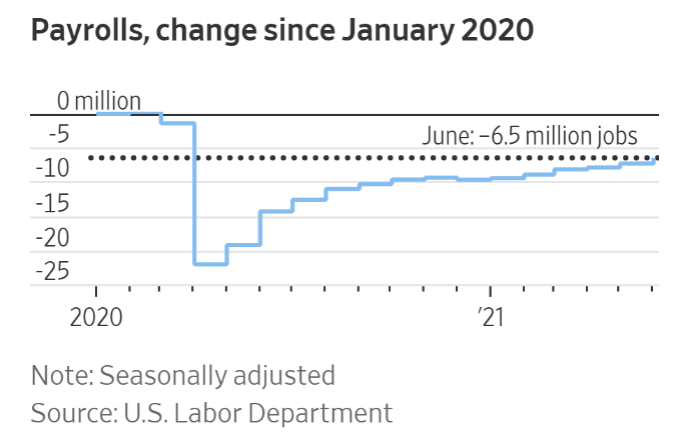

A second element which leads us to our current view that inflationary pressures are largely transitory relates to the current state of the U.S. labor market. Yes, it is certainly true that there are many anecdotal incidents of labor market pressure. Hiring bonuses at McDonalds, significant increases in hourly compensation for manufacturing workers, and enhanced benefits packages are a few examples of what may feel like growing inflationary pressure. However, we agree with the Fed on the job market. The data does not yet support true labor market pressure.

Labor market participation remains well below pre-pandemic levels, and the U.S. still has quite a way to go to reach an unemployment rate similar to that last seen in February of 2020. We would argue that pandemic factors (fear, childcare, eldercare, etc.) along with government transfer payments are temporarily limiting the available supply of labor while at the same time stimulating demand. This short-term squeeze is forcing corporations to act aggressively in order to remain competitive. However, as children return to school, pandemic fears ease, and government transfer payments cease, we believe that labor market slack will dampen wage inflation.

Finally, while the Federal Reserve Bank remains accommodative, the velocity of money has not increased significantly. A great deal of the liquidity injected by the Fed remains trapped in both individual savings and on bank balance sheets. In our view it would be difficult for inflation to truly take hold in such an environment. While our views could change, at the moment we remain unconvinced that rising inflation, at least of the 1970s variety, is here to stay.

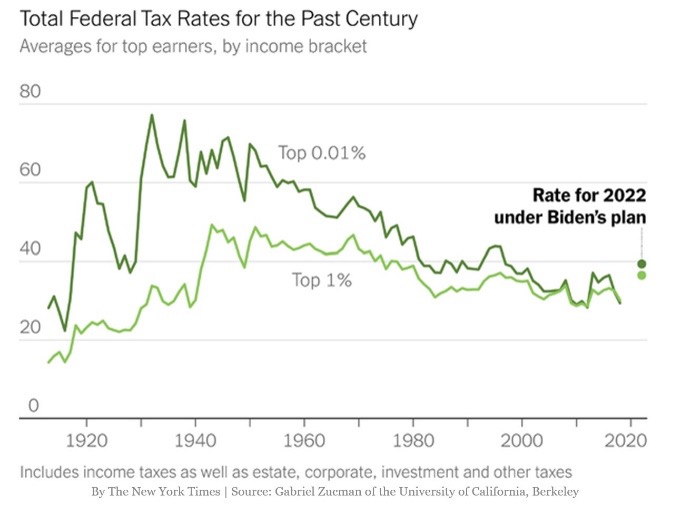

As previously noted, volatility has fallen and equity market valuations are priced for perfection. Markets are expecting an additional fiscal stimulus package and a corresponding tax bill to go with it. Further, the Delta variant and continued morphing of Covid-19 may lead to additional economic impact, particularly outside the U.S. These variables, when viewed in the light of a market which has not experienced a short-term correction since before the election, suggest that caution is warranted.

Despite our concerns, we believe the most likely scenario remains one in which U.S. equities end the year above their June 30 close; however, we also anticipate increased volatility and a probable correction during the third quarter. Countercyclical rebalancing and a preference for short-duration fixed income remain our first line of defense against this expected outcome.

For additional information about Cornerstone Management or this report, please contact

Bryan Taylor or Chad Crawford

770-449-7799

bryan@cornerstonemgt.net

chad@cornerstonemgt.net

Financial Advisory Consultants DBA/Cornerstone Management Inc. is a Registered Investment Advisory Firm. Although the information in this report has been obtained from sources that the Firm believes to be reliable, we do not guarantee its accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report may only be dispensed with this disclosure attached.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.