1Q 2021 Cornerstone Commentary

There have been three great inventions since the beginning of time: fire, the wheel, and central banking.

-Will Rogers

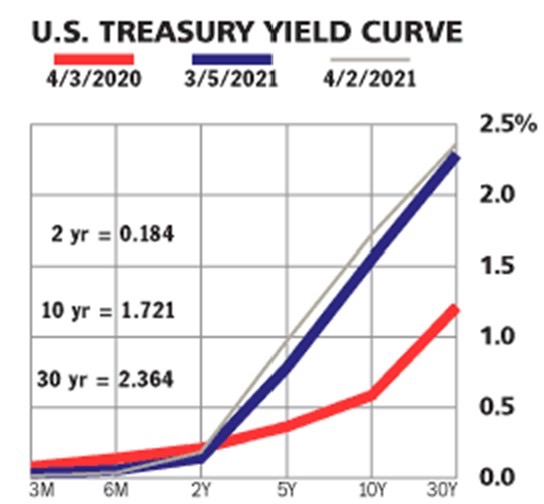

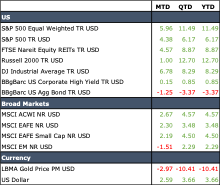

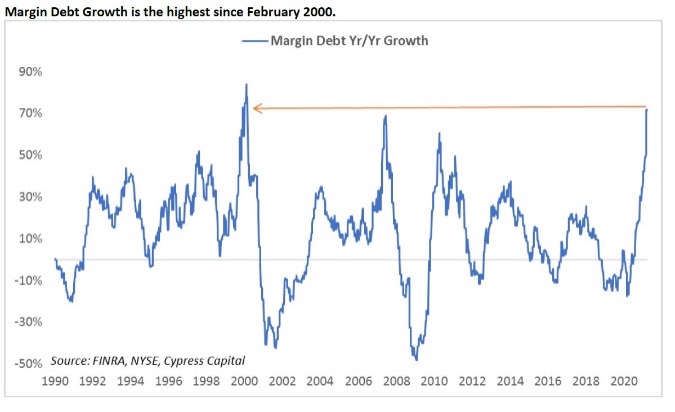

The first quarter of 2021 witnessed a dramatic extension of the 2020 global equity rally. Led by smaller capitalization equities, virtually every sector of public equity markets moved higher during the quarter. Drama at the capitol, a new U.S. President, a massive fiscal stimulus package, meme stocks and crypto mania all contributed to the backdrop of a market searching for a top. While valuations are at high—some might say stratospheric—levels, investor sentiment shows little sign of cooling, and FOMO (fear of missing out) seems to have pervaded equity markets. There is definitely a “risk on” attitude among individual and institutional investors alike. The U.S. economy bolstered by an accommodative Fed and a seemingly unlimited supply of fiscal stimulus roared out of the gates in 2021 and shows little sign of slowing in the near future. Inevitably with a hot economy come fears of rising inflation, and in the face of those fears the yield curve steepened dramatically during the first quarter.

Consequently, it was a tough quarter for fixed income assets, and global bond prices dropped significantly. I suppose the trillion-dollar question is how “sticky” are those inflation numbers? At the moment the Fed and Congress seem undeterred. Steady as you go is the answer from the Fed, while Congress seems bound and determined to “strike while the iron is hot” and pass additional stimulus in the form of an aggressive infrastructure plan. Covid fears are fading, the economy is humming, and Robinhood investors beat the “smart money.” That’s quite a kick-off for a year that not too long ago seemed like a lost cause.

In many ways the riot at the Capitol seemed to bookend the drama of the Trump presidency. While the underlying issues leading up to the event have yet to be addressed, they have been superseded by other economic events accompanying the Biden administration’s first hundred days in office. Ironically, it has been the best first hundred days of any President since FDR, at least from an equity market standpoint.

From an economic and market perspective, perhaps the most influential event of the first quarter was the passing of the much-anticipated ARP (American Rescue Plan Act)—certainly a triumph for the Biden administration and for those who believe that extra stimulus was needed to keep the U.S. economy on the proper trajectory necessary to ensure that it breaks free from the gravitational pull of Covid containment measures. The market had anticipated an additional stimulus bill and reacted accordingly. The injection of over 5 trillion in fiscal stimulus coupled with approximately 7 trillion in monetary stimulus through Federal Reserve Bank programs have provided an incredible amount of fuel for both the economy and stock market. One need look no further than the GameStop debacle to see that liquidity is sloshing around in the system resulting in sloppy capital markets and undoubtedly some level of capital misallocation. However, for the moment—a short moment perhaps—the future looks bright.

As we noted at the outset, yields rose and bond prices fell. The Barclays Aggregate Index was down over 3%, and when you couple that loss with a strong dollar, the Barclays Global Agg dropped nearly 4.5%, a decline more commensurate with equity volatility than with safe-haven assets. The Fed continues to anchor the short end of the curve, but the long end has been volatile with substantial upward pressure remaining. The MOVE Index remains extremely elevated indicating that expected yield curve volatility remains high and investors are concerned about rising rates. Cornerstone’s investment committee has addressed this concern by continuing to lower the duration in our fixed income allocations. We believe bond allocations are primarily a line of defense, and care must be taken to ensure that portfolio positioning allows them to act in this fashion while at the same time seeking to avoid significantly negative portfolio outcomes.

Following the strong positive returns of 2020, investors should prepare for much tougher sledding in 2021. Global equity performance was quite positive during the first quarter. U.S. small capitalization stocks led the way with the Russell 2000 up 12.7%. However, it was value that really provided the “wow” factor in the first quarter. The Russell 2000 Value Index was up over 21% for the first three months of the year bringing its one-year trailing return to nearly 100%, a stunning move for a broad-based index and well ahead of the S&P 500 over the same period. Large capitalization stocks continued to perform admirably as well. The Dow Jones Industrial Average outperformed the S&P 500 rising 8.29% during the quarter. Again, the truly dynamic moves can be seen on the value side where the Russell 1000 Value Index was up just under 12% well ahead of the Russell 1000 growth which rose just 1% during the first three months of 2021. REITs also staged a bit of a comeback, up 8.9% for the quarter.

While not quite as dynamic as the U.S. results, international stocks also performed quite well. The MSCI EAFE was up approximately 3.5% and the MSCI Emerging Markets Index was up just over 2% for the first quarter. Again, smaller capitalization equities outperformed with the S&P Developed ex US under 2B Index up over 5% for the quarter and nearly 68% for the one-year trailing period. Strong returns from value, REITs, and international small cap significantly impacted Cornerstone portfolios propelling them ahead of global equity benchmarks. We utilized this opportunity to rebalance out of some large cap core positions into peripheral diversifying sub asset classes like REITs and small cap.

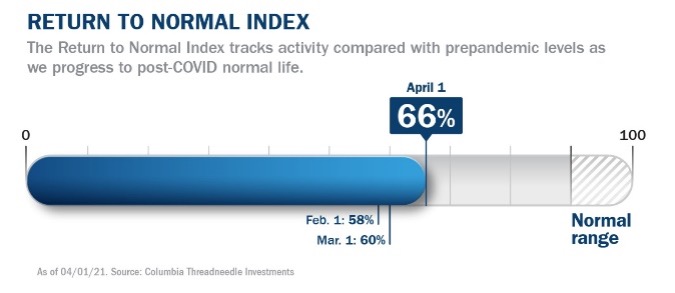

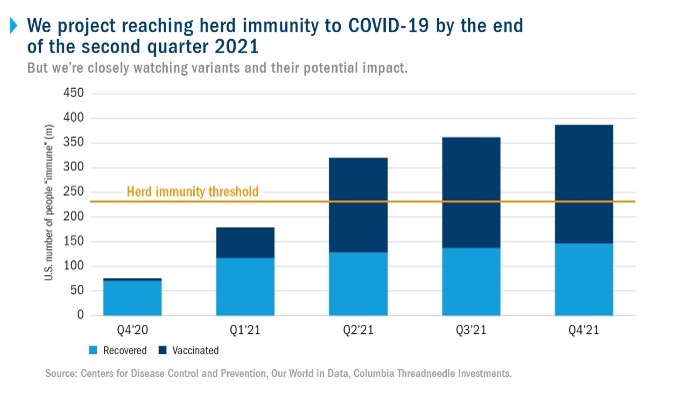

Looking forward we find much to be positive about, particularly over the next 9-12 months. Markets have clearly rallied on expectation of a gradual reduction in Covid-19 constraints and the potential for the U.S. to reach herd immunity by the third quarter. As a leading economic indicator, markets are clearly moving on the expectations for continued fast paced growth in the U.S. economy.

An accommodative Federal Reserve coupled with fiscal stimulus and a possible infrastructure package should help ensure continued economic strength for the remainder of 2021. Further out, the situation becomes more clouded as the impact of stimulus rolls off and markets and the economy are forced to contend with a less accommodative monetary policy. We should also note that short-term technical indicators are mixed and U.S. markets are overdue for a short- term correction. The last correction of any magnitude occurred in October 2020, and so we would not be surprised to experience a short-term decline over the next few months. Despite these concerns we expect equities to end the year well and have positioned our portfolios accordingly.

For additional information about Cornerstone Management or this report, please contact

Bryan Taylor or Chad Crawford

770-449-7799

bryan@cornerstonemgt.net

chad@cornerstonemgt.net

Financial Advisory Consultants DBA/Cornerstone Management Inc. is a Registered Investment Advisory Firm. Although the information in this report has been obtained from sources that the Firm believes to be reliable, we do not guarantee its accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report may only be dispensed with this disclosure attached.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.