The State of Fear

I would define True Courage to be a perfect sensibility of the measure of danger, and a mental willingness to endure it.

– General William T. Sherman

What a difference a couple of weeks makes! It seems like ages ago that we were concerned about the growing impact of the COVID-19 Virus on Italy and the knock-on effects on the U.S. Economy. Today we are concerned about the growth curve of COVID-19 in the U.S. and growing limitations on individual movement here in the U.S. Fear is in the air! Physical fear and economic fear have combined to provoke an almost unprecedented response from individuals and governments around the world. Children have been sent home from college, primary school, and daycare. Americans are implementing social distancing, personal hygiene measures, and quarantine options that would have been unthinkable just a short time ago, and financial markets are attempting to handicap the damage to the global economy. Previously we had indicated that the market decline had all of the indications of a short sharp correction. Additional data on the spread of the virus along with the planned response of governments around the world resulted in markets breaking through lines of support and heading into traditional Bear Market Territory.

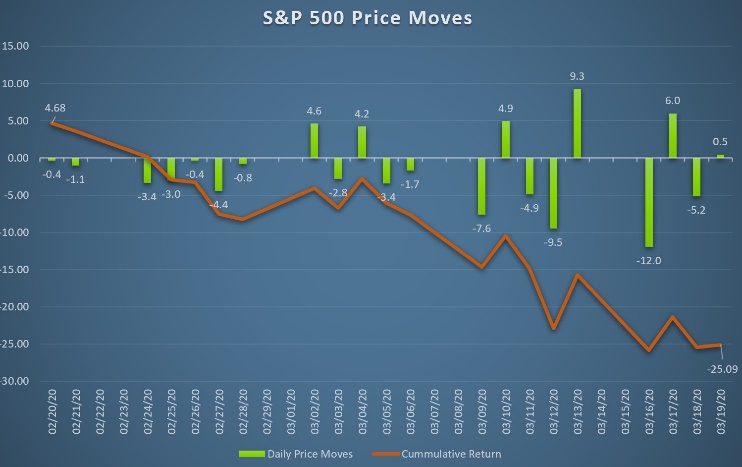

The speed and volatility of this decline, while not unprecedented, has been extreme. Broader Equity Markets have touched downside levels in excess of 30% during the last two week period on multiple occasions and intraday and weekly volatility levels correspond with the worst of the 2008 and 1987 periods. Until very recently bond markets had provided a relatively safe haven for investors but as demand for cash and liquidity rose bond markets began to exhibit signs of stress. Yields, which had been falling, reversed course and bond market spreads widened significantly. Dislocation in the bond markets is a classic sign of financial distress and is indicative of graver economic concerns. We had previously noted our expectation that the sharp downside move in equities was likely corrective in nature and did not necessarily signal a coming recession. Recent developments in the bond market coupled with more significant declines in equity markets around the world are now clearly signaling a more significant economic set back.

The aggressive spread of COVID-19, and the dire statistics emerging from Italy have prompted a dramatic response from governments around the world. The U.S. Government has essentially moved to a wartime footing and is working to aggressively combat the spread of the virus. Following recommendations of the CDC, the WHO, Johns Hopkins, and others Federal and State authorities have initiated an aggressive “Slow the Spread” campaign designed to help limit the transmission rate of the novel virus to the broader American population. Cross border traffic has been limited, public gatherings have been cut, and in some cases “shelter in place” rules have been put into effect. It is hoped that an aggressive response to the transmission of the virus will limit the spread and allow the U.S. Healthcare System to better cope with the seriously ill. From a response standpoint most experts agree that Western Democracies outside of Asia have been slow to respond allowing the virus a more substantial foothold and consequently, a more significant impact on the population. We believe these concerns are warranted, but there are also some mitigating factors that should be noted.

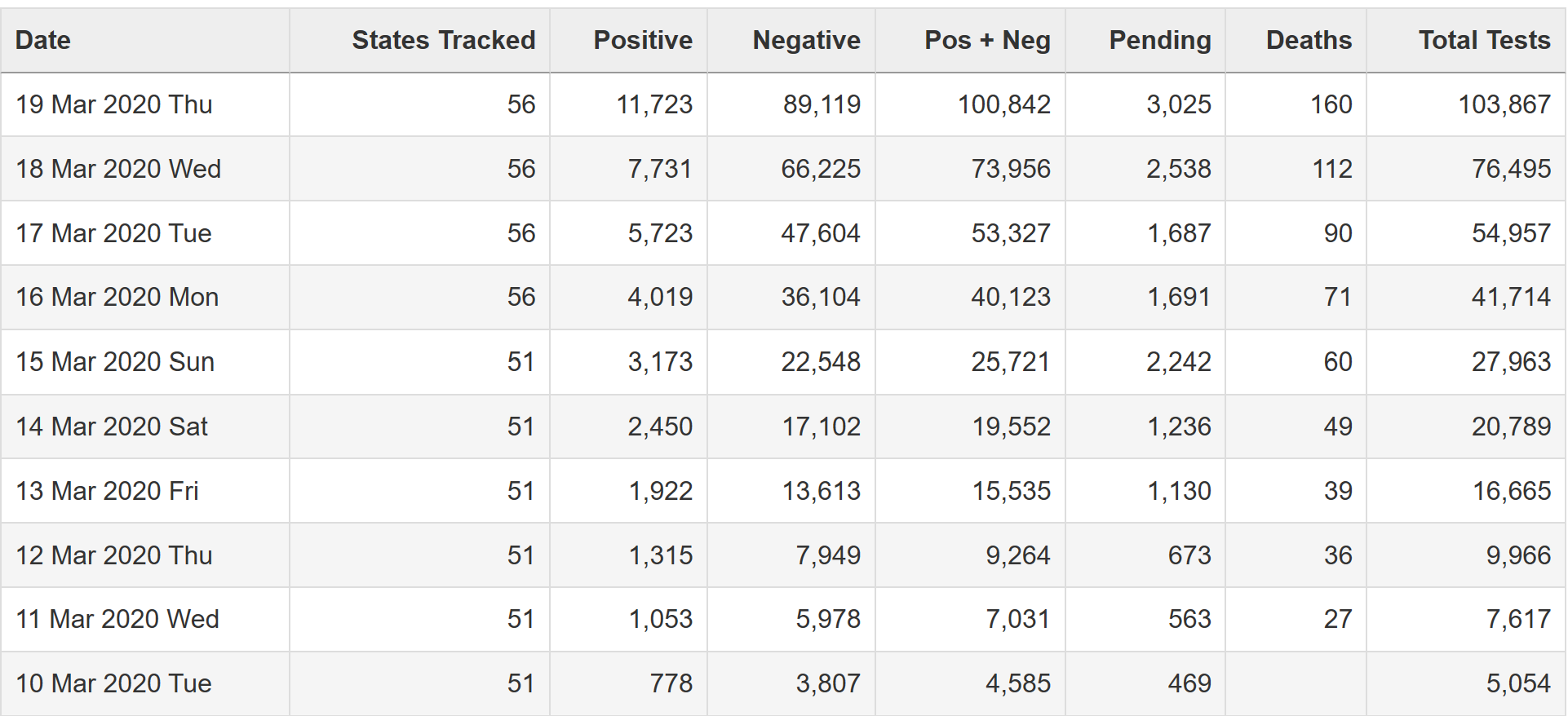

First, in other pandemics early mortality rate assumptions were often overstated. Due to testing challenges, the number of individuals actually infected with the disease is often understated, and consequently the mortality rate is determined using a lower number of tested and infected cases resulting in an overstated mortality rate. Second, a number of studies have indicated that other forms of the coronavirus (SARS, MERS, etc.) have seen their impact degrade as temperature increases. While we can not be certain of the effect of rising temperatures on COVID-19, many respiratory infections lessen with warmer temperatures and transmission is also negatively affected by sunlight and humidity. Third, we should not underestimate the response of healthcare and drug providers. While testing in the U.S. initially got off to a relatively slow start, changes to the U.S. approach are now having an impact and testing is increasing rapidly.

Further a significant number of companies are working on treatment options ranging from antivirals to an actual vaccine. Much has been made of the fact that a vaccine is unlikely to be available for 12-18 months, but various retro-viral drugs and other drugs used to treat similar conditions are being tested, and, in some cases, recommissioned for use in the near future. It is our understanding that the FDA is relaxing constraints and working with the various drug manufacturers to bring relief as quickly as possible.

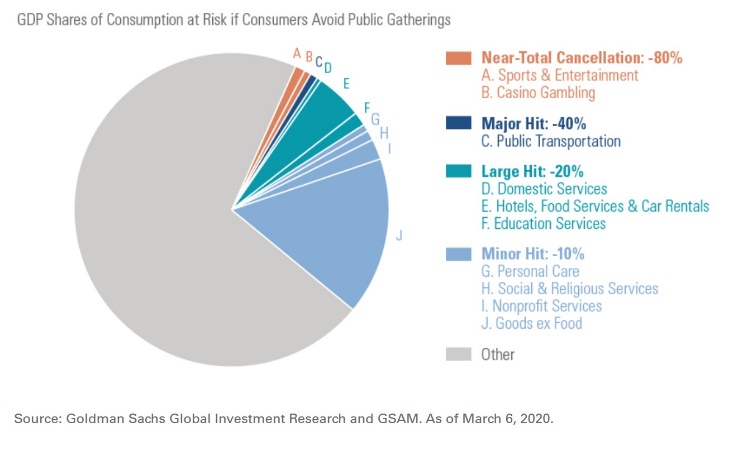

While these factors may indeed help limit the negative impact of the virus on the U.S. population, the effect on the U.S. and global economy remains difficult to evaluate. The aggressive travel limitations, social distancing, and hygienic requirements will undoubtedly take a tremendous toll on the U.S. economy in the short term. Airlines, the hospitality industry, along with restaurants (to say nothing of the cruise industry) will all be seriously affected. The drop in the price of oil, brought about by the price war between Saudi Arabia and Russia and exacerbated by the global demand shock, adds an additional negative for the energy industry. However, the drop in the price of oil is also a significant benefit for the consumer…although if one’s travel is curtailed how much of a benefit can be gained from lower gasoline prices at the pump? Therein lies the rub, we just don’t know. A shutdown of this magnitude is unprecedented in modern U.S. history.

Technology allows us to work remotely, order our food online, and in many ways continue our lives, but significant segments of the economy will be negatively impacted and it is doubtful that other areas will fully offset the shock. While U.S. economic numbers were relatively strong through February more recent high frequency economic data indicates a very sharp slowdown. Such a slowdown is further complicated by the reporting structure for U.S. GDP growth. Growth is reported on an annualized basis so even a relatively small fall off from a previous quarter will look dramatic. For example, an absolute decline in activity of 5% from the previous level would be reported as an 18.5% quarterly decline in GDP which is a massive number surpassing the largest post WWII drop of 10% during the 1980 recession. However, we hasten to note that while a drop of this magnitude is unprecedented it does not have to spell “demand destruction” rather it is, in our view, more likely to reflect “demand delay”. Delayed demand comes back more quickly than demand that must be built from the ground up. It is for this reason that Central Banks and Governments around the world are acting so aggressively to limit the impact of this shock. Over the last week the Fed has engaged in a dramatic fashion. Initially, the Fed committed 1.5 Trillion to the repo market (the market in which banks, brokers, and other large financial institutions lend to one another). Then over the weekend they committed an additional $700 billion in asset purchases, cut the Fed Funds Rate to effectively zero, and cut the Discount Rate (the rate at which the Fed loans to member banks) to 25 basis points while at the same time extending the duration of such loans to 90 days. The Fed also lowered rates on Swap lines with other central banks. Throughout the week the Fed has continued to bring additional policy to bear utilizing various liquidity mechanisms from the 2008-2009 crisis all in an effort to maintain orderly markets, boost liquidity, and reassure investors.

The fiscal response has also been significant. The federal government has already pushed back the annual tax filing date from April 15th to July 15th and along with it the need to make a payment if funds are owed. On the other hand the government will process refunds if a return is filed to better get money into the hands of tax payers quickly. Student loan payments are also being put on hold and other measures to help individuals are being put in place. Congress is considering a comprehensive bill, potentially in excess of $1.3 trillion, to provide a relief package to beleaguered corporations while at the same time putting money back in the hands of those who will need it most. It seems likely that similar to 1975, 2001 and again in 2008 the government will make direct payments to individuals. Much has been made of this fiscal stimulus and while some are concerned that it does not go far enough to plug the gap in GDP, that will likely be brought about by the measures taken to combat the COVID-19 Virus, it is a significant stimulus package and should help reassure skittish investors.

Markets have continued to be volatile and mostly negative throughout the week as these measures were considered. While the decline to date has been significant it is difficult to assess the value of a company when the potential hit to corporate earnings remains so vague. The market has declined through most technical support levels and is quite vulnerable at this point. Negative news and concerns about the growing impact of the virus on the population are likely to result in additional volatility and a corresponding decline in valuations. We hasten to note that all is not lost!

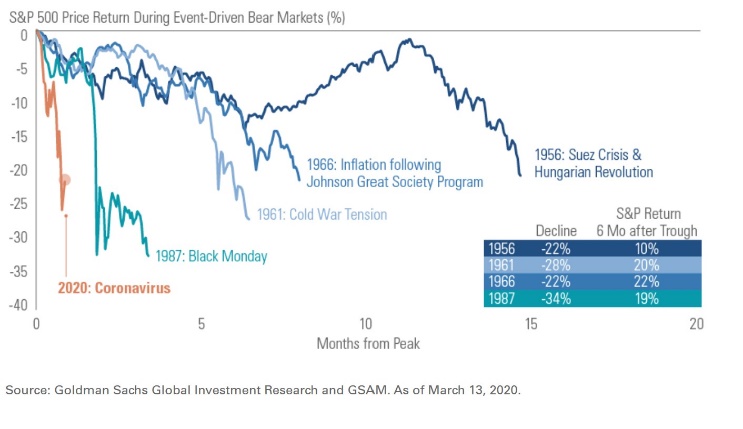

Valuations have come down significantly in the last two weeks and some areas of the markets are trading at extremely low levels. While the shock to the U.S. and global economy is real the reality is that we will get through this event. Chinese production appears to have regained 60-80% of its pre-crisis levels and Beijing is beginning to loosen some restrictions on movement in the country. While the situation in the West is likely to be different, we believe that the most dire scenarios being discussed are unlikely to materialize. Crowds tend to panic and it is easy to pile on and imagine worst case scenarios. The drop in equities is significant, but to this point, we have only dropped a bit below the levels set in December of 2018. This decline has been short, sharp and deep. Bear markets of the last 70 years have generally experienced a median decline of around 30%…about where we are now. However, it has generally taken approximately 1.5 years to hit that trough. This market has done it in 4 weeks.

While we see more negative volatility to come, we believe that we are getting closer to a level at which the market can base and begin to rebuild. As noted, in the midst of a fear induced panic valuations don’t matter much, but the market is moving back toward a reasonable value and many stocks are trading at levels not seen in many years. Stocks in the energy sector are trading below their lows set in 2008, and oil itself has fallen to levels last seen in 2002. As the path of the Virus and its impact on the U.S. population and health system becomes clearer we believe saner heads will prevail and investors will begin to find value in the midst of chaos.

Our bond managers are noting significant opportunity in the corporate sector and value- based equity managers that have had cash on the sidelines are beginning to deploy small amounts in areas where they feel comfortable with current valuations. As Sun Tszu said: “Opportunities multiply as they are seized. In the midst of chaos, there is also opportunity. The good fighters of old first put themselves beyond the possibility of defeat, and then waited for an opportunity of defeating the enemy.” Diversification, strategic allocation, a significant liquidity reserve are all methods we employ in our clients’ portfolios to help insure that we have put ourselves beyond the possibility of defeat so that we can seize future opportunities. In many ways this situation is a battle. It is a classic battle against fear and irrationality. We are not traders, but investors and the opportunities will present themselves if we remain patient and alert.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.