Cornerstone Fixed Income Commentary

Conquering Bond Bears

“I was absolutely unemotional about numbers. Losses did not have an effect on me because I viewed them as purely probability driven, which meant sometimes you came up with a loss. Bad days, bad weeks, bad months never impacted the way I approached markets the next day.”

James Leitner – Flacon Management Corporation

The challenge is that investors do not expect to lose money in bonds. They are unprepared for fixed income volatility, and when it hits it surprises conservative investors who have grown accustomed to the boring consistency of most bond portfolios. The average investor with significant bond exposure is looking for consistent return, low volatility, and safety. The first six months of 2022 have rattled such investors. Returns on very conservative, short-duration, bond portfolios are slightly negative; returns on intermediate high-grade credit portfolios are down in double digits; and returns on longer-term fixed income portfolios are experiencing equity-like declines. In short, it is the worst bond market in 40 years. The bear has arrived! What are bond investors to do?

In short, “Do not panic.” Bonds are often not fully understood, and unlike stocks they contain safety mechanisms that help protect investors and generally result in positive returns if a reasonable amount of patience is employed. The need for patience is directly commensurate with the time horizon of one’s fixed income portfolio. For investors with extremely short-term bond portfolios, returns will move back into the black in short order. Those with longer-term bond portfolios will have to be patient for a longer period of time. To understand the “safety” of bonds, one must understand a few key terms and accept some of the principals of bond math. For many of us math is not our favorite subject, and the complexity of the math associated with bonds portfolios is enough to leave the average investor confused at best and with a significant headache at worst. Take heart, we do not intend to delve too deeply into the esoteric nature of duration, convexity, option-adjusted spread, etc. However, there are few concepts that we would like to share with our readers with an eye toward providing comfort in the midst of the current storm.

Most investors are aware that a bond, in its simplest form, is simply a loan. When one makes a loan, one expects repayment at some point in the future, and one agrees on an interest rate for that period of time. The concept is relatively straightforward, and most investors are comfortable with our explanation thus far. The challenge begins when one adds the complexity of liquidity to the mix. What if I wish to sell my loan because I need my money sooner than I expected? This is where bond markets come into play. Corporations, municipalities, governments, and even individuals (through mortgages) borrow money in the form of bonds. Those bonds can be traded on a daily basis. However, to trade such an instrument, one must have a pricing mechanism, and so bonds like stocks are priced and traded throughout the day.

The manner in which debt investments are structured is the bond investor’s first line of defense—the “Bear Killer” if you will. Unlike stocks, bonds are meant to be repaid. Therefore, they are higher in the capital stack than equity. Bond investors have a claim on the borrower and expect to receive their principal back at the end of the bond’s term. In the relatively rare case of default, the owner of the bond generally receives some or all of his principal back through the liquidation of the borrower’s assets. This is a critical point to understand because if one owns a single bond one expects to receive one’s principal back at a fixed point in the future. If an investor owns a portfolio of bonds, then we can determine an average maturity for the portfolio, and as bonds mature principal is paid into the portfolio allowing the purchase of additional bonds. Across all sectors of the bond market, defaults are quite rare, and if one owns a diversified pool of investment grade bonds, then default risk is diversified away to such an extent that we can generally ignore it. Because bond investors expect to receive their principal and interest back over the term of the bond, we often categorize bonds as safe investments. As we have previously indicated, a diversified portfolio of bonds is safe in this sense. The investor will generally receive his or her interest and principal back according to the terms of the bond. This fact alone should help alleviate some trepidation on the part of bond investors.

However, the bigger challenge for most investors is when their portfolio value declines. What causes this decline? When will it end? How do we make our money back? These are all valid questions that concern bond investors. These concerns often become acute when investors hold a pool of bonds through a mutual fund, exchange-traded fund, or other commingled vehicle. This is because they cannot tangibly see each loan/bond maturing. In fact, the manager may trade certain bonds while allowing other bonds to mature according to their natural time line. To better understand the volatility and the relative safety of such pools, we not only need to understand the probability of default, but we must also understand the level of interest rate sensitivity in the pool. This is where the math comes in.

As noted above, bonds are issued with a particular maturity date. For example, the U.S. government issues 3-month, 6-month, 1-year, 3-year, 5-year, 10-year, 20-year, and even 30-year bonds. In 2017 the country of Austria issued a 100-year government bond with a 2.1% coupon rate! For the Austrian government that must have seemed like a pretty good deal. Considering such a long-term asset, one begins to see the problem. What if I hold that asset for a few years and decide I need my principal back to utilize for some other purpose? The market must adjust for the remaining time horizon of the bond and the change in interest rates. Conceptually, if interest rates rise, then my current Austrian bond is worth less because I could invest my money at a higher rate today than the rate I am receiving on my 100-year bond. Conversely, if interest rates fall, then I am very happy with my 100-year bond at 2.1%, and so the price of my bond must go up to induce me to sell it.

In the bond market we measure interest rate sensitivity through a concept called “duration.” Most bond investors think of maturity or the time to maturity of their bond portfolio. Again, if I buy a 100-year Austrian bond, it will mature in 100 years. Each bond has a maturity, and for a pool or portfolio of bonds we can determine the average maturity of all bonds in the pool. We can also determine the duration of each bond or the average duration for a pool of bonds. Generally, shorter maturity bonds have shorter durations, and longer maturity bonds have longer durations. Other factors, like bond call provisions, affect these calculations but are beyond the scope of this discussion.

As investors, we appreciate the fact that our portfolio of debt is liquid and we can sell it, but along with the benefit of liquidity we must also accept that some level of volatility in price is inevitable. We can better understand and prepare for that volatility by understanding duration. For example, a mutual fund comprised of bonds or a bond portfolio that is considered intermediate-term indicates that it has an average maturity between 7-10 years. We can also calculate the average duration for such a portfolio or index. The Bloomberg Aggregate Bond Index is often utilized as a benchmark for intermediate- term bonds, and it currently has a duration of around 6.4.

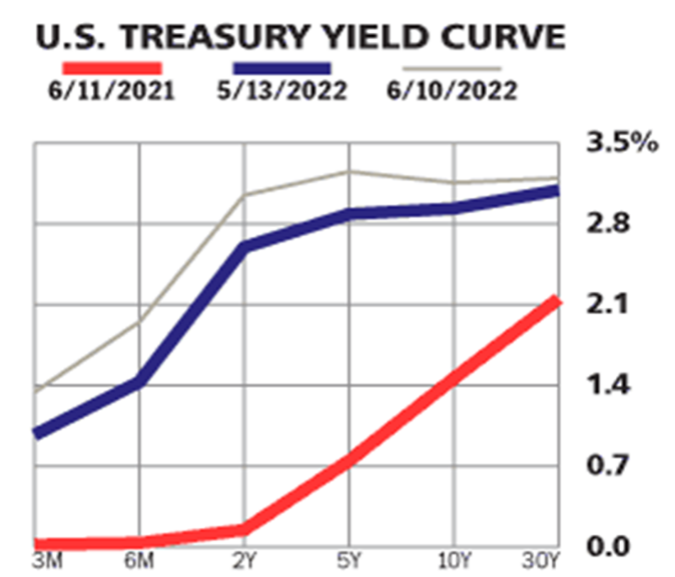

Another concept related to better understanding our bond portfolio and the impact of duration on our investments is the “yield curve.” We have already discussed maturity, but we need to consider the entire spectrum of the bond market. Effectively, we have bonds that are maturing from one month out to 30 years. Each bond has a different maturity and interest rate. We can graph those rates at various times and this provides us with an estimate of the yield curve.

We normally simulate the yield curve utilizing government bonds to eliminate the impact of credit risk. We know that riskier borrowers will have to pay a higher rate of interest than the federal government, so we can add a “spread” along the yield curve to adjust for the credit quality of the borrower.

To better understand the impact of duration in practice, we can utilize a small amount of math. To simplify the math, we will assume our portfolio has a duration of 5. If interest rates rise 1% instantaneously across the entire yield curve, we would expect our portfolio to decline by approximately 5%. The effective price change leads to the volatility of our bond portfolio. That volatility can work both for us or against us. Utilizing the same duration as before, we can calculate that a 1% instantaneous decline of interest rates across the yield curve will result in a 5% gain in our portfolio. Effectively, this is exactly what happened in 2020 when COVID hit and the Fed moved the short-term Fed funds rate to zero; the entire yield curve shifted down and bond prices went up. Many intermediate-term bond portfolios were up approximately 10% in 2020. Unfortunately, we are experiencing the downside of bond market volatility at the moment. Because of rising inflationary pressure, the Fed has very aggressively raised short-term rates and has indicated that it plans to continue raising those rates to combat continued inflationary pressure. Consequently, as one can see from the previous graph, the entire yield curve has shifted upward very quickly leading to significantly negative returns for bond portfolios.

We have already outlined the way that diversification and location in the capital stack are protective elements inside a bond portfolio and act as insurance against a bear market. Following our discussion of duration, we are now prepared to evaluate two other structural components which provide protection and security during a bear market in bonds. “Coupon payments” and “roll-down” return are two other factors that help protect bond investors. Coupon payments are reasonably self-explanatory. If we purchase a bond at a par value of $1,000 with an interest rate of 3%, then the bond pays us $30 per year. If the bond’s price drops temporarily, we still receive our coupon payment which offsets the temporary drop in price. For example, if our $1,000 bond had a duration of 3, a 3% coupon, and interest rates rose 1%, then our bond would fall to $970 (a temporary loss of $30); however, over the course of the year we would receive $30 in interest payments so our total return would be approximately zero for the year. Along with the coupon payment, we must also consider roll-down return. Effectively every bond is constantly getting closer to maturity. This means that every bond is continuously approaching par value. If we begin with a three-year bond then one year later, we have a two-year bond and so forth until at maturity we receive all of our principal back. Coupon payments and roll-down together help offset short-term price declines in our bond portfolio.

We should also note that in an upward moving interest rate environment in which bond prices are declining, coupon payments can be invested at higher rates which further offsets the price decline in the portfolio. This roll-down effect also helps limit volatility because our bonds duration and maturity are constantly declining. The combination of limited default risk, positive coupon payments, and roll-down works to protect bond investors during the occasional period of rising interest rates and effectively limits the negative price impact of a bond bear market.

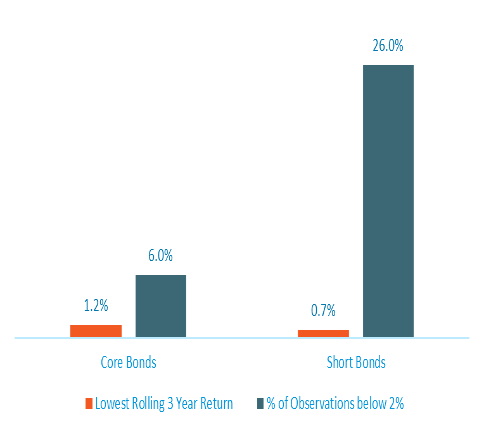

The graph above illustrates the positive return provided by both short-term and core/intermediate-term bonds over the last 30 years. Looking back over the last several market cycles, one realizes that even during periods of rising rates like 1994-95, 1999-2000, 2004-07, and 2016-19, bond portfolios have been able to produce a positive total return. The current shift in interest rates is the most dramatic move in 40 years. Investors last experienced price swings similar to those we are now experiencing in the late 70s and early 80s. Given the magnitude of the current decline, it is possible that it may take bonds a bit longer than normal to catch up, but history and bond math supports the fact that investors should ultimately experience positive total returns from their bond portfolio.

Over the last two years Cornerstone has been shortening the duration in the fixed income or bond component of our portfolios. We have also been adjusting the mix of bonds to produce additional yield. These factors help buffer Cornerstone portfolios relative to broader benchmarks and should increase the speed at which our portfolios reach a break-even level. Our clients’ objectives differ, and some may have ultra-short duration portfolios which have been less affected by current interest rate moves, but even ultra-short portfolios with a duration of less than 1-year have experienced price declines given the rapid run up in interest rates. The yield in these portfolios is increasing dramatically as well. At the beginning of 2022, a 1-year treasury bill was yielding approximately 0.40%. Today a 1-year bill is yielding approximately 2.9%. Consequently, it will not take long for our ultra-short portfolios to catch up. In the meantime, if the economy were to fall into a recession, it is quite likely that interest rates would fall and bond prices would rise accelerating the re-capture of current losses. Like all bear markets, bond bears can be quite intimidating. However, patience and reliance on diversification, debt structure, coupon payments and roll-down return will ultimately conquer the occasional bond bear.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.