Cornerstone 4th Quarter 2024 Commentary

We all want progress. But progress means getting nearer to the place where you want to be. And if you have taken a wrong turning, then to go forward does not get you any nearer. If you are on the wrong road, progress means doing an about-turn and walking back to the right road; in that case the man who turns back soonest is the most progressive man.

– C.S. Lewis, Mere Christianity

I suppose, as always, Americans wanted progress, and, in this case, progress meant walking back to the “right road”; that is, the road we were on prior to the Biden interlude. I’m sure many would suggest the choice of Donald Trump was far from “progressive” as we would utilize the term today, but as Lewis notes, simply moving forward does not mean progress toward the desired destination. Going back to the previous route sooner rather than later may be seen as the most progressive choice. It would seem that the majority of Americans, small businesses, and U.S. equity markets all felt that this was indeed the “right” road. President Trump is the first American President to win a non-consecutive second term in over 100 years. Not since Grover Cleveland have we witnessed such a feat. Like Cleveland, Trump managed to win both the popular vote and the electoral college this time around, eliminating fears of a contested election and causing “progressives” everywhere to scratch their heads and wonder what went wrong. How could a loud, bombastic, twice-impeached, ex-president regain the oval office? Apparently, by offering a more robust version of the previous “road less traveled”!

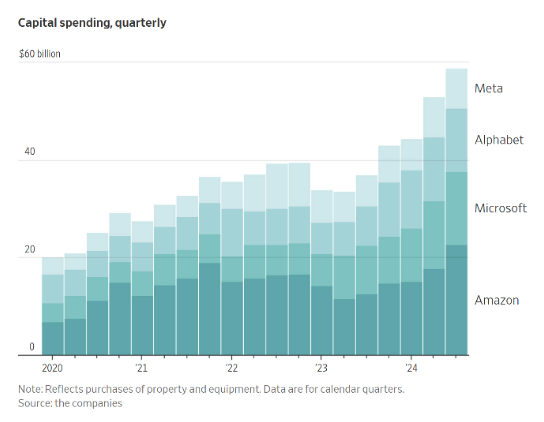

Trump promised that this time around he would re-double his efforts to drain the swamp, finish the wall, and drill baby drill. Markets, which largely went sideways throughout the early weeks of the quarter, were already beginning to anticipate a Trump victory prior to the results of November 5th. Following a decisive Republican presidential victory, it was off to the races. Commonly referred to as the “Trump Bump,” markets broadened and rallied. Neglected sectors like energy and financials bounced higher, and across the board, risk assets rallied. Perhaps it helped that tech maven and engineering genius Elon Musk is now tight with Trump, but regardless, tech rallied as well. Further, despite the snide reference to Dogecoin (DOGE) in the Department of Government Efficiency moniker (DOGE), rumors that Trump is positive about Bitcoin and is considering a strategic Bitcoin reserve sent prices soaring with the digital gold alternative exceeding $100,000 during the quarter.

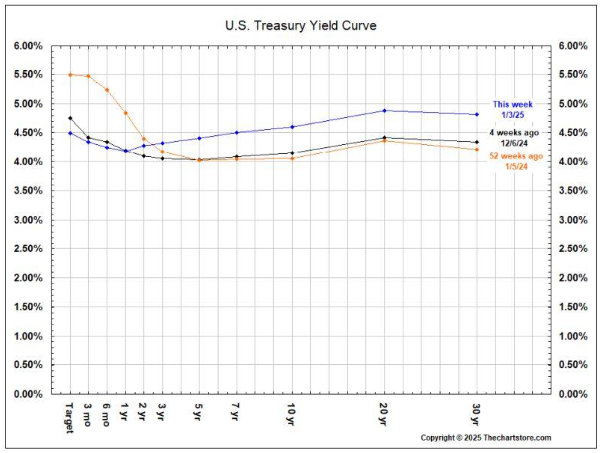

It was all fun and games until the FOMC met on December 18th and poured cold water on the burgeoning rally. A decidedly more hawkish Chairman Powell indicated that inflation wasn’t as well behaved as he would like, and the U.S. job market was more robust than expected. Consequently, the Fed Chair opined, the Fed had revised its Summary of Economic Projections (SEP) along with the “Dot Plot” (expected path of interest rates), suggesting rates are likely to remain higher than previously expected.

The 10-year Treasury, already drifting higher in anticipation of more inflationary fiscal policy, shot higher, briefly eclipsing its November 2023 high of 4.78%. Interest rate concerns capped the growth rally, and both bonds and risk assets sold off. While bonds stabilized, equities continued to fall throughout the remainder of the quarter, ultimately leading to a negative December. So much for the oft anticipated Santa Claus rally.

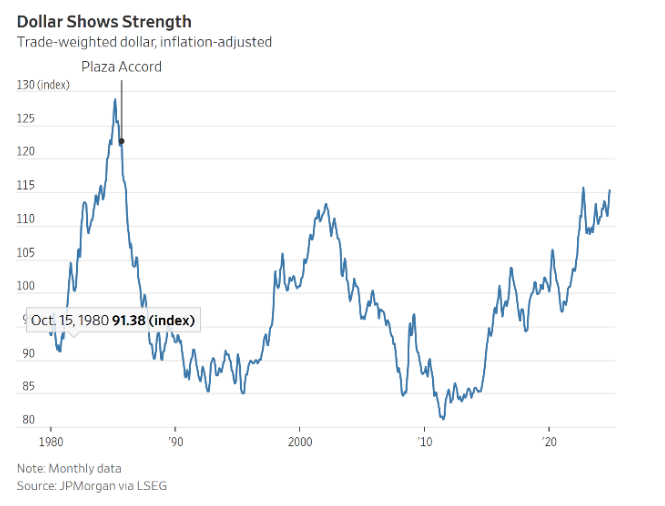

Despite the mid-December sell off, the fourth quarter was positive for U.S. equities, but for U.S. investors, the Trump win coupled with more hawkish Fed speak sparked an additional rally in the dollar.

Consequently, international bonds and equities performed poorly during the quarter.

As noted, the fourth quarter was a mixed bag from a return standpoint. Initially, virtually all investable assets gained ground, but following the Fed meeting on December 18th, many gave back most, if not all, of those gains. This was particularly true of the “diversification” asset classes like small cap, equity real estate (REITs), and international equities. The bear steepening of the yield curve erased bond index price returns gained during the third quarter and pushed annual total returns to surprisingly low levels despite higher nominal and real yields.

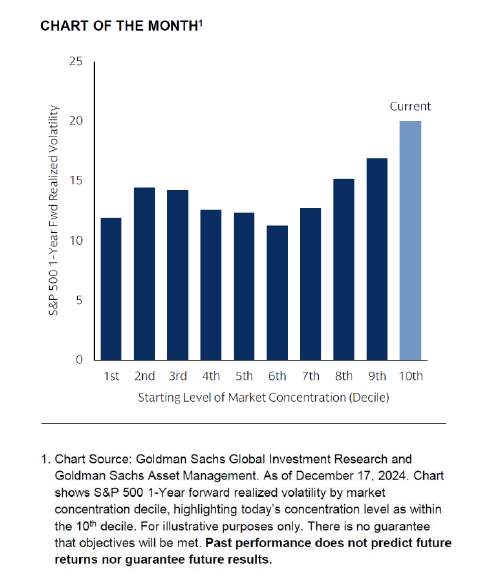

The Dow Jones Industrial Average and the S&P 500 Composite Index both managed to remain in positive territory for the duration of the quarter. The S&P 500 was up 2.41% for the quarter and a stunning 25.02% for 2024. It is quite rare for the S&P 500 to experience back-to-back years of greater than 20% returns. The last time such an event occurred was during the telecom/tech boom of the late 90s. Unfortunately, the narrowness of the market is not reassuring. The S&P 500 Equal Weighted Index was actually down 1.87% during the fourth quarter but ended up 13.01% for the year. While narrow markets are not always immediately problematic, they rarely end well. The Nifty Fifty craze of the 70s is one of the more negative examples as is the dot-com bust of 2000. Remember Bob Farrell’s rule #7: Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names. (Bob Farrell was a key leader in the Merrill Lynch research department during his tenure from 1957-2002. We find his ten “Market Rules to Remember” provide valuable guidance to investors throughout time.)

Tech and growth dominated the large-cap indexes. The Russell 1000 Growth Index was up 7.07% while the Russell 1000 Value Index was down 1.98% for the quarter. This disparity was even more dramatic when considered over the 12-month period. The Russell 1000 Growth out- performed the Russell 1000 Value by nearly 18 percentage points! Needless to say, if your portfolio was diversified, and you believe valuations matter, and you were not significantly concentrated in the top of the tech stack, your portfolio failed to keep up with broader indexes in 2024.

Small-cap value was also down for the quarter. The Russell 2000 Value Index declined 1.06% over the period. For the year the Russell 2000 Value Index posted positive returns of just over 8%. Not a bad showing in most years but again those returns pale in comparison to large-cap growth stocks. Small-cap growth did better, up 1.7% for the quarter and just over 15% for the year.

As previously noted, hawkish commentary at the December 18th FOMC meeting sent stocks reeling, but it was particularly challenging for REITs. REITs, which staged a massive comeback in the third quarter, gave up half their gains in the fourth quarter, falling over 8% for the period bringing year-to-date returns of the NAREIT Index to 4.92%. Better than bonds, to be sure, but disappointing, nonetheless.

Strong performance by U.S. mega-cap tech also tilted the Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) further in the direction of the U.S. The domestic component of the index rose to nearly 60%, and, like the S&P 500, the top seven stocks accounted for the majority of the index’s total performance. The heavy domestic weighting and outperformance was further skewed by the fact that the rising dollar had a significant impact on the MSCI EAFE Index. International returns were already significantly lower than U.S. large cap, but when combined with dollar strength, they were quite disappointing. Both indexes declined during the fourth quarter, but for the year the ACWI was up 17.49% while the EAFE was up only 3.82%. Emerging markets were crushed during the quarter, falling over 8% thanks largely to the 7% rise in the dollar over the same period. For the full year, emerging markets equities managed to turn in a solid return of 7.5%.

Fixed income, which had looked quite strong at the end of the third quarter, was rocked by a significant upward shift in interest rates across the yield curve. That fact, coupled with a rising dollar, led to a decline of 5.1% for the Bloomberg Global Aggregate Bond Index during the quarter. The Bloomberg U.S. Aggregate Bond Index declined over 3% for the quarter but managed to stay in positive territory on a year-to-date basis with a return of 1.25%. It was an action-packed quarter ending an action- packed year! The S&P 500 made 57 all-time new highs in 2024. Performance was very strong, earnings growth was positive, and the AI hyperscaling trend continued.

The market weathered a couple of major ongoing conflicts, a couple of Trump assassination attempts, a U.S. presidential election, and numerous other events both forecasted and unforeseen. Overall, the market remains extremely expensive regardless of which metric one utilizes, and it would seem that it is both narrow and priced for perfection. Diversified portfolios simply could not match the large-cap concentration of major domestic and global indexes causing many to wonder if they should simply invest their portfolio exclusively in domestic, large cap, growth companies.

While we are optimistic regarding potential market returns in 2025, we would caution against additional concentration. Both institutions and individuals can get caught up in euphoric market environments characterized by high momentum, new highs, and rapidly rising valuations. The current environment brings to mind a few other Bob Farrell rules that we believe are particularly applicable.

Farrell’s rule #3: There are no new eras – excesses are never permanent. This seems particularly appropriate at the moment as we consider the boom in AI, the talk of hyperscaler capital expenditures, and the corresponding meteoric rise in valuations of companies associated with the boom. Unlike the telecom/tech boom of the late 90s, most of the companies driving the tech sector at the moment have positive cash flow, growing earnings, and strong balance sheets.

However, we would remind our readers that this was also true of Microsoft in the late 90s, and following its peak in 2000, it took Microsoft ten years to begin growing its stock price in a meaningful way. Another cautionary tale is Global Crossing, the company known for leading the way in fiber optics cable distribution in the late 90s, which filed for bankruptcy in 2002 and was later acquired by Level 3 Communications. Nvidia, Microsoft, Meta, Apple, Amazon, Tesla, Google/Alphabet are amazing companies. They have tremendous global reach and will no doubt continue changing the world, but there is a limit to how fast they can grow and there is a limit to the appreciation of their stock prices as well. We don’t know where that limit is, and it is certainly possible that the current market may be more like 1996 than 1999. Regardless, some level of caution seems warranted!

Farrell’s rule #2: Excesses in one direction will lead to an opposite excess in the other direction. This is precisely why we must remain diversified. Much of the U.S. market and virtually all overseas markets are trading at reasonable valuations. Further, bonds are also trading at reasonable valuations, and interest rates are at levels that have historically corresponded with positive outcomes for fixed income investments. However, because of mega-cap tech, U.S. equity market valuations as a whole are at levels that have historically indicated a cautionary stance is warranted. It is important to note that valuations alone are notoriously poor timing indicators.

Farrell’s rule #4: Exponential rapidly rising or falling markets usually go further than you think but they do not correct by going sideways. We must remain prepared to protect our capital in a bear market while also not giving away too much of the potential upside as a result of our caution.

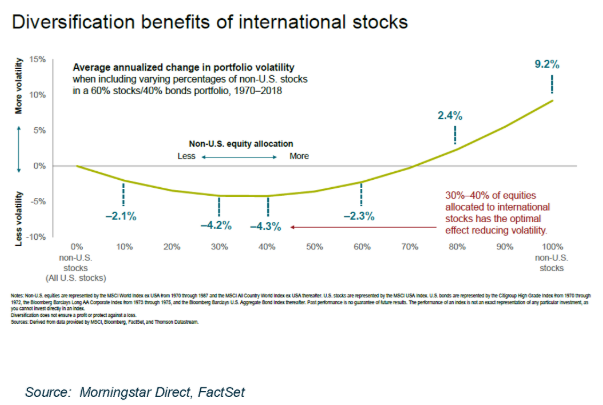

Diversification has historically proved to be one of the best sources of portfolio protection. Diversification will not fully protect a portfolio on the downside, and it does give up some amount of return on the upside, but it often proves the most beneficial when it seems the least necessary. Historic wisdom literature provides its own support for this tried-and-true investment methodology. Ecclesiastes suggests the following, “Cast your bread upon the waters, for you will find it after many days. Give a serving to seven, and also to eight, for you do not know what evil will be on the earth.” (Eccl. 1:1-2, NKJV)

Modern Portfolio Theory (MPT), one of the most influential investment constructs of the 20th Century, highlights the tradeoff between risk and return and capitalizes on the benefits of including non-correlated return series together to enhance return while reducing risk. Additionally, both UPMIFA and ERISA focus on diversification as fiduciary best practice. Nonetheless, it is frustrating when markets are running, and it feels as though one’s portfolio is being left behind.

Farrell’s rule #6: Fear and greed are stronger than long-term resolve. So, what are we to do? Simply sit on our hands and wait? Actually, we believe there are proactive actions which may be beneficial in this unique environment. The incoming Trump administration has telegraphed five key economic policy targets among its other objectives:

1) Deregulate, 2) Cut expenditures, 3) Limit illegal immigration, 4) Cut taxes, and 5) Utilize tariffs. (Note: Tariffs may be utilized only as a bargaining tactic, to promote onshoring, or to raise government revenue, but the point remains that Trump likes tariffs.) Additionally, the FOMC cut short-term rates by 100 basis points during the second half of 2024 but has now signaled that the job market remains robust, and it remains concerned about inflationary pressure. Consequently, expectations regarding 2025 rate cuts have been scaled back, and the market is now forecasting just two rate cuts during 2025.

As we consider both the outlook and market trends, we have taken several actions in our portfolios. We have lowered our exposure to international equities. We have reduced international small cap, emerging markets, and developed market exposure to levels that we believe represent the minimum level necessary to capture the benefit of global diversification.

We are redeploying these funds into domestic markets. Additionally, our deployment is designed to offset the drift in broader indexes. We are adding both growth exposure and dedicated mid-cap exposure to our portfolios to help offset the growing value bias present in our long-term strategic allocations. This move also helps offset the dedicated small-cap bias characteristic of our strategic allocations.

We continue to believe that both a small-cap bias and value orientation are beneficial to portfolios in the long-term, but the drift in global equity markets brought about by large scale passive investing coupled with the dominance of a few key tech names has resulted in Cornerstone portfolios effectively becoming more small cap and value biased. We feel it is necessary to offset this drift and return portfolios to a more “neutral” stance. Following this move our portfolios will have a larger average equity capitalization and will be more growth oriented while still retaining a modest value and small-cap bias relative to major indexes like the Russell 3000, the S&P 500, and the ACWI. Finally, we are also slightly reducing the duration (duration is a measure of interest rate sensitivity) in our portfolios to offset the probability of increased bear steepening of the yield curve. Each of these actions is designed to allow Cornerstone portfolios to remain in compliance with long-term investment policy targets, and to help enhance the normal benefits brought about by diversification and strategic allocation.

While we are optimistic about equity prospects for 2025, we believe it is wise to be prepared for significant volatility. Additionally, often market declines occur because of an unknown exogenous shock—a black swan, if you will. Diversification and long-term strategic asset allocation coupled with solid security level analysis provide significant protection in the event of unexpected rough water. We believe our additional structural and tactical moves position our portfolios to benefit from continued equity momentum but also help provide some downside protection should tech leadership breakdown.

Cornerstone Management Inc. is a Registered Investment Advisory Firm. Although the information in this report has been obtained from sources that the Firm believes to be reliable, we do not guarantee its accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report may only be dispensed with this disclosure attached.