Cornerstone 4th Quarter 2022 Commentary

As for it being different this time, it is different every time. The question is in what way, and to what extent.

Tom McClellan

We are nowhere near a capitulation point because it’s at that point where it’s despair, not hope, that reigns supreme, and there was scant evidence of any despair at any of the meetings I gave.

Dave Rosenberg

Barring that natural expression of villainy which we all have, the man looked honest enough.

Mark Twain

Perhaps the same could be said of Sam Bankman-Fried! He must indeed have looked honest enough before the crumbling of the FTX empire during the fourth quarter of 2022. The crypto saga has added to the “Crypto Winter” and to the drama of the fourth quarter—a quarter in which both stocks and bonds managed to rally despite central banks’ focus on raising rates and tamping down aggregate demand, a lackluster election in the U.S., and a winter storm that put Southwest Airlines clearly in the sights of congressional busybodies with little better to do than try to determine how to run an airline! Perhaps they could run an airline a bit better than they seem to be running the country! Afterall, after winning a pitiful majority, the Republicans struggled to select a Speaker of the House. The Biden administration is dealing with questions regarding the handling of classified documents. Neither party seems particularly well-equipped to address the current economic challenges brought about by massive fiscal spending coupled with aggressive accommodation by the Fed—to say nothing of the ongoing global challenge of the Russo/Ukraine war, trouble in the Balkans, a recalcitrant China, and the lingering effects of Covid-19.

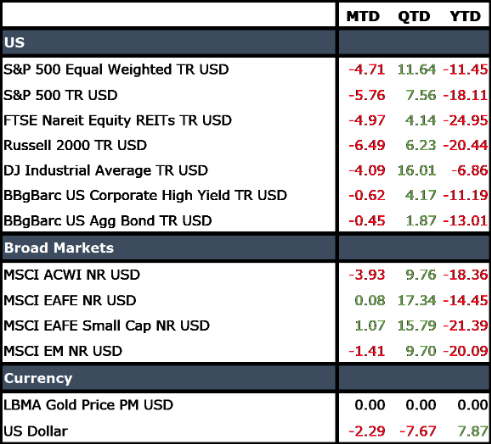

Yet through it all, corporate earnings surprised to the upside, stocks rallied, and bond investors decided that perhaps inflation really is going to moderate after all. Despite the drama and the hype, U.S. markets experienced more of a pre-Santa Claus rally which ultimately faded into year end. However, a 7.5% rally by the S&P 500 and an explosive 16% upward move by the Dow Jones Industrial Average made the holidays quite a bit cheerier than they could have been.

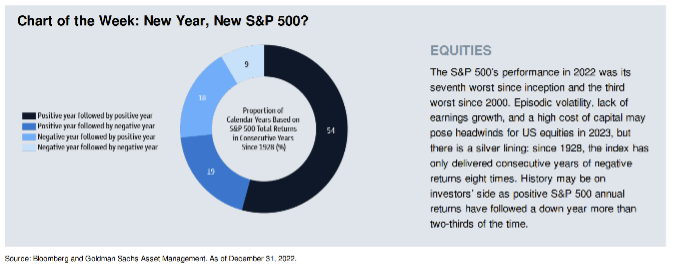

As if the gains in U.S. equities were not enough, a falling dollar and warm temperatures spurred European equities and led to significant gains in the MSCI EAFE Index as well. Late in the quarter, growing recessionary fears took hold capping the equity advance and limiting the upward momentum. However, those recessionary fears coupled with slowing inflationary data allowed the Fed to slow the pace of rate hikes. Rather than an additional 75bps hike, the Fed settled for a 50bps adjustment at their December meeting. Slowing inflation and softening in many economic indicators renewed fears that the U.S. economy would be unable to avoid a recession, and bonds rallied. While not enough to significantly soften the pain of three quarters of negative price impact, the nearly 2% rise in the Bloomberg Agg was a welcome relief for bond investors. The worst performance in modern history in the bond market led to the worst performance by the traditional 60/40 asset allocation mix since the Great Recession. Utilizing the S&P 500 and the Bloomberg Aggregate Bond Index to construct the allocation yielded a negative return of just over 16%. When considered on the global basis, the results are even worse. A portfolio comprising 60% MSCI ACWI and 40% Bloomberg Global Aggregate Bond Index declined 17.51%, and that was with a nearly five percentage point rally in the Global Agg during the fourth quarter. It was a rough year indeed for having begun with such promise and a new high for the S&P 500 on January 3, 2022. Unfortunately, the Index achieved that high, and it was downhill after that!

As we noted, global equities rallied throughout the quarter. Big U.S. stocks did quite well although it must be said that value once again trounced growth. The Russell 1000 Value Index was up 12.42% for the quarter while the Russell 1000 Growth Index was up only 2.2% over the same period. For the year, large cap value outperformed growth by nearly 22 percentage points. The story was much the same in small cap with the Russell 2000 Value Index outperforming by approximately 400 basis points in the fourth quarter alone and nearly 12 percentage points for the year. Value stocks were led by the energy sector—that is, the carbon-based energy sector. Perhaps the most hated area of the market, energy stocks were up nearly 65% in 2022. Despite the rally, energy stocks remain quite cheap on a historic basis and remain a very small percentage of S&P 500. On the other hand, the S&P 500, the Russell 1000, and other broad, cap-weighted benchmarks were driven lower by technology in general and a few key stocks in particular. The six largest contributors to the S&P 500’s decline contributed nearly ten percentage points to the drop of 18%. Led by Apple, which briefly eclipsed the $3 trillion market capitalization level (A larger market cap than that of most countries!), it lost approximately $1 trillion falling 26% during 2022. Amazon was another major culprit, down 50% for the year, and let’s not forget Tesla, the darling of the auto industry and tech together, down a stunning 65% in 2022!

A softening Fed and warming winter conditions in Europe led to a significant decline in the dollar during the fourth quarter. This move allowed developed market foreign equities to catch their U.S. contemporaries. The MSCI EAFE gained a stunning 17.34% during the fourth quarter and ended the year down 14.45%. International small capitalization stocks staged an impressive comeback as well, and the MSCI Emerging Markets Index rose 9.70% to end the year down just a hair over 20%—remarkable gains for foreign equities faced with double digit inflation, volatile oil prices, and continued global supply challenges.

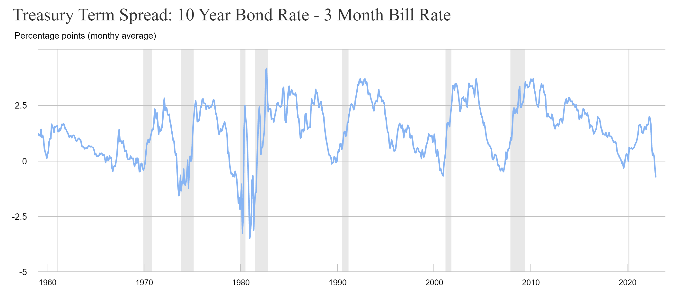

The Fed maintained its policy stance throughout the fourth quarter raising rates at both the November and December meetings. Slowing inflationary readings and a decline in various economic indicators ultimately led to both a more inverted yield curve and rising bond prices. Intermediate to longer term bonds rallied nicely during the quarter, and the Bloomberg Aggregate Bond Index gained back nearly two percentage points during the quarter.

Ultimately the Fed ended the year with the Fed Funds rate between 4.25 and 4.5%. Expectations for the terminal rate continue to fluctuate, but we believe the Fed will lift rates above 5% in 2023. With short-term rates ending the year well above 4% and a yield curve that has moved substantially higher throughout the year, the prospects for future fixed income returns have improved significantly.

In many ways, the fourth quarter of 2022 was a fitting end to a volatile year. Like much of the year, inflationary concerns and monetary policy drove market results occasionally interspersed with exogenous events like the FTX bankruptcy and U.S. mid-term elections. For most of the year markets moved lower as equity multiples contracted due in large part to rising interest rates. Recessionary fears have largely been countered by the possibility of a Fed pivot and subsequently lower rates which could allow multiples to move higher again. Markets have vacillated throughout much of the year with steep declines followed by stunning ascents.

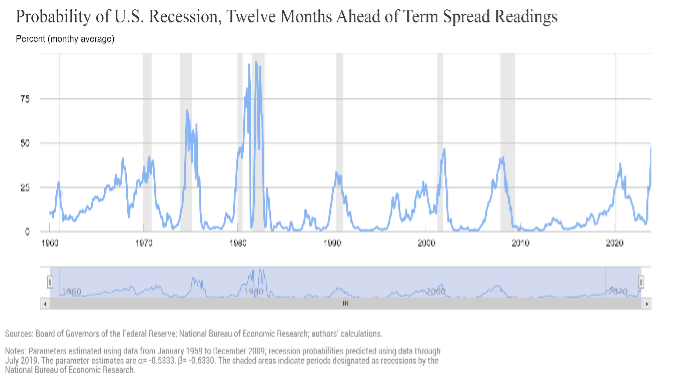

CMI portfolios gained on a relative basis throughout the fourth quarter and the year in its entirety. Buoyed by a significant tilt toward value, strong performance on the part of active managers, and an emphasis on yield and shorter duration, portfolios finished the quarter and the year down in absolute terms but significantly ahead of broader benchmarks. We anticipate continued volatility in the months ahead. The jury remains out regarding the probability of recession in 2023, but all the signs are there. The level of inversion in the yield curve alone has resulted in a recession virtually 100% of the time in post war market history.

When coupled with still rising rates and a basketful of negative economic indicators, it is difficult to see the U.S. economy avoiding a recession in the upcoming year. However, profit margins have not yet contracted significantly, and unemployment remains at historic lows, so some hope remains that a “softish” landing might still be attainable.

To us, the old adage, “Don’t fight the Fed,” seems quite relevant at the moment, and having built up cash throughout the fourth quarter, we remain defensive in our portfolios. As we enter 2023, we are more optimistic regarding the fixed income side of the market. We expect positive returns and will allow durations to rise gradually throughout the first quarter as we continue to monitor Fed activity. We are less sanguine regarding equity markets. We expect earnings to continue to fall and continued volatility as markets seek to determine when the Fed will pivot and if a recession can be avoided. Consequently, we intend to retain our value tilt and look for niche opportunities as they arise. Ultimately, we believe a falling U.S. dollar may provide unique opportunities to bolster our foreign equity exposure.