Cornerstone 3rd Quarter 2024 Commentary

The triumph of “les autres”…

When investment decisions need to be considered at the speed of light, something is seriously wrong

Frank M Bifulco (Barron’s Letters to the Editor 5-24-2010, Stock Trader’s Almanac)

The game is lost only when we stop trying

Mario Cuomo (Former NY Governor, C-SPAN, Stock Trader’s Almanac)

If more of us valued food and cheer and song above hoarded gold, it would be a merrier world.

J.R.R. Tolkein (The Hobbit)

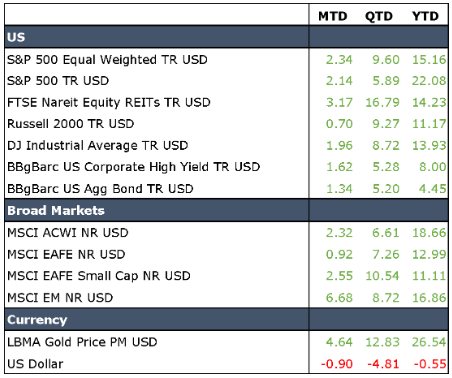

Indeed, “the others,” commonly referred to as the “the frugal 493,” staged quite the comeback in the third quarter. Just when it seemed that the Magnificent Seven would not only rule the market but perhaps take over the world, the tide changed. The broader market outperformed both the S&P 500 Composite and the NASDAQ during the third quarter of 2024 – a rare feat in this new era of AI.

The third quarter of 2024 was anything but dull! Two assassination attempts, a surprisingly dramatic and devastating hurricane, a rate cut by the Federal Reserve Bank, a change in the presumptive Democratic presidential nominee, an escalation in the Middle East conflict, and a tech stock mini crash were a few of the more significant events which transpired during the period. The quarter began with a strong bond rally and ended with stock markets at new highs. In short, there was something for just about every investor to cheer about during the quarter. Even that arcane relic gold rallied alongside its trendy 21st century cousin Bitcoin which, we might add, is up a staggering 49% in 2024.

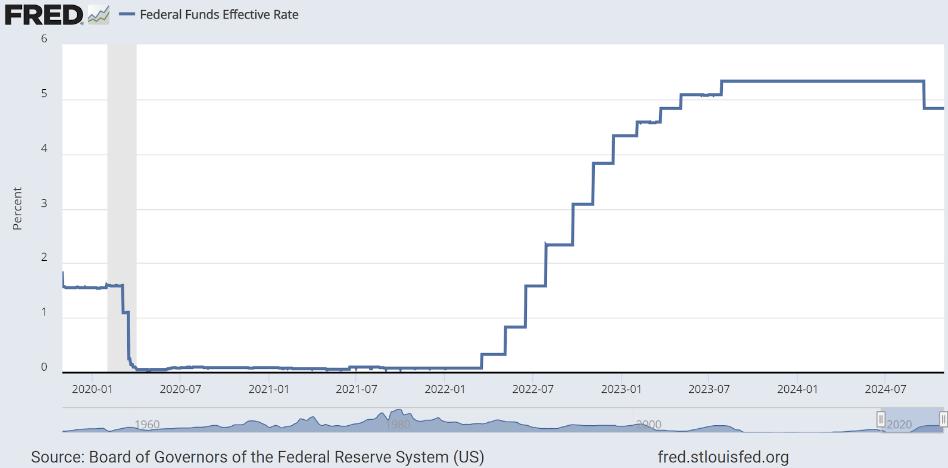

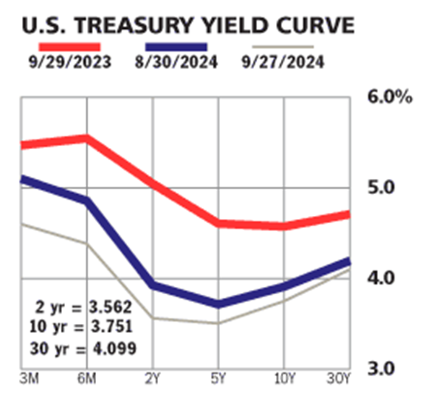

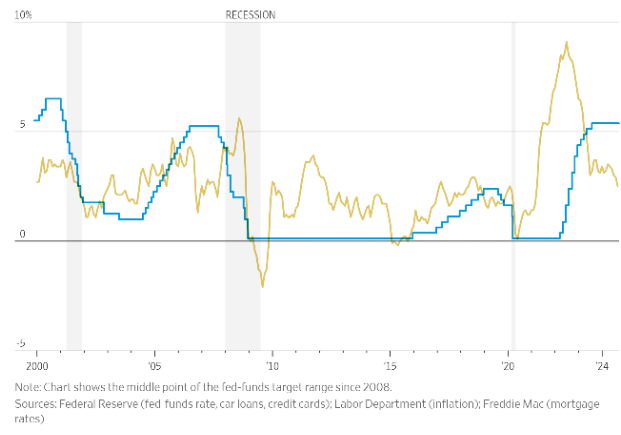

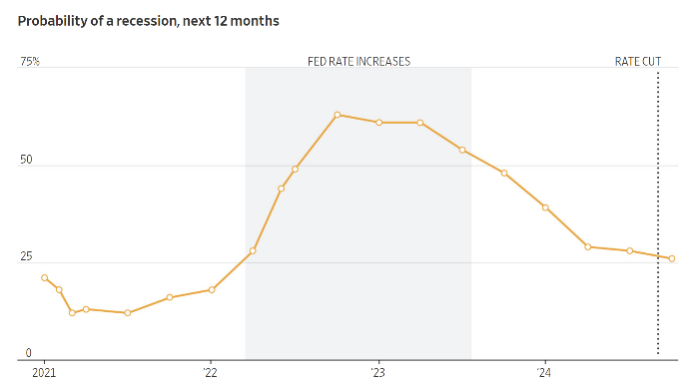

As we entered the third quarter, the macroeconomic discussion was focused on the “softness” of U.S. economic data, and the probability that this softness would lead the Fed to cut rates during the quarter. If not at the July meeting, then certainly the Fed would cut at the September meeting. In anticipation of the coming cut, the bond market rallied significantly early in the quarter. As the quarter unfolded, fears of economic meltdown intensified leading to a sharp decline in equities in early August accompanied by a corresponding rally in bond prices. The VIX (an index of market volatility) briefly moved above 65, a level not seen since the COVID-induced stock market decline in 2020. Like a summer thunderstorm the panic was over in short order, and the market quickly regained lost ground as additional economic data renewed Wall Street’s confidence in the proverbial soft landing. The data was good enough to ensure that the sky wasn’t falling, but not so good that the Fed wouldn’t cut interest rates in September. During his speech at the Jackson Hole Symposium later in August, Chairman Powell further reassured markets regarding the Fed’s view that inflation was moderating, the economy was healthy, and the job market was softening enough to allow the Fed to consider a rate cut at the upcoming meeting in September.

Both equity and bond markets continued to perform well in advance of the Fed’s meeting on September 18th. The Fed did not disappoint, delivering a surprising 50 basis point cut at their meeting. However, following the Fed’s meeting, bond volatility began to rise as economic and inflationary data proved stronger than expected, and yields have since risen, erasing much of the price gains of the last quarter.

Along with the market and economic fireworks, the presidential race changed dramatically as President Biden announced his intention to step out of the race as the presumptive Democratic nominee in favor of Kamala Harris. Biden’s change of heart cut into the dramatic gains in the polls that Trump made following the June 27th debate and the subsequent July 13th assassination attempt. Despite all the fireworks, the presidential race remained close throughout the quarter. Drama in the Middle East around the Israeli pager attack led to concerns that the conflict would broaden further, and oil prices rose a bit as a result. Finally, to cap off an already tumultuous quarter, Hurricane Helene roared ashore in the big bend region of Florida on September 26th. Damage in areas not normally affected by hurricanes like the South Carolina upstate, western North Carolina, and eastern Tennessee was significant but will likely only have a modest impact on economic data in the months to come. Despite their ferocity, most natural disasters have little lingering effect on the broader U.S. economy. However, numbers alone do not tell the full story, and it is likely that western North Carolina, in particular, will take some time to fully recover.

As previously noted, the broader markets performed well during the third quarter. Large cap domestic stocks rallied significantly, and the more neglected areas of the market posted surprisingly strong results. The S&P 500 Equal Weight Index was up 9.60% during the quarter, eclipsing the cap-weighted S&P 500 Composite Index by nearly 400 basis points. Value finally had a strong quarter with the Russell 1000 Value Index up 9.43% vs 3.19% for the Russell 1000 Growth – a rare win for value which, despite significant valuation differentials, has struggled to keep up since the growth declines of 2022.

Small cap stocks also had their moment in the sun. Like their larger cap brethren, small cap growth stocks outperformed value for the quarter. The Russell 2000 Growth Index was up over 10% for the period outperforming the Russell 2000 Value by approximately 165 basis points. Despite the strong showing, smaller capitalization companies continue to be a drag on portfolios in 2024 underperforming most large cap stocks by a significant margin.

REITs, which have been out of favor recently as the market has focused on the challenges in traditional office properties coupled with higher interest rates, staged something of a comeback during the quarter. They were the best performing major sub asset class for the third quarter of 2024. The NAREIT Index rallied over 16% for the quarter bringing the index back into positive territory for the year.

The stronger than expected move by the Fed led to a later quarter decline in the U.S. Dollar – a rather welcome development for unhedged U.S. investors with international equity holdings. The MSCI EAFE gained over 7% during the quarter, eclipsing the ACWI Global Index for the first time in recent memory. International small cap came on strongly as well, up over 10% for the quarter. Not to be outdone, emerging markets equities gained 8.72% for the quarter and are now up almost 17% on a year-to-date basis. A rising tide did indeed lift all boats in the third quarter!

Despite significant volatility, inflationary concerns, and Federal Reserve uncertainty, the bond market had a phenomenal quarter. The Bloomberg U.S. Aggregate Bond Index gained 5.2% during the quarter, and its global counterpart was up just under 7% thanks to the falling dollar. In general, central banks continue to ease monetary policy with the notable exception of Japan whose counter policy raised much of the August market ruckus. While the future is always uncertain, the Fed’s “dot plot” suggests two additional rate cuts during the remainder of 2024. With the strong 50 basis point cut to initiate this cycle, we believe the Fed may have gotten a bit ahead of itself, but what do we know? Perhaps inflation really will drop to 2% in the next few months, GDP will remain resilient, global bond markets will ignore the rising U.S. budget deficit and burgeoning debt load. Then again, perhaps it won’t.

While there is no doubt economic data has proved remarkably resilient, and the U.S. consumer has proved remarkably resilient, we continue to be a bit concerned that perhaps all is not quite as well as it appears on the surface. It is difficult, at least in our view, to explain how the government can spend profligately, the economy can grow above trend, and monetary policy can ease, all while inflation politely meanders its way back to the fabled 2% target. Typically, monetary easing and fiscal stimulus is employed during an economic slowdown, but here we find ourselves in the midst of a supposedly strong economy with a Fed that is cutting rates and two presidential candidates who seem to be trying to outdo one another in their attempts to buy votes!

Growth stocks remain expensive, and interest rates are not all that high by historic standards. Perhaps the Fed has correctly interpreted the proverbial tea leaves and will lead us into that rare and wonderful soft landing, but risks do remain. Leading economic indicators continue to disappoint, the yield curve is largely still inverted, and manufacturing is in a contraction: not exactly the data dreams are made of, at least not our dreams. We agree that it is hard to see an immediate slowdown on the horizon, but in our view, it is hard to sound the “all clear.” Given continued macro uncertainty, richly valued growth stocks, and lingering inflationary concerns, we continue to believe some level of caution is warranted.

Cornerstone Management Inc. is a Registered Investment Advisory Firm. Although the information in this report has been obtained from sources that the Firm believes to be reliable, we do not guarantee its accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report may only be dispensed with this disclosure attached.