Cornerstone 3rd Quarter 2023 Commentary

It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.

George Soros

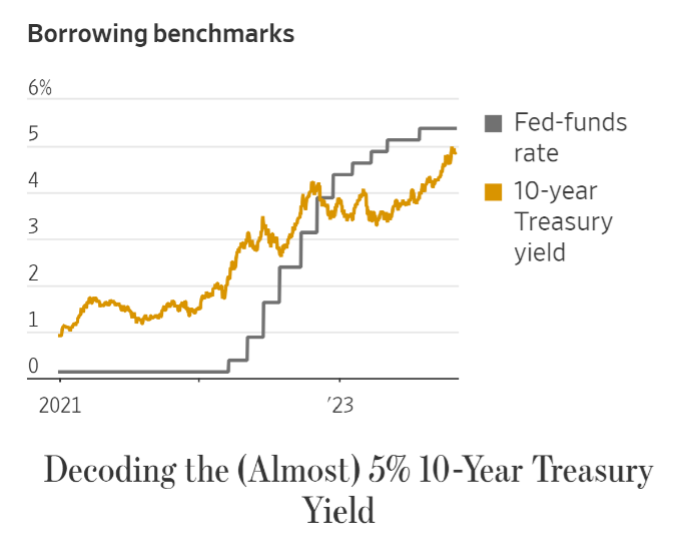

Following the surprisingly strong results of the first and second quarters of 2023, the third quarter proved to be quite the dismal refrain. Markets fell across the board! Stocks and bonds both declined significantly during the quarter, and cash was one of the few asset classes that proved a safe haven for the average investor. The quarter began well, with equities prices continuing to run on the back of better-than-expected second quarter earnings, but economic strength caused concerns of additional Fed action, and at the same time weak bond demand and worries regarding America’s debt load led to a bear steepening of the yield curve. Add to that, the never-ending Ukrainian conflict, the toppling of the speaker of the house, and the UAW strike against GM, Ford, and Stellantis, and perhaps the quarter was doomed from the beginning!

The Magnificent Seven: Apple, Microsoft, Alphabet (Google), Amazon, Meta Platforms (Facebook), Nvidia, and Tesla lost a bit of their luster as the vaunted tech sector slid over 5% during the quarter. While they continue to perform well on a year-to-date basis, the darlings of the AI boom took a breather, and without them the market was leaderless. The steepening of the curve was problematic for bond valuations and equity valuations alike, and the broader bond market gave up all of its previous gains and ended the quarter in the red. In short, outside of cash the quarter was a disaster, but investors in the cash market pocketed a little over 1.3% for the quarter. Clearly, we have come a long way from the 0.25% returns of a year ago. Energy was really the only other bright spot for the quarter. The sector rallied over 12% between July and September.

The narrowness of the market can easily be seen by the significant disparity between the S&P 500 Cap Weighted Index and the S&P 500 Equal Weighted Index. The cap weighted version remains up 13% for the year while its equal weighted counterpart is up a measly 1.8%. Valuations are equally disparate, with the largest AI-driven names trading at over 40x earnings while the remainder of the market trades closer to 15x earnings. Without the largest cap growth names, domestic and international equities have gone nowhere in 2023. Despite being down 3% for the quarter, the Russell 1000 Growth Index remains up nearly 25% for the year. The Russell 1000 Value Index, on the other hand, was also down about 3% for the quarter but is up only 1.8% on a year-to-date basis.

Small cap stocks did poorly in the third quarter as well. However, in the small cap space value gained significant ground relative to growth. The Russell 2000 Growth Index was down almost 7.5% for the quarter while the Russell 2000 Value was down 3% over the same period. Both indices lost ground, but the disparity between growth and value narrowed, a result which favored our tilt toward value. REITs were no help! The interest rate sensitive asset class fell nearly 4% for the quarter and is now down almost 6% for the year. Unfortunately, concerns related to the beleaguered asset class continue to grow as investors worry about refinancing rates, vacancy rates, and a slowing housing market.

International markets performed in line with domestic equity markets. The MSCI ACWI was down 3.5% for the quarter and up 10% for the year. Bereft of U.S. tech, the MSCI EAFE dropped 4% for the quarter but remains up approximately 7% on a year-to-date basis.

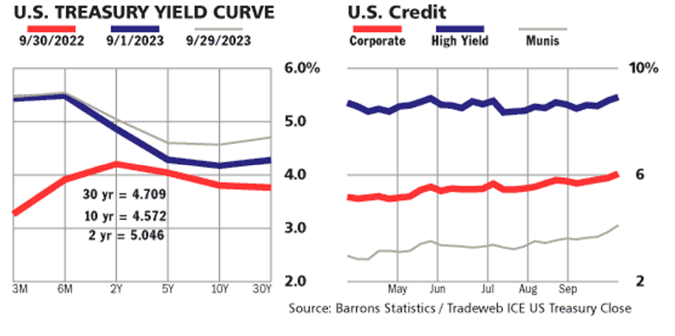

Finally, hit by a bear steepening late the in quarter, the U.S. Bloomberg Aggregate Bond Index was down 3.24% for the quarter and nearly 1.25% on a year-to-date basis. This drop is in the face of a nearly 6% yield! Had it not been for solid year-to-date yield gains, the index would look even worse. As it is, yields remain strong, and with the odds of a late year Fed hike declining, it is possible that bonds still manage to eke out a small gain for the year. In our view this makes bond valuations and forward-looking expected returns even stronger.

Despite the weakness in securities markets during the third quarter, U.S. economic performance continued to surprise to the upside. The job market remains tight, and payrolls data came in stronger than expected. While the manufacturing sector continues to struggle, recent data has improved slightly, and the service sector continues to offset the weakness. Preliminary data released as of this writing points to very strong GDP growth during the third quarter. Not quite the stuff recessions are made of.

However, set against this positive outlook the yield curve remains kinked, and we should note that it is usually when the inversion corrects that the recession begins.

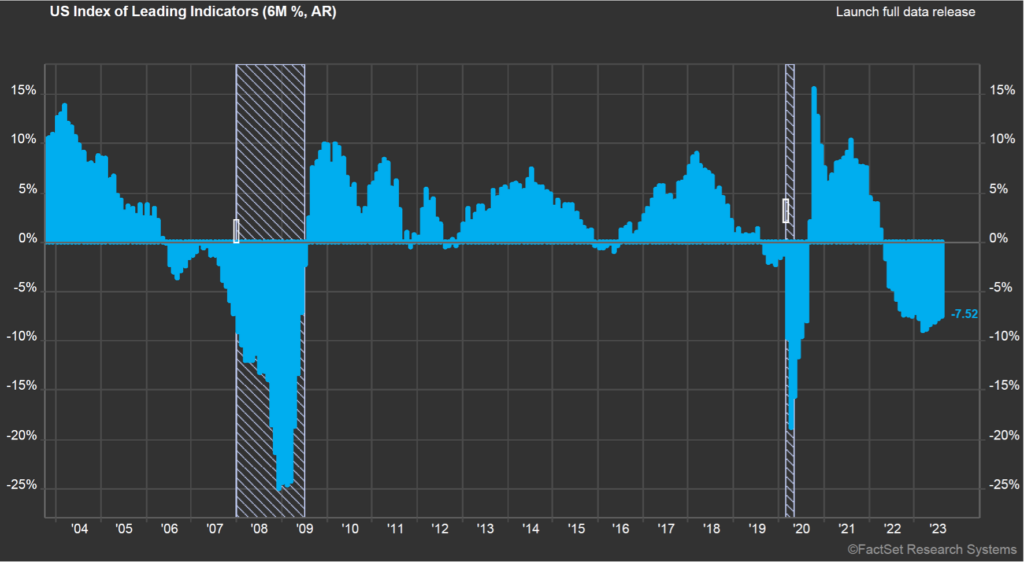

Leading economic indicators continue to point to recession, and inflation remains above the Fed’s target. Throw in rising oil prices, a couple of major conflicts (the Hamas invasion of Israel occurred just after quarter end), the UAW strike, and a leaderless house for much of October, and it’s definitely difficult to be a bull!

There is no question that the positive economic data suggests that a soft landing remains a strong possibility. However, we stubbornly continue to believe that a mild recession remains the base case for the U.S. economy. In our view, excess fiscal and monetary stimulus led to extremely strong consumer and corporate balance sheets. The U.S. consumer also built up excess savings during the Covid containment period and then found themselves well employed with rising wages in the wake of the pandemic. Consequently, the consumer has remained resilient and has pushed the recession into the future, but the prospect of avoiding one altogether still seems remote. We should note that stocks tend to act as a leading economic indicator, and as noted previously, much of the market has gone nowhere over the last 18 months. We see little opportunity for explosive growth over the next 6-9 months. We plan to remain defensive with our value tilt fully in place, additional international exposure to counter the risk of a falling dollar, and allowing cash balances to rise to buffer volatility.