Cornerstone 1st Quarter 2025 Commentary

The Not so Glorious Revolution

The Revolution was made to preserve our ancient, indisputable laws and liberties, and that ancient constitution of government which is our only security for law and liberty.

Edmund Burke (Between Revolutions: Re-apprraising the Restoration in Britian)

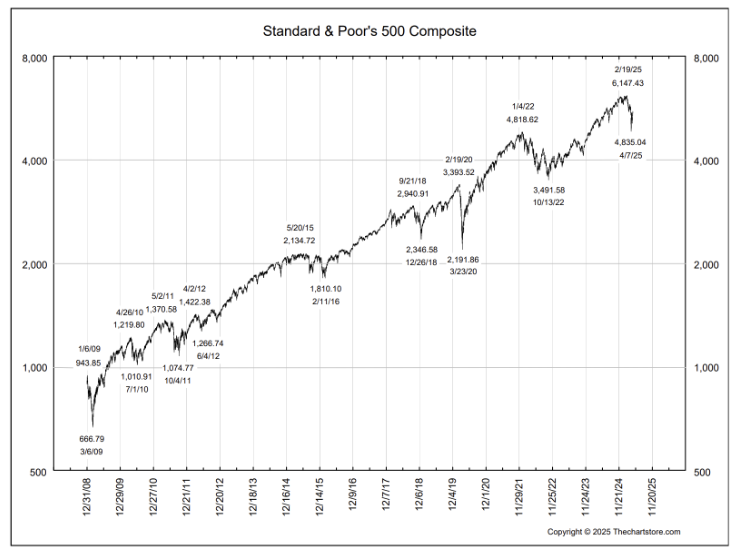

Mr. Trump was inaugurated the 47th President of the United States on January 20, 2025, and thus began the “Not so Glorious Revolution.” At least, like England’s Glorious Revolution of 1688, it has been largely bloodless, and it did begin somewhat gloriously, from a market perspective, with the S&P 500 hitting an all-time high roughly a month later on February 19. There are other similarities, of course. Seeking to counter what he views as the growing establishment of a progressively controlled authoritarian state, Trump has, during his first 100 days in office, sought to strengthen what he perceives as our traditional government of the people, by the people, and for the people.

Trump proceeded rapidly through a host of executive orders and directives. Pursuing deregulation through the utilization of the Department of Government Efficiency (DOGE), he subsequently attempted to shore up meritocratic selection throughout the government and universities alike with the elimination of Diversity, Equity, and Inclusion (DEI) across governmental bodies. Additional action to protect the borders, strengthen the military, and the attempt to end two regional wars all pale in comparison to the drama brought about by the Trump tariffs!

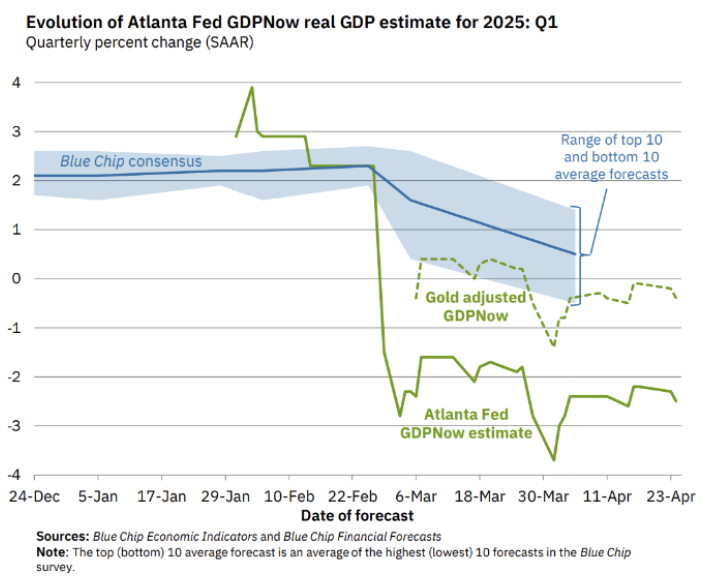

Economists and market participants alike had been expecting tariffs, but as more information became available, the market became more and more concerned about what was to come, and it was those fears leading up to “Liberation Day” on April 2 which led to the precipitous decline from the highs of February to the anxious days of late March. As economists scrambled to make forecasts, pragmatic companies the world over sought to get ahead of whatever tariffs might be in store. Imports to the U.S. soared during the first quarter. Those imports were further boosted by an unusual arbitrage opportunity in gold. A significant difference in the New York gold spot price and the London gold fix price, thought to be largely driven by expected tariffs, resulted in significant imports of gold during the first quarter. These seemingly disconnected factors are important because both impact GDP. The overall surge in imports resulted in a massive adjustment to expected GDP which in turn contributed to investor uncertainty.

As the quarter ended, fears of recession had grown significantly, and business sentiment had declined markedly. Thus, the “Glorious MAGA Revolution” quickly became the “Not so Glorious Revolution,” at least in the eyes of the investment public. Markets declined, volatility increased, and bonds rallied. In short, the bulls were chased off, and Wall Street became the habitation of the bears. However, we suspect that, like the Glorious Revolution of 1688, there is much history left to write. Many of this administration’s objectives are admirable and, in our view, necessary for the continued prosperity and success of this still young republic. In our view, the administration’s key objectives – reducing the budget deficit, cutting government spending and reducing governmental regulation, leveling the playing field for global trade, supporting key industries for security purposes, and leaning into a meritocratic hiring and admissions policy among others – can lead to a stronger, more globally competitive country. Regardless of one’s viewpoint, the next four years are likely to prove anything but boring in the pursuit of these goals.

As we noted, markets opened 2025 on a relatively strong note, rising through January and into February. The S&P 500 reached an all-time high on February 19. Although the broader NASDAQ Composite was not able to establish a new high, the more concentrated NASDAQ 100 set a new high on February 19, as well.

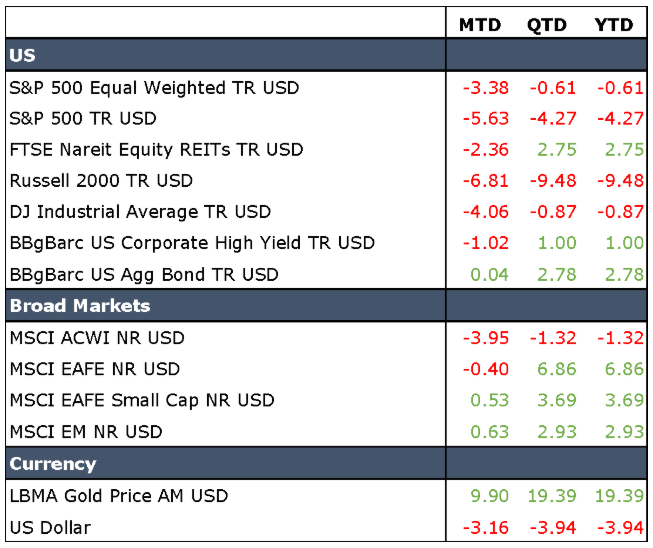

Unfortunately, this point proved to be the peak for the quarter. Returns faded throughout the remainder of the period, and despite its early run, the S&P 500 ended the quarter in negative territory, down nearly 9% from its high and ending the quarter down 4.27%. The S&P 500 Equal Weighted Index fared much better, down only 0.61% over the same period. REITs were a relatively safe haven during the quarter and turned in a respectable return of 2.75%.

Generally, value has outperformed growth in 2025. The Russell 1000 Value Index was up a bit over 2% during the quarter, outperforming the Russell 1000 Growth Index by nearly 12 percentage points over the period as the Magnificent Seven finally stumbled and more defensive sectors gained ground. The same was true for small cap as the Russell 2000 Value Index outperformed its growth counterpart by nearly 400 basis points. However, it wasn’t enough to keep small cap value stocks in the black, and the Russell 2000 Value ended the quarter down approximately 7%. Mid cap held up a bit better, down around 3% for the quarter.

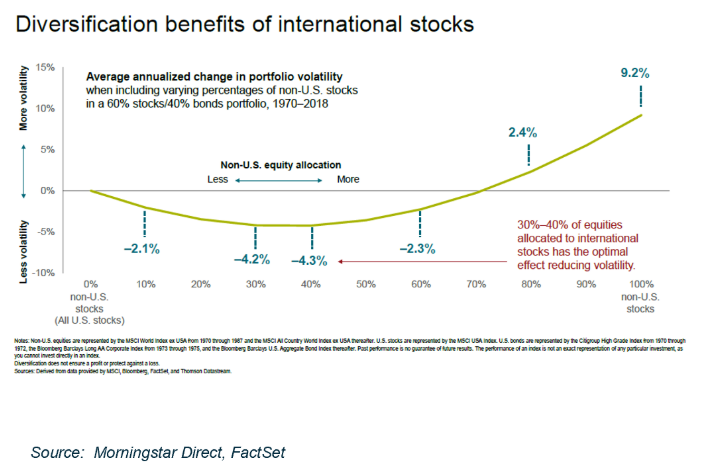

Surprisingly, international stocks did quite well during the first quarter. The administration’s response to the Ukrainian conflict and comments related to European defense spending rattled European nations and Germany in particular. The Germans passed a unique defense spending resolution bypassing future spending “brakes” and providing a significant boost to the defense sector. A broader infrastructure spending bill also passed, giving European markets their moment in the sun. The MSCI EAFE index rose nearly 7% during the quarter on the back of the future spending plans and a falling dollar. The weaker dollar also provided enough fuel to get emerging market equities into the positive column for the first quarter. Pulled down by U.S. tech, the MSCI All Country World Index slid 1.32% during the quarter despite the strong performance by European equities.

It was a volatile start to what we expect to be a volatile year. As we indicated, what began as a “Glorius Revolution” in the eyes of the market began to look a bit tarnished as the quarter progressed. We noted in “The Palantir” commentary we published earlier this month that we believe this administration does have an economic plan, and that it is following that plan. While we don’t agree with every action the Trump administration has taken, we believe that many of its objectives should be positive for markets and the economy in the longer run. However, at the moment we find ourselves battling significant tariff-induced volatility, stubbornly high inflationary pressure, and a Fed that remains on hold.

Cornerstone portfolios performed well during the quarter. Fixed income continues to be a bright spot in all our portfolios. Our shift from small cap into mid cap helped overall performance, and our REIT exposure also provided a bit of a lift. The transition from international to domestic equities was not quite as timely. However, much of our international exposure was sourced from international small cap and emerging markets and, consequently, did not prove to be much of a drag on overall performance. Periods like this remind us why international can act as a positive diversified.

We expect to write more on tariffs in the months to come. We will continue now with some related thoughts on the Fed, gold, and the U.S. dollar. The Fed remains in a challenging place. Inflationary data has not improved in any significant way, and one of the major concerns brought about by tariffs is that they are likely to be inflationary. We should remind our readers that tariffs are actually like a tax. (This fact is often overlooked and is an important point.) In the case of tariffs, the tax can be paid by the foreign firm through lower prices, by the importing firm through lower margins, or by the end consumer. Depending on the elasticity of supply and demand, there is also the possibility of substitution limiting the tariff’s impact. However, in most cases economists expect an upward price shock. This can ultimately lead to a new higher equilibrium pricing model and is thus inflationary. The Fed is aware of all of these factors and, given the slow response of existing data, the strength of the labor market, and the increase in inflationary expectations by the general public, has chosen to remain on hold. Currently, futures market expectations suggest the Fed may not move until at least June and possibly later. This has largely kept the Fed on the sidelines, and, consequently, they have had little opportunity to buffer short-term market volatility. (Incidentally, we would argue this is not their role anyway, but it is the role they have often taken in recent years.)

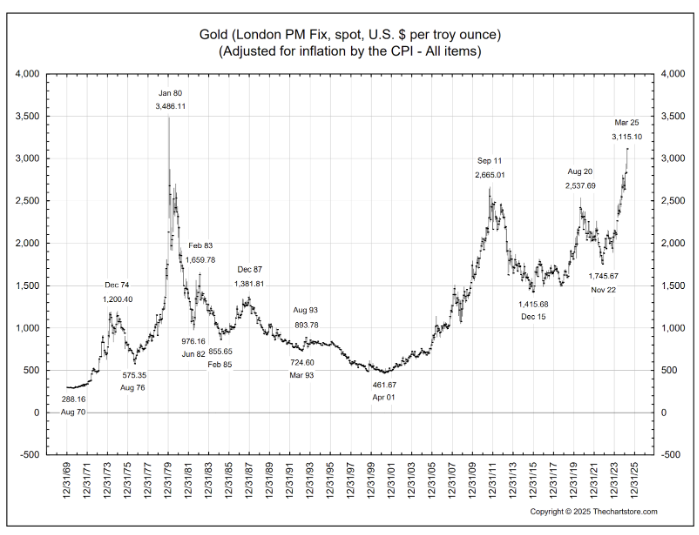

Gold has continued to rally. Perhaps this is due to inflationary fears, a weakening dollar, and geo stability concerns. While all these factors are no doubt impacting the price of gold, it seems likely that at least some of the recent rally may be more directly related to tariff concerns and short-term arbitrage opportunities.

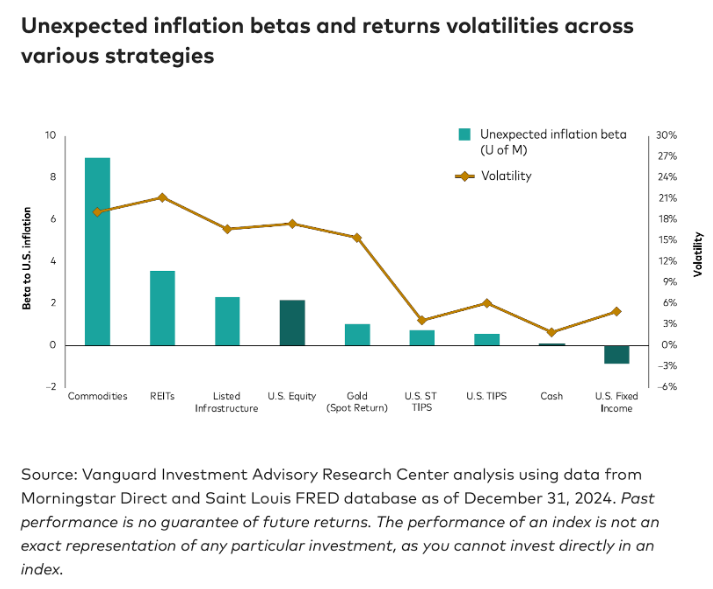

While gold can be a reasonable diversifier, we believe other assets are often superior to a “long position” in the precious metal. Gold doesn’t provide dividends, requires storage cost, and is subject to normal supply and demand concerns. In most cases other assets provide better inflationary protection. In our view, gold is most helpful in disastrous scenarios where its high value-to-weight ratio and high level of fungibility can provide the owner with a significant measure of personal protection from a systemic collapse in the local currency or governmental system.

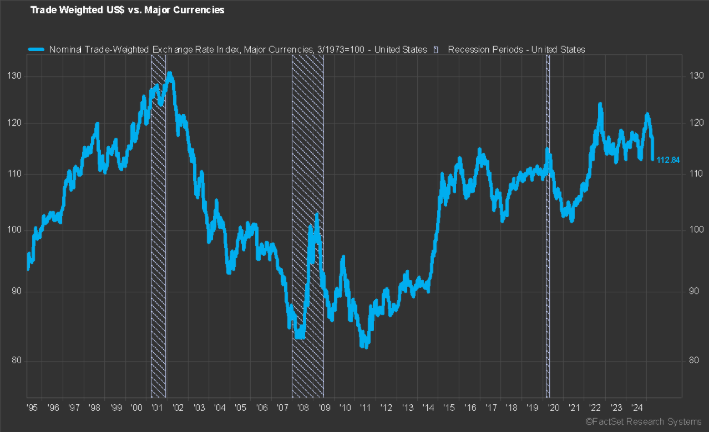

The dollar remains a bit of a mystery at the moment. Classical economics suggests that a higher tariff regime should result in a stronger local currency.

This fact coupled with the slow-moving Fed and relatively high short-term interest rates should result in a stronger dollar all else being equal. However, lower global trade could result in foreign countries requiring less dollars, and a slower growing economy also brings less foreign investment. We do not view this issue as significant at the current time, and we believe concerns about the dollar’s reserve currency status are overblown. The dollar remains historically strong, and a modest amount of weakness should actually act as a benefit to exports.

Cornerstone Management Inc. is a Registered Investment Advisory Firm. Although the information in this report has been obtained from sources that the Firm believes to be reliable, we do not guarantee its accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report may only be dispensed with this disclosure attached.