Cornerstone 1st Quarter 2024 Market Commentary

“Bäume wachsen nicht in den Himmel.” – or “Trees don’t grow to the sky.”

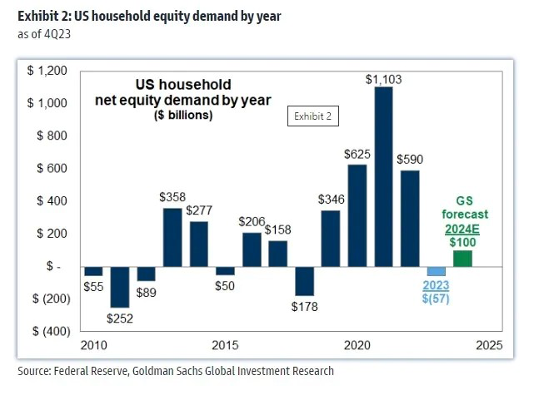

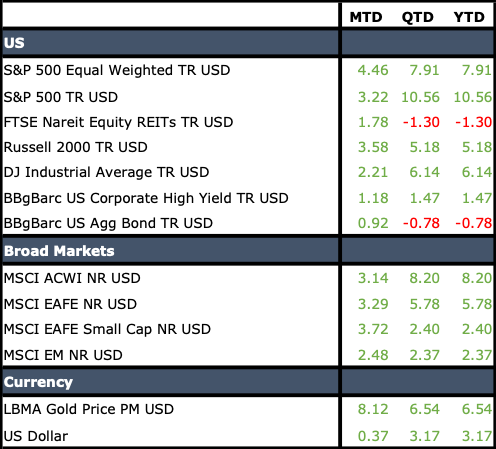

Lately it seems like they do! The first quarter of 2024 once again challenged growth stock skeptics like us as Big Tech raced higher, and, in some cases, Small Tech even became Big Tech as stocks like Super Micro Computer eclipsed $50 billion in market capitalization during the quarter. The AI boom was in full flower during the opening quarter of the year, and, when coupled with expectations that inflation was whipped and the Fed would certainly be cutting interest rates throughout 2024, it led to a fantastic first quarter. While it is true that the market narrowed a bit, a nearly 8% return by the S&P 500 Equal Weighted Index and a corresponding 6% return by the venerable Dow Jones Industrial Average is hardly something to sneeze at. Investors couldn’t get enough, equity that is, during the first quarter of 2024. They just kept piling in, and stocks advanced throughout the quarter.

Earnings for the fourth quarter came in strong, and economic data continued to be robust in the opening days of 2024. Despite continued concerns about Israel, the ongoing slog in Ukraine, and rising oil prices, investors remained optimistic. They drove stocks higher throughout the quarter and not just in the U.S.; markets around the world rose, too. The MSCI All Country World Index was up over 8%, and the MSCI EAFE was up nearly 6%. A stronger dollar put pressure on Emerging Markets, but they still managed to post positive returns in dollar terms with the MSCI EM Index up nearly 2.5% during the quarter.

Really, the only rub was fixed income. As the economic data continued to strengthen, inflationary data refused to cooperate. Inflation, it seems, is a stubborn beast and is valiantly fighting all the Fed’s efforts to subdue it. However, the Fed refused to give up.

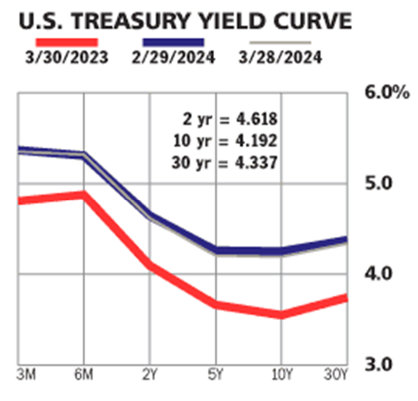

Markets gradually came around to the Fed’s way of thinking, and late in the quarter bonds sold off and interest rates rose. Rising U.S. interest rates led to a strengthening dollar and concerns about where global interest rates were headed. Even the Bank of Japan got in on the action, raising rates in March for the first time in 17 years. Perhaps the infamous years of ZIRP (Zero Interest Rate Policy) are truly behind us, but regardless of whether or not central banks have finally gotten religion, the fact remains the yield curve here in the U.S. experienced a bear steepening late in the quarter which resulted in yet another negative quarter of bond returns. The Bloomberg Aggregate Bond Index dropped nearly 1% for the quarter. Surprising volatility given that the index accrued more than 1% in interest over the same period.

Bond volatility is, in our view, likely to be the story for much of 2024. While the VIX Index remains relatively benign, the MOVE Index which measures bond volatility remains quite elevated. Higher interest rates provide a buffer against longer term negative outcomes, but short-term price action continues to test investors’ resolve and drive skittish bond buyers to the safety of the nearest money market.

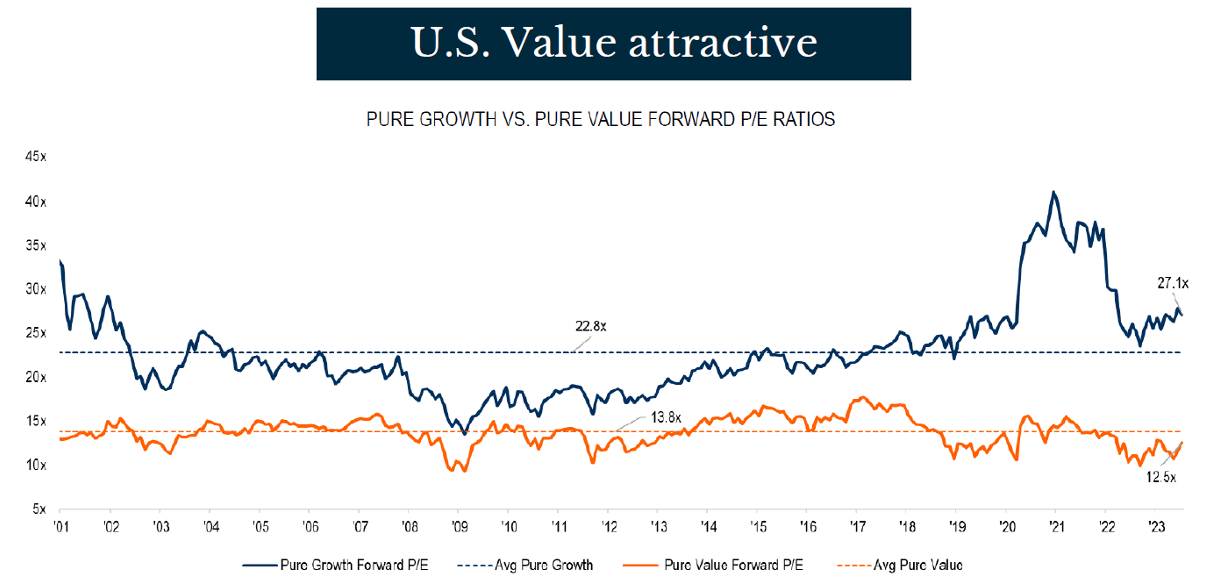

As noted, the first quarter of 2024 was a great quarter from an equity perspective. Big U.S. growth stocks led the way. The Russell 1000 Growth Index was up over 11% during the quarter, and the Russell 1000 Value was not too far behind, up nearly 9% over the same period. In the small cap space, the differential was more significant. The Russell 2000 Growth Index was up a bit over 7.5% while the Russell 2000 Value Index was up just under 3%. The growth-value divide continues to be a challenge with investors who favor growth highlighting strong earnings and the possibility of falling interest rates as supporting elements for their argument, and those who favor value pointing to higher real rates and low valuations along with current cash flow as the supporting elements for their position. As always, we believe that both strategies should be employed in a well-structured portfolio, but at the moment we remain more concerned about the valuation and future earnings growth of “growth companies” and feel a bit more comfortable tilting our portfolios toward value strategies where we believe lower multiples provide a measure of protection against more negative outcomes.

International stocks also performed well during the first quarter of 2024. Despite a rising dollar, the MSCI EAFE managed to gain nearly 6% during the opening quarter of the year, and the inflationary outlook across developed markets outside the U.S. generally improved over the period. Further, the European Central Bank sounded a bit more dovish than the Fed during the quarter, a fact which may have helped bolster developed market equities. As we noted previously, Japan’s central bank raised rates for the first time in 17 years in March, but the twenty-basis-point move was hardly restrictive and speaks more to Japanese growth and the return of some small measure of price appreciation after years of disinflation largely brought about by an aging population than it does to the true tightening of monetary policy.

Unfortunately, inflationary pressure and stronger than expected economic growth was tough on the bond market. The yield curve steepened during the month of March with the back half of the curve rising significantly. As fixed income markets came to grips with the fact that the Fed’s dot plot was not changing and interest rate cuts were not all that imminent, bonds sold off. The Bloomberg Global Aggregate Bond Index was down a little over 2%, and the Bloomberg Aggregate Bond Index declined approximately 0.80% during the quarter.

2024 opened with a bang, and most of the Street remains firmly convinced that the Fed has engineered a soft landing. Earnings expectations for the remainder of the year are quite strong, and to this point stock markets around the world have shrugged off the myriad of macro and micro economic concerns. We, at Cornerstone, have remained a bit more cautious.

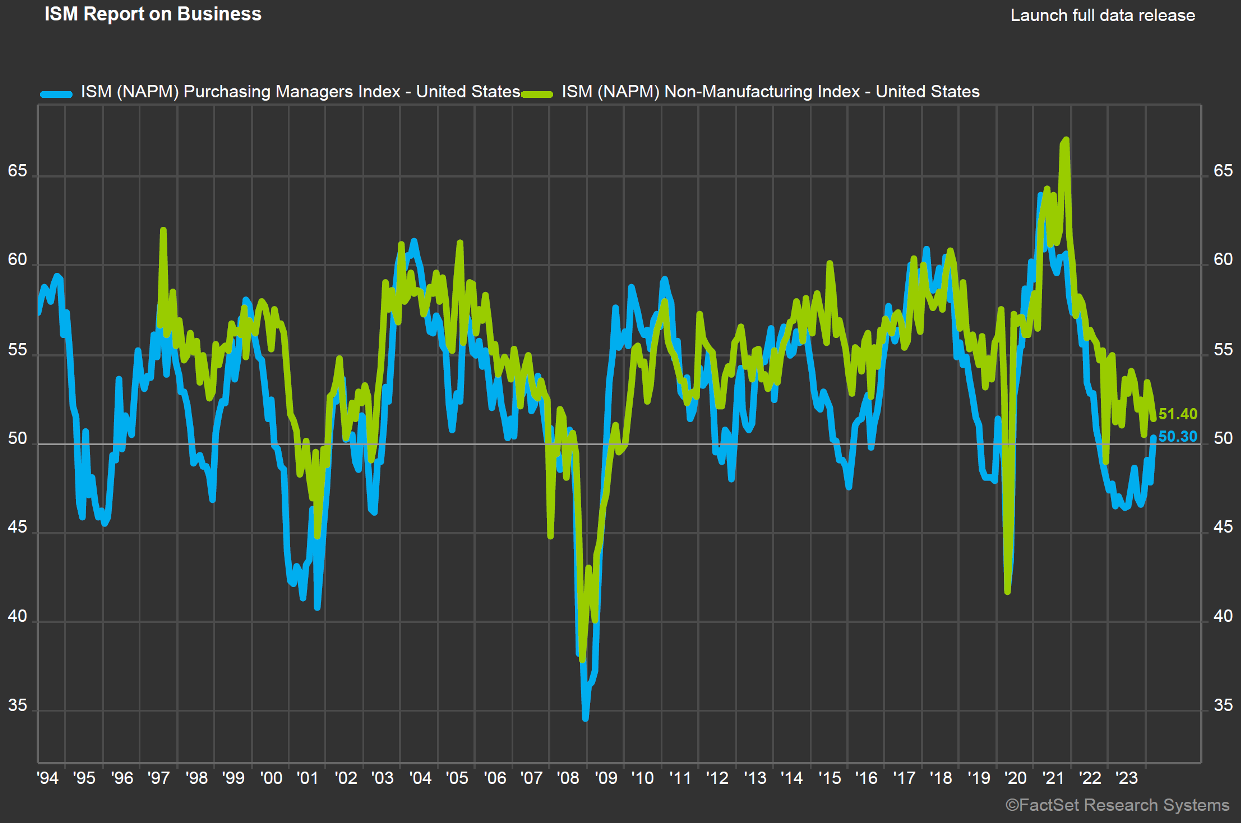

We must admit that the U.S. consumer has proved resilient, the job market has remained robust, and overall demand seems healthy. However, both the ISM Manufacturing and Services Indices are vacilating between expansion and contraction. Many leading economic indicators remain negative. The yield curve remains significantly inverted, and we are grappling with two significant regional conflicts. Oil prices are up despite a strengthening dollar, and the housing market, to say nothing of corporate real estate, is beginning to truly feel the effect of higher interest rates.

We are not overly pessimistic. In fact we expect equity markets to be positive for much if not all of 2024. However, we prefer to remain a bit cautious, husbanding our cash and maintaining our tilt toward value. We continue to believe it is more likely that growth will take a breather, allowing other sectors of the market a chance to catch up, and if we should experience a more negative surprise, our more conservative tilt should help buffer portfolios. In the end, we certainly want to gain from the phenomenal growth in technology-oriented shares, and we do believe that AI will have a significant impact on the global economy. However, we can’t forget the lessons of the past, particularly those of the dot-com bubble. Trees don’t grow to the sky, future growth is difficult to measure, and massive technological change often carries with it surprising winners and losers. Let’s be careful not to miss the forest for the trees!