4Q 2021 Cornerstone Commentary

No matter how far you have gone on a wrong road, turn back

Turkish Proverb

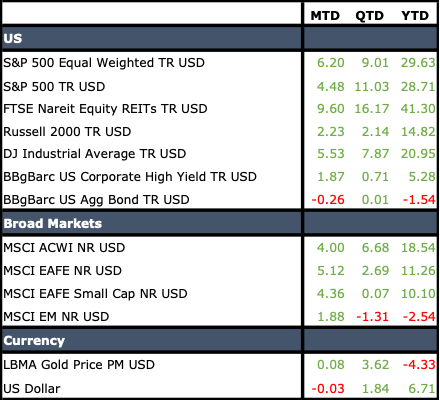

The fourth quarter continued the upward trend that has been in place since the beginning of 2021. Markets rallied off the lows of September hitting multiple new highs throughout the quarter. Equity strength was broad-based with virtually all major areas of the market participating in the rally.

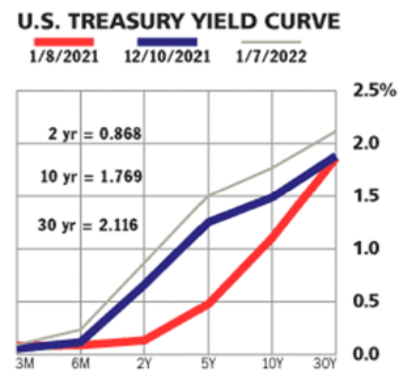

Inflationary fears mounted during the quarter, and the Federal Reserve Bank indicated that they would accelerate their plan to reduce open market bond purchases to zero by March of 2022. The Fed’s dot plot of future interest rates also rose indicating that Fed members are becoming more concerned about inflation and believe that interest rate hikes will be necessary to contain the current spike in prices. Futures markets are currently pricing in a high probability of three 25 basis point hikes in 2022 with a fourth hike reasonably likely. Interest rates concerns continued to weigh on bond markets, and bonds ended the quarter largely unchanged but still down for the year. These trends were generally mirrored around the world with bonds remaining under pressure throughout the fourth quarter and generally ending the year in the red.

Developed market equities mirrored the U.S. rally, but a strong dollar put pressure on emerging markets equities which were down for the fourth quarter and for the year. As noted, market strength led to solid returns in diversified portfolios during the quarter. CMI portfolios benefited through their exposure to real estate, value-oriented equities in the small cap and emerging markets space, along with an overall bias to U.S. equites. Fixed income exposure benefited from reduced duration along with some manager specific factors. With the S&P 500 ending the year close to an all-time high, the fourth quarter of 2021 brought to a close one of the best 12-month periods of performance in the index since the late 1990s. The S&P 500 ended the year up 28.71% bringing its three-year annualized performance to 26.06%.

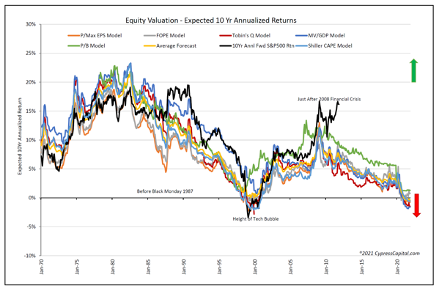

Despite continued Covid concerns, U.S. markets have reached extremely high levels of valuation and have continued to set new highs. While valuations are extended by most metrics, they have fallen slightly as earnings actually increased faster than prices throughout most of the year. Despite this slight improvement in traditional valuation measures, valuations remain high on both a relative and absolute basis, and future returns are likely to be muted. Rising interest rates, margin pressure, and tougher year-over-year comps also suggest that equity returns are likely to remain under pressure throughout 2022.

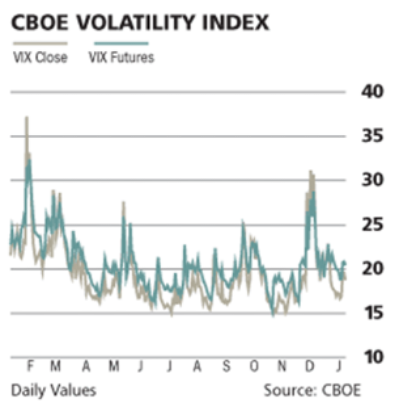

Rising rates also provide a significant headwind for fixed income investments implying that globally diversified balanced portfolios are likely to provide limited total returns over the upcoming year. Volatility also began rising during the third and fourth quarters of 2021, and we expect this trend to continue in the upcoming quarters. The U.S. government was unable to pass the Biden administration’s Build Back Better plan, and political sentiment remains sharply divided. As we enter a midterm election year, this situation is likely to add to rather than detract from market volatility.

As noted, equity market performance was extremely strong throughout 2021. In general, large cap stocks once again led the way with well- known indices like the S&P 500, the Dow, and the NASDAQ all substantially higher. The S&P 500 was up 28.7% for the year adding to strong 2019 and 2020 performance and bringing the three-year annualized return to 26%. This type of environment was last seen during the late 1990s and should give investors pause as they consider expected equity returns over the next few years.

Despite a strong showing by value stocks, led by a resurgent energy sector, large cap growth stocks once again outperformed during the fourth quarter of 2021. The late year rally allowed growth to once again outperform value in the large cap space. However, the situation was markedly different in smaller capitalization stocks. Smaller capitalization growth stocks struggled throughout the year, and the fourth quarter witnessed a continuation of that trend. While the Russell 2000 Index was up a cool 14.8%, this masked the massive divergence between growth and value disciplines. The Russell 2000 Growth Index was up 2.8% while the Russell 2000 Value Index was up 28.3% for the year.

In CMI portfolios this massive divergence was further accelerated by our primary small cap value manager which generated a return of nearly 40% over the course of the year. Overall, CMI’s tilt toward value was constructive throughout the year in 2021 despite the rebound in growth during the fourth quarter. REITs were the highest performing major liquid asset class in 2021. The FTSE NARIET Equity Index was up a stunning 16% for the quarter and over 41% for the year. Most CMI portfolios maintain a dedicated weighting of 5-10% in REITs, another helpful contributor to performance during year. International markets provided solid, low double-digit returns throughout 2021. The MSCI EAFE Index was up approximately 2.7% during the fourth quarter bringing its annual total return to 11.26%. Emerging markets were one of the few areas in the equity universe to experience outright negative returns during 2021. The MSCI Emerging Markets Index was down 1.31% in the fourth quarter and approximately 2.5% for the year.

Unfortunately, inflationary fears and rising interest rates were a headwind for bonds, and both U.S. and global bond indices remained under pressure throughout the year. The Bloomberg Barclays U.S. Aggregate Bond Index was flat for the quarter and ended the year down 1.54%. The Global Agg was significantly worse in dollar terms, down 4.5% for the year. Thus, a globally diversified balanced portfolio was hampered by its allocation to bonds and cash. Despite the challenges posed by fixed income markets, most globally diversified portfolios did quite well during the fourth quarter and throughout 2021 with returns in the high single digits to low double digits. While not quite as strong as 2020, this was much better than one might have expected given the lackluster performance of most bond alternatives.

As one can see from the graph above, the challenge for fixed income was that interest rates moved up across the curve. As we move into 2022, it is likely this trend will continue as it is widely expected that the Fed will be forced to raise interest rates three to four times during the coming year. We believe that the curve is likely to flatten with most of the pressure being placed on shorter term securities. However, continued inflationary pressure may exert substantial upward pressure on the longer end of the curve as well.

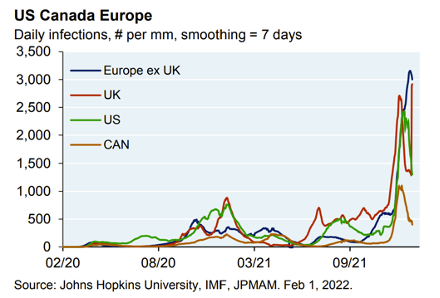

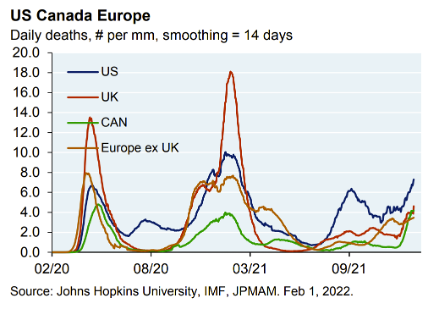

Along with strong third-quarter earnings results and additional communication from the Fed regarding the end of quantitative easing and the beginning of interest rates hikes, the big story for the fourth quarter was the rise of the Omicron variant of the Covid-19 virus. The emergence of the new strain impacted travel and caused renewed concerns about worker availability and supply chain impact. While seemingly not as dangerous as the Delta variant from an overall health perspective, Omicron has been significantly more contagious and has spread rapidly across the globe. This has led to renewed challenges for the travel industry, short-term labor force impact, and increased restrictions on the hospitality industry in some areas of the country as well as the world at large.

For now, the market seems to be discounting the impact of the new variant, perhaps because of the low death rate associated with this particular strain. While companies have been impacted in the short term by labor force disruption, travel implications, and other factors, it is widely believed that Omicron will have little effect on corporate earnings.

Despite our desire to bring this chapter of global history to a close, it appears that the pandemic remains with us and is likely to have a significant but moderating impact throughout 2022. We do not know what variants may appear in the upcoming months, but infection-based immunity has certainly increased significantly around the world. This fact coupled with increased vaccination coverage, better antiviral treatment options, and growing apathy toward continued lockdowns suggests that the Covid-19 pandemic’s impact on the global economy will gradually wane throughout the upcoming year. Other factors are likely to continue to assert themselves, and we believe the focus of markets will shift toward more traditional economic variables. As we move into 2022, we believe that inflationary concerns will the primary focus for markets during the first half of the year. It seems unlikely to us that the Biden administration will be able to push through much substantive legislation during a midterm election year, and consequently all eyes will remain on the Fed as monetary policy will take center stage in the fight against rising inflationary concerns. Midterm election years often tend to provide weak overall results from an equity perspective, and this would fit our narrative for 2022. By most traditional metrics valuations remain stretched, and the market remains in the 90th percentile from a valuation standpoint.

While such a position does not imply an immediate decline, it may suggest that forward-looking returns are likely to be more muted. As we survey equity returns over the last three- and five-year periods, we believe that this is likely to be the case. We also believe that our ongoing tilt toward value may offer some level of protection from the rolling corrections we expect in the upcoming year.

As we end the first month of the new year, markets have suffered one of those corrections, and it remains to be seen if markets will rally or if this correction will become a full-fledged bear market. We think a deep bear market is unlikely at the moment. However, we do expect continued volatility throughout the remainder of 2022, potentially capped by a year-end rally should Republicans regain the majority in both houses of Congress. Suffice to say that while we believe equity exposure in our portfolios should remain at target levels, our expectations are low, and we would be content with low single-digit returns in balanced portfolios over the upcoming year.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.