4Q 2020 Cornerstone Commentary

We should never despair, our situation before has been unpromising and has changed for the better, so I trust, it will again. If new difficulties arise, we must only put forth new exertions and proportion our efforts to the exigency of the times.

-George Washington

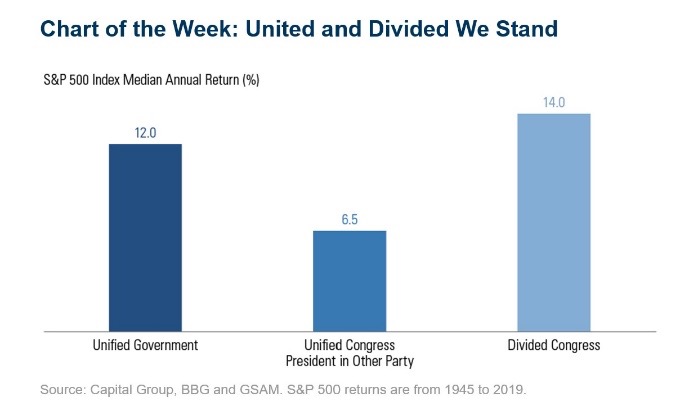

Regardless of your political affiliation, the fourth quarter of 2020 was a momentous affair. An election that was surprisingly close and offered something for both sides to crow about was followed by an amazing amount of political drama, the likes of which has not been seen for many years…perhaps since the Nixon Administration. Despite the drama, markets around the world marched ahead.

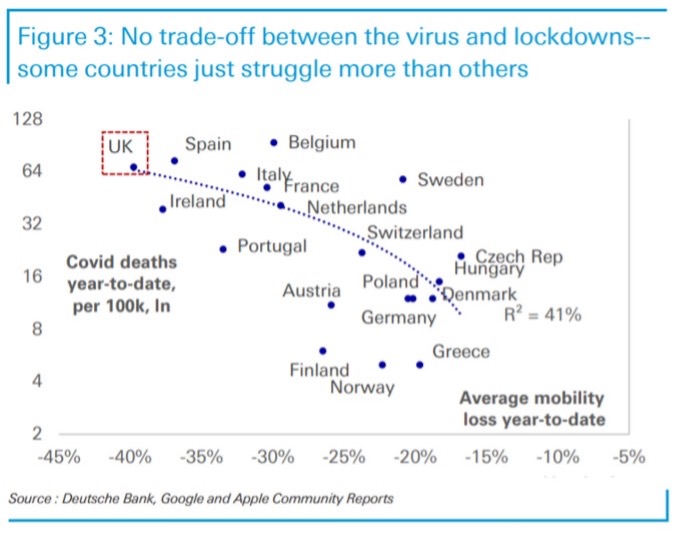

Much of the advance could be attributed to the announcement of two independent COVID vaccine candidates which received FDA approval during the quarter. The success of the Pfizer/BioNTech and Moderna vaccines are a tribute to Operation Warp Speed. Their acceptance by the FDA provided a great deal of hope to U.S. investors that viral containment was perhaps closer than expected. Continued positive economic news also helped boost stocks, and the final approval of an additional 900 billion dollar COVID-19 relief bill late in the quarter was icing on the cake for equities. COVID lockdowns continued during the quarter as the much debated “second wave” gained ground following the Thanksgiving holiday and the onset of colder weather across much of the northern hemisphere. The incoming administration highlighted their intent to continue aggressively combatting the virus, and to expedite distribution of the vaccine to the greatest extent possible.

While we are certainly not out of the woods, the market chose to focus on the future beyond the immediate impact of continued lockdowns and travel limitations, and many sectors that have struggled during the post-March rally moved higher. The energy and financial sectors were two areas of the markets that moved up significantly. The long awaited “rotation into value” oriented securities was led by the energy sector and various cyclical stocks and resulted in strong gains for value managers during the last couple of months of the year.

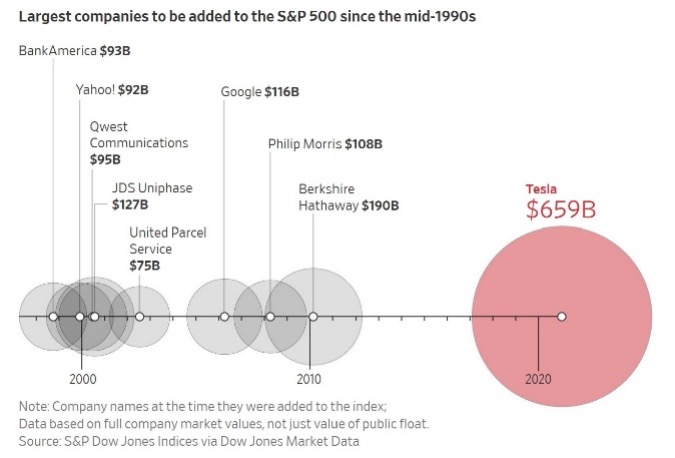

We should also note that following a dramatic 12-month rally, Tesla finally entered the S&P 500 Index! Acceptance into the index had been delayed as Tesla continued to struggle with consistent profitability, but following a fifth consecutive quarter of profitability, Tesla joined the index December 21, 2020. This is particularly notable because Tesla’s market cap will make it one of the most influential companies in the index. In a year where six stocks drove the majority of the index’s return, Tesla’s addition to the mix further distorts the structural return of the well-known index. Tesla is far and away the largest stock by market cap to be added to the index, and, upon inclusion, it will represent over 2% of the S&P by market cap. It is also significant to note that while Tesla’s recent run up will not help the index, a subsequent decline following inclusion could have a demonstrative effect on market performance.

The story of Tesla is both important and instructive. It is important because it demonstrates the impact of a relatively high flying “new economy” stock on a major index and on passive portfolios around the world. It is instructive because it demonstrates the challenges related to selecting, utilizing, and constructing benchmarks. In 2020, capitalization weighting and the “size” effect had a tremendous impact on broad-based benchmarks utilized throughout the investment community. This situation could leave an investor feeling that their portfolio did not perform well simply because they did not have significant exposure to a small cadre of U.S. technology heavyweights.

Further, investors focused on passive investing may actually be inclined to “chase” performance in particular indexes due to a construction methodology they don’t understand. Benchmarks are important, and passive investing can be a very efficient method of portfolio implementation, but knowledge and discretion are required. Tesla is an excellent example of how a passive investor can end up with significant exposure to a company that was “selected” to be in their index at a potentially inopportune time. Ironically, this is the very situation that many passive investors were trying to avoid in the first place!

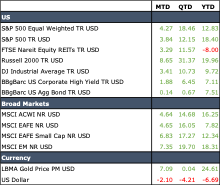

The Dow finished the year up 9.72%, a solid annual return but significantly less than the 18.4% return posted by the S&P 500. As we have already indicated, 2020 was unique in many ways, but from a market perspective significant deviation between sectors, capitalization ranges, and growth orientation resulted in extremely wide variations in major indexes.

It is significant to note that the “equal weighted” S&P 500 index was up just under 13% further highlighting the performance impact of the largest stocks in the index. To clarify, Facebook, Amazon, Apple, Microsoft, and Google produced an average return of 56% in 2020 while the remaining 495 stocks averaged only 11%. Smaller capitalization stock staged an impressive rally late in the year. The Russell 2000 rose over 30% during the fourth quarter and ended the year up approximately 20% outpacing both the S&P 500 and the Dow. Value-oriented securities also rallied late in the year. However, despite a 16% rally in the fourth quarter, the Russell 1000 Value Index only ended up 2.8% while the Russell 1000 Growth Index finished the year up 38.49%.

International stocks also staged a late year “comeback.” Developed market international stocks represented by the MSCI EAFE were up nearly 8% for the year and 16% during the fourth quarter. Emerging markets rallied nearly 20% late in the year bringing the final tally of the MSCI EM index to 18.31% for 2020. The late year rally was boosted by a declining dollar and was also characterized by a significant growth value divergence.

2020 was also a strong year for fixed income. Interest rates reductions by the Fed late in the first quarter led to a strong rally in bonds, and performance persisted throughout the remainder of the year. However, upward drift in the long end of the curve coupled with a declining dollar led to significant outperformance by global bonds late in the year. The Barlcay’s Aggregate Bond Index was up 7.5% for the year, but the Barclays’ Global Aggregate Bond Index, up over 3% in the fourth quarter alone, finished the year up over 9%. The declining dollar and concerns about inflation also boosted the price of gold. The precious metal was up nearly 25% in 2020.

Diversified portfolios did relatively well in 2020, and Cornerstone’s portfolios were no exception. Most of our globally diversified portfolios were up 9-11% eclipsing the Dow, but, of course, lower than the S&P 500. Our portfolios were boosted by strong returns from small and large cap growth along with our partial rebalancing moves made following the declines of the first quarter. Further, our utilization of various ultra-short duration alternatives boosted our return relative to other cash proxies and helped limit cash drag. Our overall value tilt was detrimental to absolute performance as was our dedicated exposure to U.S. REITs. REITs along with the energy sector, financials, and utilities ended the year in the red. It is interesting to note that JP Morgan’s diversified global index portfolio was up approximately 10.6% in 2020. Double digit returns in a 60/40 portfolio during a low interest rate environment are nothing to “sneeze” at, but undoubtedly many investors were “wowed’ by the dramatic returns of the tech sector and Tesla. Those returns were quite dramatic, and along with a few other stocks resulted in extremely high returns for those with concentrated growth portfolios.

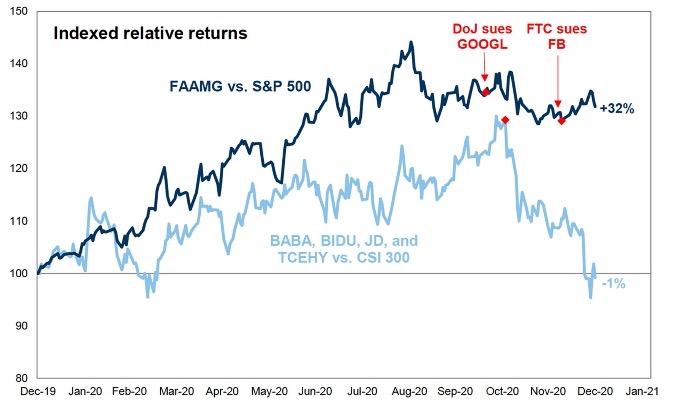

As we enter 2021, it seems quite likely that recent trends may change. Value looks significantly less expensive than growth, and the tech sector is facing a number of head winds which may limit short-term appreciation. As the graph above indicates, government action against the tech sector had a much more dramatic impact on Chinese tech names than on U.S. names. However, tax law changes and growing concerns related to free speech may ultimately impact U.S. tech as well. Given the valuation divergence, we intend to maintain a modest overweight to value strategies as we enter 2021. We expect COVID-19 containment to remain a significant issue throughout 2021. Although the vaccines offer hope, and fiscal stimulus will help mitigate the economic effects of current containment measures, it is unlikely that the world will return to “normalcy” (whatever that is!) until the third quarter or perhaps even later. Even now, there is discussion about cancelling altogether the rescheduled Tokyo Olympics. The Biden administration has pledged to focus on fighting the virus, and President Biden has already signed several executive orders related to vaccine distribution and production. However, even with the greatest of efforts, it will likely take until early summer to achieve significant vaccination levels. We remain optimistic that some level of “herd immunity” may be reached prior to significant vaccination distribution levels being reached. Ultimately, such an outcome may lead to better-than-expected outcomes. However, in the short term, we believe that expectations for the stock market remain elevated and valuations are stretched.

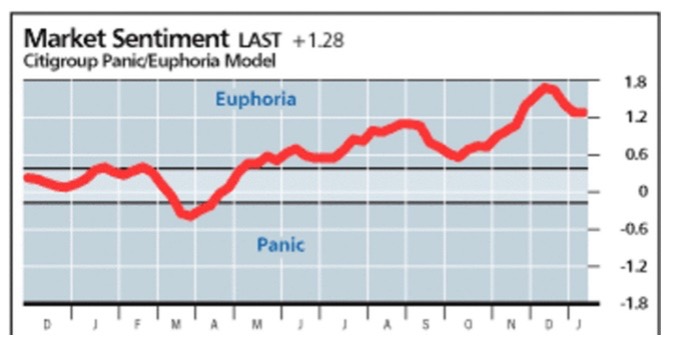

Overall, the market appears to be priced for perfection. We believe that optimism for 2021, in its entirety, is justified, but short-term caution is also warranted. We are restructuring our fixed income allocations to reflect a steepening yield curve, and we will retain a reasonable level of liquidity. As noted above, we will also retain our overweight to value while at the same time rebalancing our other sub asset allocations back toward policy targets to provide both protection in the event of market volatility and upside potential in the event that the market continues upward without a pause.

Financial Advisory Consultants DBA/Cornerstone Management Inc. is a Registered Investment Advisory Firm. Although the information in this report has been obtained from sources that the Firm believes to be reliable, we do not guarantee its accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. This report may only be dispensed with this disclosure attached.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.