3Q 2021 Cornerstone Commentary

If you want to keep on learning you must keep on risking failure – all your life

John W. Gardner

We do not believe if we do not live and work according to our belief

Heidi Willis

The soul is dyed the color of its thoughts. Think kon those things that are in line with your principles and can bear the light of day. The content of your character is your choice. Day by day, what you do is who you become.

Heraclitus (Greek Philosopher, 535-475BC

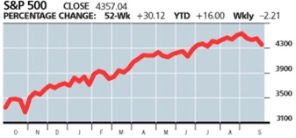

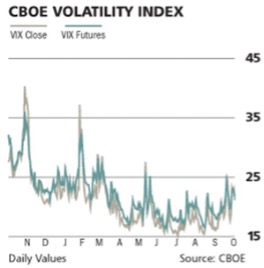

Well, September lived up to its hype bringing volatility back to the market and ending the hyperbolic rise of domestic equities. While not much of a correction, the September decline did wash out most of the 3rd quarter’s gain. September also provided a bit of a test for markets more used to upside surprises. The fifty- day moving average, which had acted as support for the S&P 500, was finally breached. Although stocks did not completely break down, a more bearish vibe was evident in late September. As we finalize the writing of this commentary, it is important to note that the market has rebounded and actually set new high to strengthen the positive trend and perhaps set a new line of support.

From the lows of June, volatility rose throughout the quarter and culminated in a sharp correction at the end of September. As noted above, the correction was not particularly significant at the index level. On the other hand, many securities actually declined substantially, and risk assets in general came under significant pressure. Crypto currencies, emerging markets, smaller capitalization stocks, and tech stocks all suffered declines, and the Dow Jones Industrial Average finished the quarter down 1.5%.

The return of volatility is a welcome event. A portion of the return that equity investors receive is predicated on the fact that equities are more volatile than other “lower returning” asset classes. The “equity risk premium” in financial literature is derived from this fact. Consequently, when volatility remains low one must consider whether something has changed or if a reversion to the mean is expected. By definition reversion to the mean would require a period of higher volatility to offset the low volatility period. As investors, we depend on some level of volatility to help justify the returns we are seeking. Additionally, we have noted in previous commentaries that healthy markets rarely move upward without consistently testing the advance through bouts of selling and volatility. In our view, this recent spate of selling pressure was healthy for global financial markets and provides a level of comfort that buyers remain confident there is still value to be found in this market.

- Cornerstone 3rd Quarter 2021 Commentary

What value, you might ask? In a market that is clearly trading at very high multiples and seems expensive in the light of almost any valuation metric, value may be hard to come by. Yet during this short and shallow correction a number of well-known stocks declined by 15%-20%. Third quarter earnings are also expected to be quite strong, and all early indications support that expectation. Of course, the bar is relatively low on a year-over-year basis. But even if we consider the trend prior to the COVID-induced decline of 2020, corporate earnings are on the rebound, driving stocks higher and actually reducing market multiples. According to JP Morgan Asset Management, thanks to earnings growing faster than equity prices, multiples have actually declined by nearly 12% in 2021. So perhaps there are a few opportunities remaining to be found after all.

| MTD | QTD | YTD | |

| US | |||

| S&P 500 Equal Weighted TR USD | -3.79 | -0.22 | 18.92 |

| S&P 500 TR USD | -4.65 | 0.58 | 15.92 |

| FTSE Nareit Equity REITs TR USD | -5.40 | 0.98 | 23.15 |

| Russell 2000 TR USD | -2.95 | -4.36 | 12.41 |

| DJ Industrial Average TR USD | -4.20 | -1.46 | 12.12 |

| BBgBarc US Corporate High Yield TR USD | -0.01 | 0.89 | 4.53 |

| BBgBarc US Agg Bond TR USD | -0.87 | 0.05 | -1.55 |

| Broad Markets | |||

| MSCI ACWI NR USD | -4.13 | -1.05 | 11.12 |

| MSCI EAFE NR USD | -2.90 | -0.45 | 8.35 |

| MSCI EAFE Small Cap NR USD | -3.57 | 0.90 | 10.02 |

| MSCI EM NR USD | -3.97 | -8.09 | -1.25 |

| Currency | |||

| LBMA Gold Price PM USD | -4.59 | -1.53 | -8.47 |

| US Dollar | 1.73 | 1.94 | 4.77 |

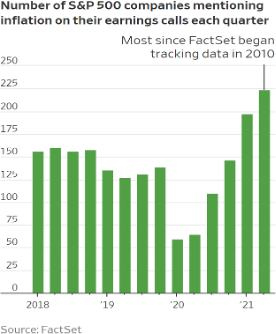

The September decline did not just impact stocks; it negatively impacted bonds as well. Both markets faced new COVID concerns as the Delta Variant wave peaked across the globe. Along with pandemic concerns, supply constraints have also taken on “pandemic” like proportions and continue to drive fears of run-away inflation. Finally, weaker than expected job growth and declining consumer sentiment added to fears of an economic slowdown. Taken together, the dreaded “Stagflation” word began to show up in blaming inflation for any negative impact on future margin expansion. While such fears are, in our view, likely overblown, they are certainly not without merit. In fact, bond yields worked their way higher throughout the month of September.

The upward movement led to negative returns, and the Bloomberg US Aggregate Bond Index (formerly Barclays US Aggregate Bond Index) dropped nearly 1% at the end of September. The steepening of the yield curve was not overly significant, and when coupled with the flattening experienced early in the quarter, it was almost a non-event. Investment grade bonds were largely flat when evaluated over the quarter in its entirety.

The dollar remained relatively strong throughout the quarter, putting additional pressure on overseas investments which declined a bit more than their domestic brethren. Emerging markets equities were the worst performer with a decline of more than 8% over the same period.

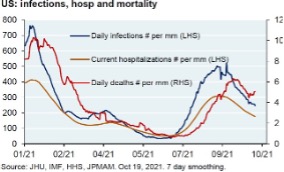

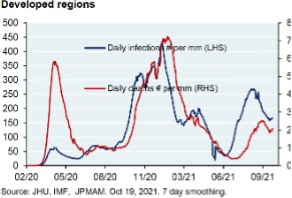

The situation with the third COVID/Delta Variant wave appears to be improving. The combination of vaccinated individuals and those individuals and those individuals who have had the virus suggests that a significant amount of the population is at least somewhat protected from the virus. While the virus continues to affect supply chains and global travel, it appears that the most recent wave is ebbing. In most places around the world, each subsequent wave has been somewhat less impactful than the one before.

While the virus still exists around the world, the successive waves may gradually decrease in terms of intensity. It also seems quite obvious that we will be dealing with the impact of COVID for some time to come. Places like New Zealand and Australia which had largely dodged earlier COVID waves are now being more substantially impacted. While we believe that is unlikely that the virus itself derails global equity markets, we believe it will continue to affect supply chains for much of 2022.

supply chain issues to be resolved and pricing pressures to ease, but this will take a significant amount of time. Supply chain pressure, relatively high raw goods prices, and labor market challenges are not particularly conducive to growing one’s profit margins, and we are concerned that many corporations will struggle to protect their margins over the coming quarters. While we remain relatively sanguine about the longer-term inflationary impact, we will continue to keep an open mind and carefully observe incoming data. If inflation begins to take hold in a more meaningful way, additional adjustments to our fixed income positions may be required.

The fourth quarter of the year is often the strongest from an equity performance standpoint, and markets have once again begun to rally. September’s correction and the subsequent rebound to new highs suggest that the uptrend is intact. We believe that markets are likely to drift higher into year end. As earnings season ends, we expect the market’s focus to turn to the Fed’s tapering plans and to the planned infrastructure package and the tax bill that is likely to accompany it. We expect it will be an eventful end to 2021, but at this point the upward trajectory of the market appears likely to continue.

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.