What is a Donor Advised Fund?

Introduction to Donor Advised Funds

Donor advised funds (DAFs) are a rapidly-growing giving tool: DAF assets nearly doubled from 2015 to 2019. They provide flexibility in the timing of the charitable deduction, the timing of the ultimate charitable gift, and the selection of investment approach. Furthermore, they are accessible to many donors and offer several benefits relative to a private family foundation. Charities are increasingly offering DAF platforms to their donors. With all of that said, what is a donor advised fund?

Donor Advised Fund Definition

A donor advised fund can be thought of as a charitable giving account. A DAF is established with a 501(c)(3) charity (i.e. a public charity). The donor places funds on deposit in an account and potentially gains an immediate tax deduction. If the charity allows, the donor may select an investment option for the funds.

Following initial deposit, the donor may choose to make grants from the DAF. These grants must be directed to charities, including to the charity with which the DAF was established. The donor may make additional contributions to the DAF and receive additional potential tax deductions.

It is important to make particular note of the word “advised” within the term “donor advised fund.” Once the donor has made a deposit into the DAF, the funds are property of the charity hosting the DAF program. While the donor makes requests/advises on matters like grants or investments, the donor no longer has official control. That said, it is common practice for charities to accommodate donor requests within the general constraints of the charity’s DAF program.

In summary, a donor advised fund can be defined as an account in which contributions can be made, charitable grants can be issued, and funds can be invested.

How do Donor Advised Funds Work?

DAFs are flexible yet relatively simple. When used properly, they are powerful giving tools. A donor first establishes a donor advised fund with a charity. The donor funds the DAF with cash or another asset and selects an investment option. Contributions of long-term appreciated assets to a DAF can avoid capital gains taxation, and the donor can receive an income tax deduction at fair market value.

Once the DAF has been funded (and the contributed asset has been liquidated, if applicable), the donor may request that grants be issued from the DAF. Before a donor opens a DAF, it is important that he or she understands whether the charity hosting the DAF program will decline any grants. Typically this issue will arise if a requested grantee’s mission is antithetical to the mission of the DAF program’s host.

In addition to making grants, the donor may make additional contributions to the DAF at any time. If the donor’s intended use of the DAF (e.g. the timeline for making grants) changes, the donor may wish to review the asset allocation. Aside from the potential tax deductions for contributions, DAFs generally do not require tax reporting on the part of the donor.

Recommended Uses and Benefits of Donor Advised Funds

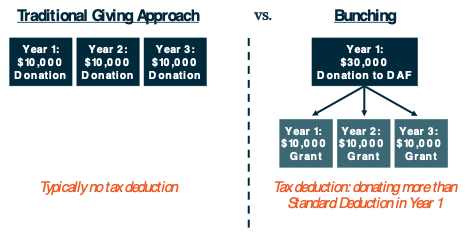

One of the benefits of donor advised funds is that the donor controls the timing of both when he or she receives the potential income tax deduction and when he or she makes gifts to an operating charity. This factor supports a giving strategy that we call “bunching.”

Bunching means that in a single year, a donor makes a contribution to his or her DAF representing multiple years of intended grants. With a larger contribution, the donor is able to maximize his or her potential income tax deduction relative to the standard deduction. In the following years, the donor can make grants on the donor’s own timing.

Donor advised funds may also be used as endowment-like vehicles. The donors can select a growth-oriented investment option and make distributions at a sustainable rate. This way, a DAF can last in perpetuity, allowing many generations of family members to participate in charitable giving.

One of the potential benefits of a donor advised fund is that it may be a viable alternative to a private family foundation. In fact, DAFs have several advantages over private family foundations:

- DAFs avoid the tax on investment income that private family foundations face

- Donor advised funds can issue grants anonymously

- DAFs do not face a requirement to grant a certain percentage of their assets each year (note: the organization hosting a DAF program may impose its own requirements)

- The organization hosting the DAF program maintains responsibility for accounting (as opposed to the donors)

- Contributions to donor advised funds generally have a higher ceiling in terms of the percentage of the donor’s adjusted gross income (AGI) that can be deducted for income tax purposes

Selecting a Charity to Host Your Donor Advised Fund

A number of investment brokerage firms, community foundations, operating charities, and educational institutions offer donor advised funds. When choosing with which organization to place your DAF, we recommend considering factors such as the following:

- Do you have a positive relationship with the organization? How do you feel about the alignment of its values with yours and its excellence in serving donors?

- Does the organization offer a streamlined platform for DAF operations, including online capabilities?

- What terms does the organization place on DAFs, such as approved grantees and minimum amounts for account size, contributions, and grants?

- What are the fees and/or required grants to the organization?

- Do the investment options fit your goals for the DAF?

Conclusion

We believe that donor advised funds are a leading component of charitable giving in the future. In fact, DAF contributions represented less than 5% of individual charitable giving in 2015 but nearly 13% in 2019. For families that wish to have a charitable giving account that offers great flexibility and can last for generations, the benefits of donor advised funds are significant. We encourage charities that do not yet have a DAF program to start one soon!

If you would like to learn more about our Planned Giving Administration services like our integrated solutions for donor advised funds, feel free to contact us to learn how Cornerstone Management can help your non-profit organization today!

Source for DAF assets doubling and contributions as percentage of individual giving: National Philanthropic Trust’s 2020 Donor-Advised Fund Report

Bunching Concept Diagram

*Max % of AGI tax deduction for donations is 100% in 2021

Learn more about Cornerstone Management’s services: OCIO, Planned Giving, Gift and Estate Consulting, and Asset Management Consulting services.